- United States

- /

- Electric Utilities

- /

- NYSE:DUK

How Investors May Respond To Duke Energy (DUK) Naming a Veteran CEO and Securing $1.75 Billion in Debt

Reviewed by Simply Wall St

- Duke Energy's board of directors recently appointed Jeffrey Guldner, former chairman and CEO of Pinnacle West Capital Corporation, as a board member and committee participant, while also completing nearly US$1.75 billion in new fixed-income offerings due in 2035 and 2055.

- This combination of a seasoned industry leader joining the board and successful capital-raising initiatives highlights Duke Energy's ongoing focus on executive expertise and financial flexibility as it pursues its clean energy transition and large-scale infrastructure investments.

- We'll explore how Jeffrey Guldner's appointment may influence Duke Energy's investment narrative and long-term growth strategy.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Duke Energy Investment Narrative Recap

For investors considering Duke Energy, the primary thesis hinges on the company's ability to fund and execute a major clean energy transition while managing capital requirements and regulatory support. The appointment of Jeffrey Guldner to the board, while adding proven industry expertise, is unlikely to materially influence near-term catalysts like major project execution or address the primary risk of rising capital costs, though it does align with Duke's commitment to leadership depth.

Among recent announcements, the completion of nearly US$1.75 billion in fixed-income offerings stands out. This move directly supports the company's ongoing investment needs for infrastructure upgrades and clean energy projects, but also reinforces the growing importance, and associated risks, of external financing as Duke expands.

Yet, in contrast to management actions that shore up financial flexibility, the growing dependence on debt financing introduces potential risks that investors should be aware of...

Read the full narrative on Duke Energy (it's free!)

Duke Energy's outlook anticipates $35.4 billion in revenue and $6.1 billion in earnings by 2028. Achieving these targets implies annual revenue growth of 4.7% and a $1.4 billion increase in earnings from the current $4.7 billion.

Uncover how Duke Energy's forecasts yield a $132.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

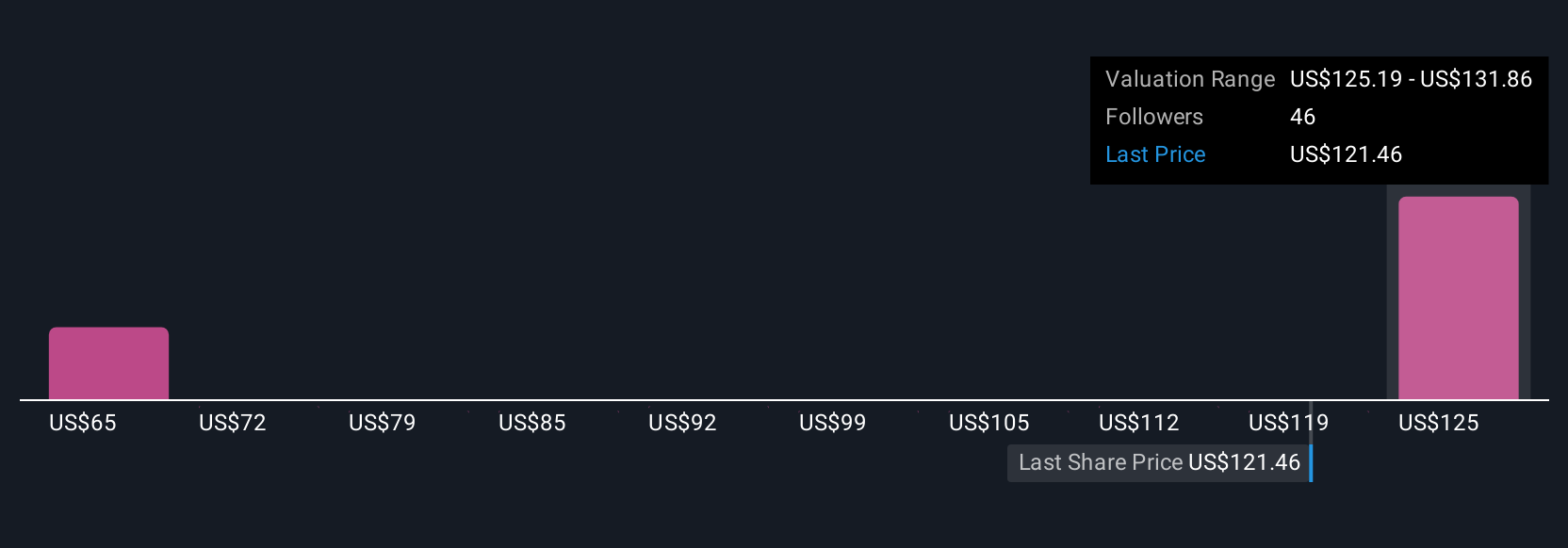

Simply Wall St Community members shared fair value opinions ranging from US$65.17 to US$132, with 6 perspectives represented. While some expect significant future upside, the reliance on external financing remains a central issue that could affect Duke Energy's returns, be sure to examine different viewpoints before making up your mind.

Explore 6 other fair value estimates on Duke Energy - why the stock might be worth 46% less than the current price!

Build Your Own Duke Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Duke Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Duke Energy's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives