- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (NYSE:DUK) Is Paying Out A Larger Dividend Than Last Year

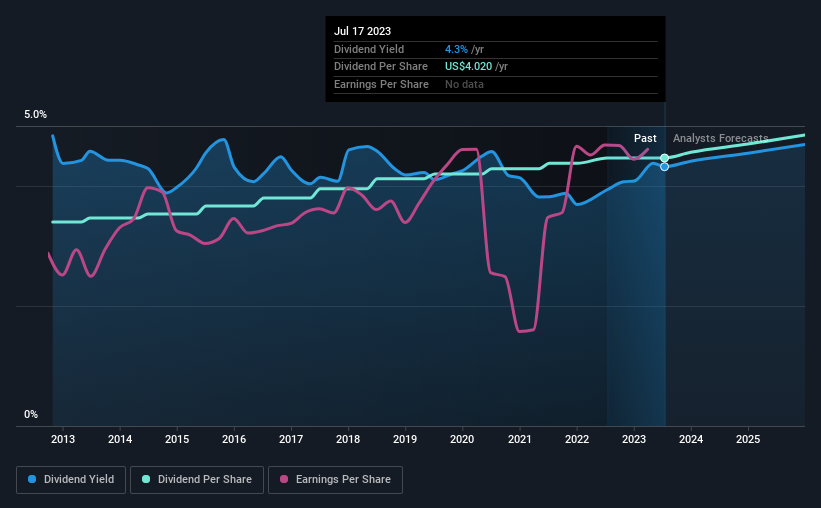

Duke Energy Corporation (NYSE:DUK) will increase its dividend on the 18th of September to $1.02, which is 2.0% higher than last year's payment from the same period of $1. Based on this payment, the dividend yield for the company will be 4.3%, which is fairly typical for the industry.

View our latest analysis for Duke Energy

Duke Energy's Dividend Is Well Covered By Earnings

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Prior to this announcement, Duke Energy's dividend was making up a very large proportion of earnings, and the company was also not generating any cash flow to offset this. We think that this practice can make the dividend quite risky in the future.

The next year is set to see EPS grow by 26.6%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 65% which would be quite comfortable going to take the dividend forward.

Duke Energy Has A Solid Track Record

The company has been paying a dividend for a long time, and it has been quite stable which gives us confidence in the future dividend potential. The dividend has gone from an annual total of $3.06 in 2013 to the most recent total annual payment of $4.02. This means that it has been growing its distributions at 2.8% per annum over that time. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

Dividend Growth May Be Hard To Achieve

Investors could be attracted to the stock based on the quality of its payment history. Earnings has been rising at 3.7% per annum over the last five years, which admittedly is a bit slow. Duke Energy's earnings per share has barely grown, which is not ideal - perhaps this is why the company pays out the majority of its earnings to shareholders. That's fine as far as it goes, but we're less enthusiastic as this often signals that the dividend is likely to grow slower in the future.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think Duke Energy will make a great income stock. In the past the payments have been stable, but we think the company is paying out too much for this to continue for the long term. We don't think Duke Energy is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for Duke Energy (1 is concerning!) that you should be aware of before investing. Is Duke Energy not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives