- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (NYSE:DUK) Reports Q1 2025 Earnings With US$8 Billion Revenue Surge

Reviewed by Simply Wall St

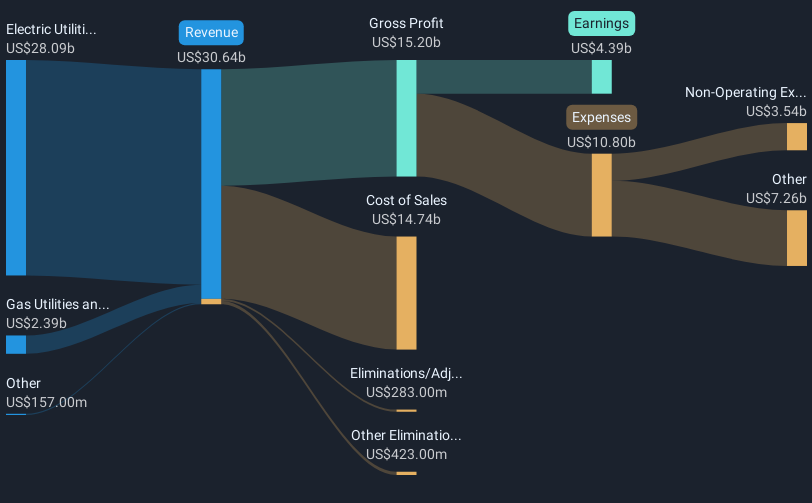

Duke Energy (NYSE:DUK) recently reported robust first-quarter earnings, with net income rising to $1,379 million from $1,138 million year-over-year, alongside an increase in sales revenue. The company's announcement of a quarterly dividend of $1.045 per share and executive changes, such as Julie Janson's retirement, coincided with a broader market movement. Despite market uncertainties due to tariff discussions and Federal Reserve announcements, Duke Energy's share price advanced by 7%, aligning with overall market growth trends. This performance highlights the company’s resilience amidst a backdrop of market fluctuations and investor anticipation towards earnings announcements.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Duke Energy's recent quarterly earnings report, highlighting an increase in net income to US$1.38 billion and a quarterly dividend of US$1.045, has drawn attention to its growth prospects. The share price increase of 7% aligns with market trends, suggesting investor confidence despite external uncertainties like tariff negotiations and Federal Reserve updates. The company's long-term focus on infrastructure investment through 2029 promises to improve service reliability and expand capacity, potentially enhancing revenue and stability in earnings forecasts. This positions Duke Energy for future growth, albeit with risks from regulatory hurdles and funding needs.

Over a five-year period, Duke Energy delivered a total return of 81.1%, reflecting strong past performance. This compares favorably to the US Electric Utilities industry's 13.8% return over the past year, indicating the company has outperformed its peers over the shorter term as well. The consensus analyst price target of US$124.21 suggests a modest upside from the current share price of US$121.7, indicating that analysts perceive Duke Energy to be approximately fairly valued. While the anticipated infrastructure expansion may deliver promising results, its eventual impact on revenue and earnings remains subject to execution and external factors.

Assess Duke Energy's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Duke Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives