- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (DUK): Is the Current Share Price a Fair Reflection of Value?

Reviewed by Kshitija Bhandaru

Duke Energy (DUK) shares have delivered a 6% gain over the past month, catching the attention of investors tracking utility stocks. The company’s performance stands out as broader market trends and sector dynamics continue to influence the outlook for regulated utilities.

See our latest analysis for Duke Energy.

Duke Energy’s 19.2% year-to-date share price return signals that investor momentum is picking up, particularly after the strong run in the last three months. This builds on a solid one-year total shareholder return of just over 10%, underscoring the company’s resilience in a shifting utilities landscape.

If you’re looking to broaden your investing lens beyond utilities, this is a great moment to discover fast growing stocks with high insider ownership

With shares currently trading just below consensus analyst targets and steady fundamentals on display, investors are left wondering if Duke Energy is a bargain amid momentum or if all future growth is already priced in.

Most Popular Narrative: 3.8% Undervalued

With Duke Energy closing at $128.53 per share and the most popular narrative placing fair value at $133.54, analysts see a modest price gap driven by long-term catalysts. The numbers suggest more than short-term optimism; there are deeper fundamental shifts shaping this view.

Major economic development wins (e.g., AWS's $10B data center in North Carolina), paired with accelerated migration and manufacturing demand in Duke's service territory, are expected to drive robust, multi-year load and volume growth, supporting higher revenues and long-term EPS growth. Supportive state and federal legislation, such as the Power Bill Reduction Act in NC and the Energy Security Act in SC, streamlines cost recovery for new generation and grid investments, reducing regulatory lag and improving cash flow and earnings stability over the next decade.

Want to know what’s fueling this valuation? Analysts are betting on legacy-busting earnings and future profit multiples rarely seen in utilities. Gone are the days of slow, sleepy growth. Discover the bold financial leaps embedded in this price forecast; the real shocker is which key metric underpins their optimism.

Result: Fair Value of $133.54 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating customer adoption of solar and storage or a shift in regulatory support could quickly challenge Duke Energy’s current growth assumptions.

Find out about the key risks to this Duke Energy narrative.

Another View: What Does Our DCF Model Say?

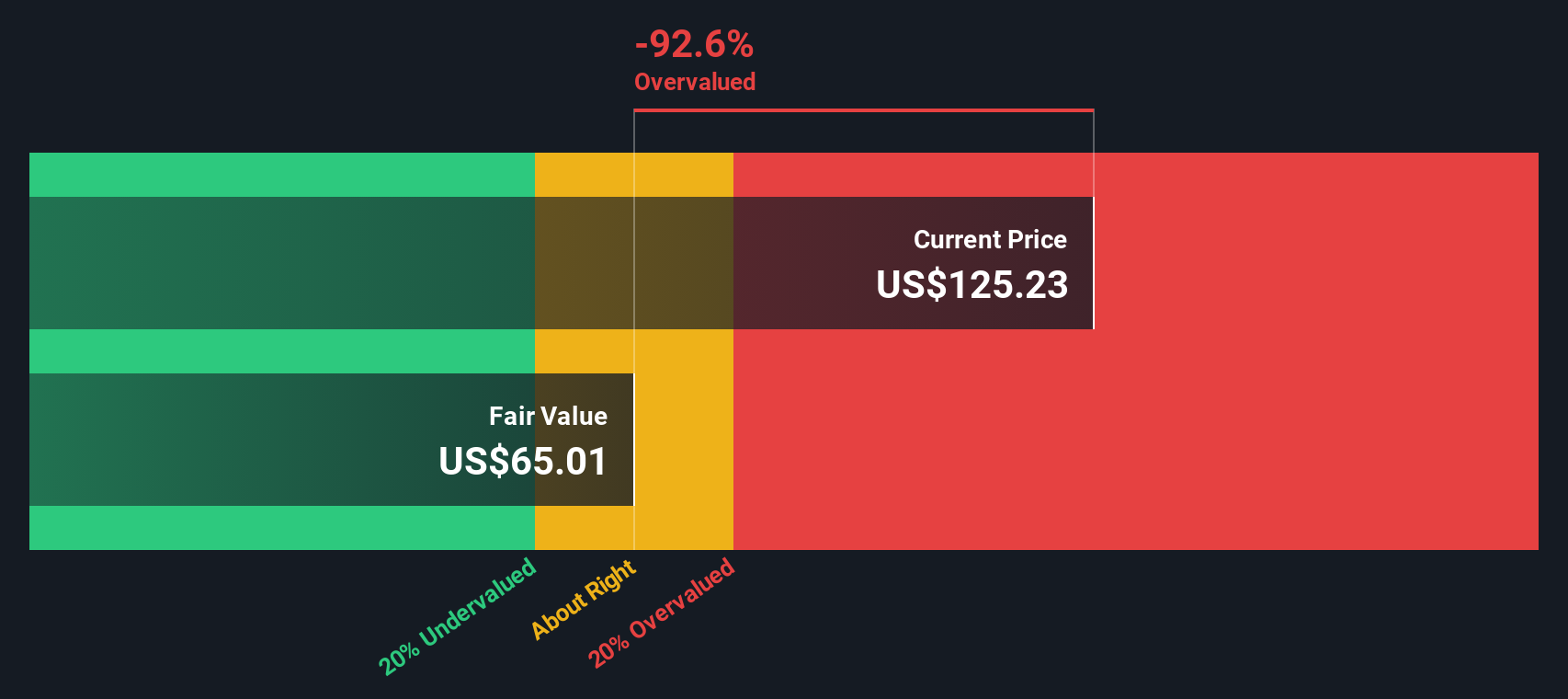

For a different perspective on Duke Energy's value, the Simply Wall St DCF model estimates fair value at just $64.90 per share. This suggests that the stock could be significantly overvalued compared to its current price. This result challenges the optimism behind recent analyst targets and raises a crucial question: which outlook better captures Duke Energy's true long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Duke Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Duke Energy Narrative

If you have a different perspective or want to dig deeper into the numbers, you can put together your own narrative in just a few minutes using the same tools analysts use, and see what sets your case apart. Do it your way

A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Exciting Investment Angles?

Don't leave your portfolio behind when new trends and sectors are gaining traction. Use Simply Wall Street’s powerful screener to spot fresh ideas that match your ambitions.

- Get ahead of the next crypto surge by researching these 79 cryptocurrency and blockchain stocks as these options make real-world breakthroughs beyond digital coins.

- Uncover fast-growing health tech by reviewing these 33 healthcare AI stocks which is redefining patient care, diagnosis, and medical innovation.

- Chase smart yield opportunities from these 18 dividend stocks with yields > 3% that offer reliable income potential in today’s unpredictable market landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives