- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Duke Energy (DUK) Community Grants Spotlight: A Fresh Look at the Utility’s Current Valuation

Reviewed by Simply Wall St

Duke Energy (DUK) just spotlighted its community focus with nearly $275,000 in surprise microgrants to South Carolina hunger relief groups, part of a broader $600,000 campaign, and investors are asking what this means for the stock.

See our latest analysis for Duke Energy.

Despite the charitable spotlight, Duke Energy’s recent share price return has eased back, with the stock down over the past month but still posting a positive year to date gain. Multi year total shareholder returns suggest steady, income oriented momentum rather than a high growth surge.

If this kind of steady utility profile appeals but you also want more sector diversification, it is worth exploring other regulated names and broader healthcare stocks opportunities for comparison.

With shares up solidly over the past year but lagging in recent weeks, and trading at a notable discount to analyst targets, is Duke Energy quietly undervalued, or is the market already factoring in its next leg of growth?

Most Popular Narrative: 14.2% Undervalued

Compared with Duke Energy’s last close of $117.97, the most followed narrative points to a higher fair value anchored in long term earnings power.

Duke's large scale commitment to nuclear and renewables (operating the nation's largest regulated nuclear fleet, plus long term renewables investment pipeline) aligns with the ongoing clean energy transition. This helps secure regulatory support and capture production tax credits that directly boost earnings and reduce exposure to commodity price volatility.

Want to see how steady revenue growth, rising margins, and a richer future earnings multiple combine into that higher valuation? The narrative reveals the full playbook.

Result: Fair Value of $137.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating customer adoption of rooftop solar and batteries, alongside higher capital and financing costs, could pressure Duke’s revenue growth, margins, and valuation assumptions.

Find out about the key risks to this Duke Energy narrative.

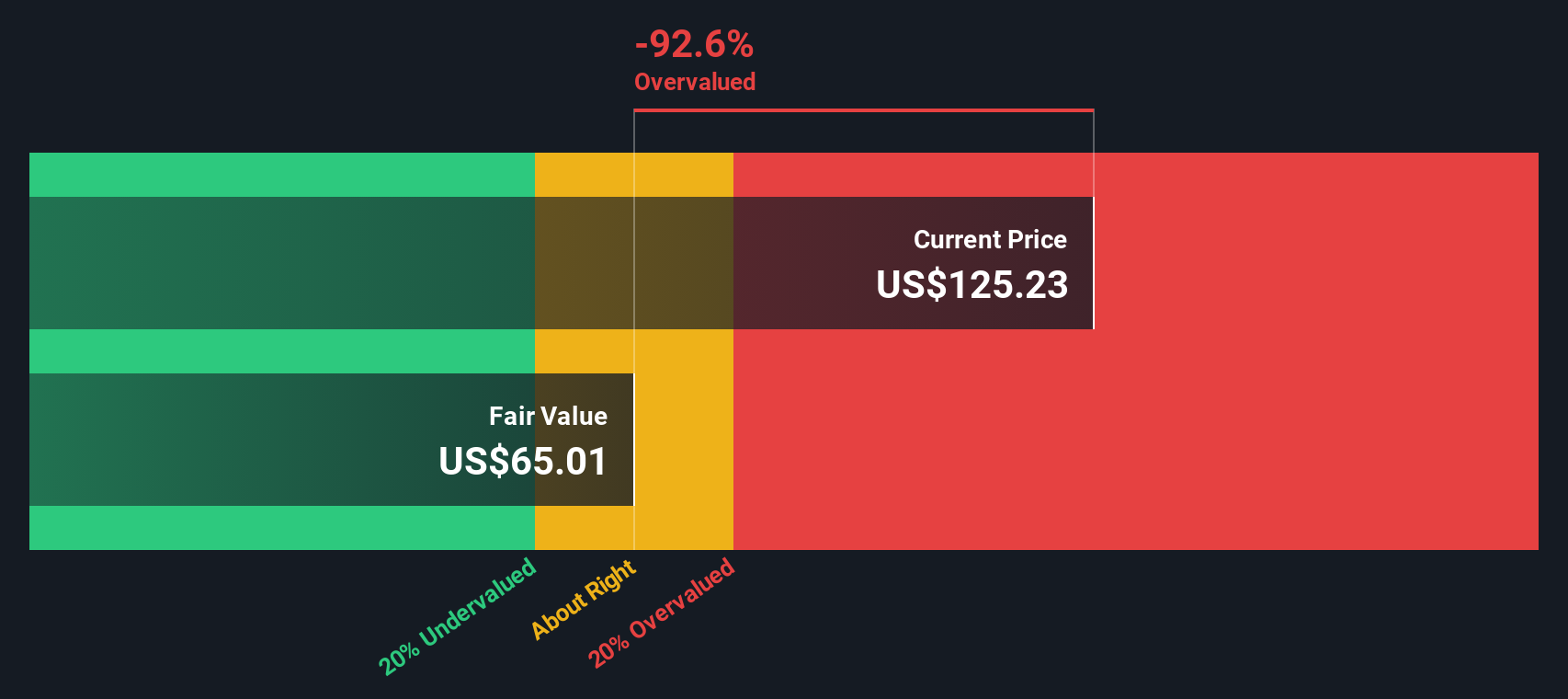

Another Lens on Value

Our DCF model presents a different view, suggesting Duke’s fair value is around $63.17, well below the current $117.97 share price, which appears overvalued on this basis. If cash flows do not ramp as expected, today’s “steady compounder” premium could be too rich.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Duke Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Duke Energy Narrative

If you have a different perspective or prefer digging into the numbers yourself, you can quickly craft a personalized view in under three minutes: Do it your way.

A great starting point for your Duke Energy research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall Street Screener today to uncover fresh opportunities that match your strategy, so you are not left watching others catch the upside first.

- Capture early stage potential by targeting these 3571 penny stocks with strong financials that already show resilient balance sheets and credible growth stories.

- Position yourself for the next wave of innovation by zeroing in on these 26 AI penny stocks shaping automation, data intelligence, and productivity gains.

- Strengthen your income strategy by focusing on these 15 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026