- United States

- /

- Electric Utilities

- /

- NYSE:DUK

Are Duke Energy Shares Worth Their 19.7% Run in 2025?

Reviewed by Bailey Pemberton

If you’re sitting on the fence about what to do with Duke Energy stock, you’re hardly alone. With a steady march upward, Duke shares have delivered an impressive 19.7% return year to date and just over 6% in the past month alone. That’s the kind of performance that grabs attention, especially for investors looking for both growth and reliability in their portfolios.

Much of this momentum seems tied to increasing optimism around the company’s clean energy initiatives and its recent expansion of renewable infrastructure, a move that has resonated well with investors looking for long-term stability in the utility space. Notably, the stock’s 11.0% one-year gain and 72.8% five-year return highlight that this isn’t just a “flash in the pan” story; there’s real staying power behind Duke’s recent rise.

But with all this upward movement, many are wondering whether the current price actually reflects the true value of the company. Our latest valuation check assigns Duke Energy a score of 3 out of 6 for being undervalued, suggesting that while the stock isn’t a screaming bargain, it’s far from overvalued based on several metrics.

So, how does Duke really stack up when you analyze it from different valuation angles? In the next section, we’ll break down the major methods investors use to gauge a stock’s worth. Later, we’ll reveal a deeper approach to understanding value that might just change how you look at Duke and the entire sector.

Why Duke Energy is lagging behind its peers

Approach 1: Duke Energy Dividend Discount Model (DDM) Analysis

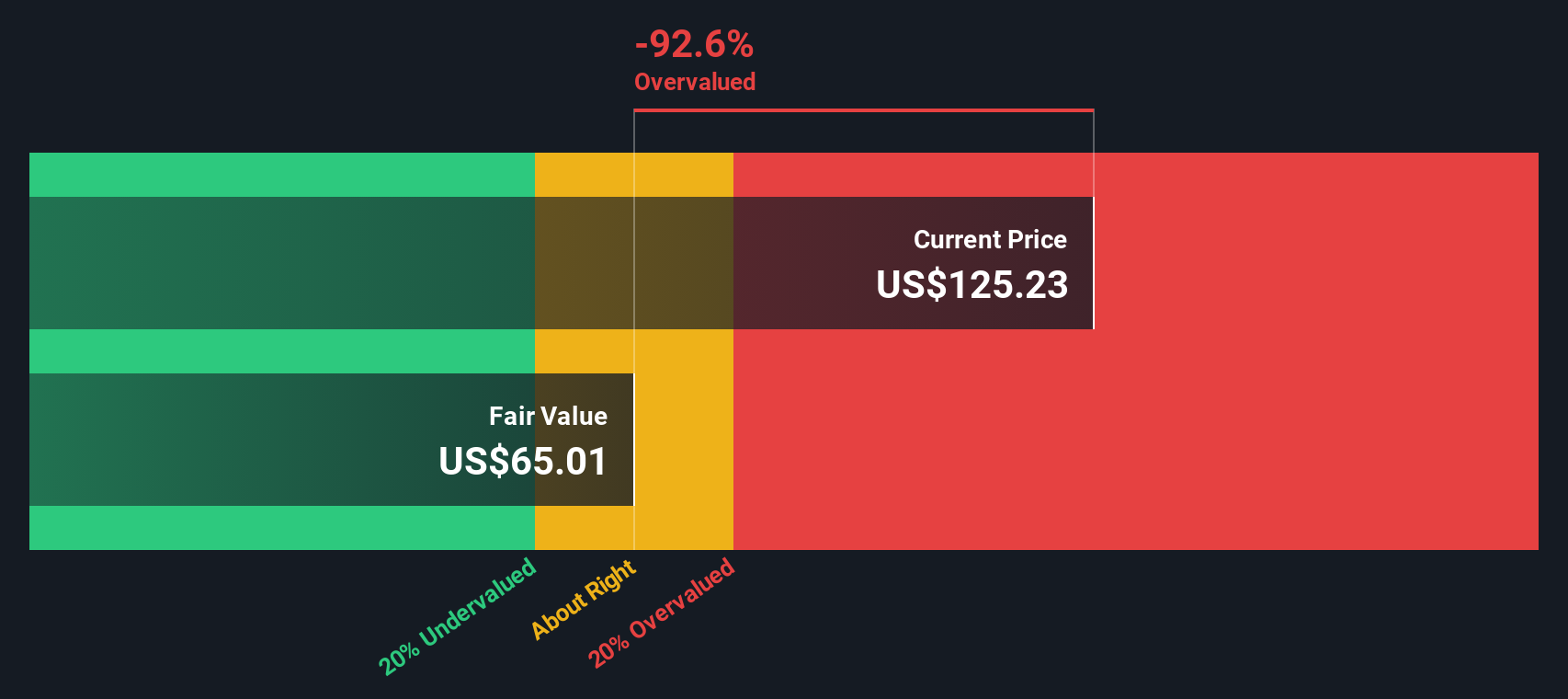

The Dividend Discount Model (DDM) estimates a stock’s intrinsic value by projecting its future dividend payments and discounting them back to today’s dollars. This approach is especially relevant for utility firms like Duke Energy that have consistent dividend histories.

For Duke Energy, the DDM is based on an annual dividend per share of $4.49 and a return on equity of 8.48%. A key concern highlighted in the model is a payout ratio of 101.89%, meaning Duke currently pays out nearly all of its earnings as dividends. This leaves little room for sustainable dividend growth or for investment back into the business. As a result, the DDM projects a slightly negative growth rate in dividends going forward (negative 0.16%).

Based on these factors, the model calculates Duke Energy’s fair intrinsic value at $64.78 per share. With Duke trading almost 99.2% above this estimated value, the DDM indicates the stock is substantially overvalued relative to its long-term dividend outlook.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Duke Energy may be overvalued by 99.2%. Find undervalued stocks or create your own screener to find better value opportunities.

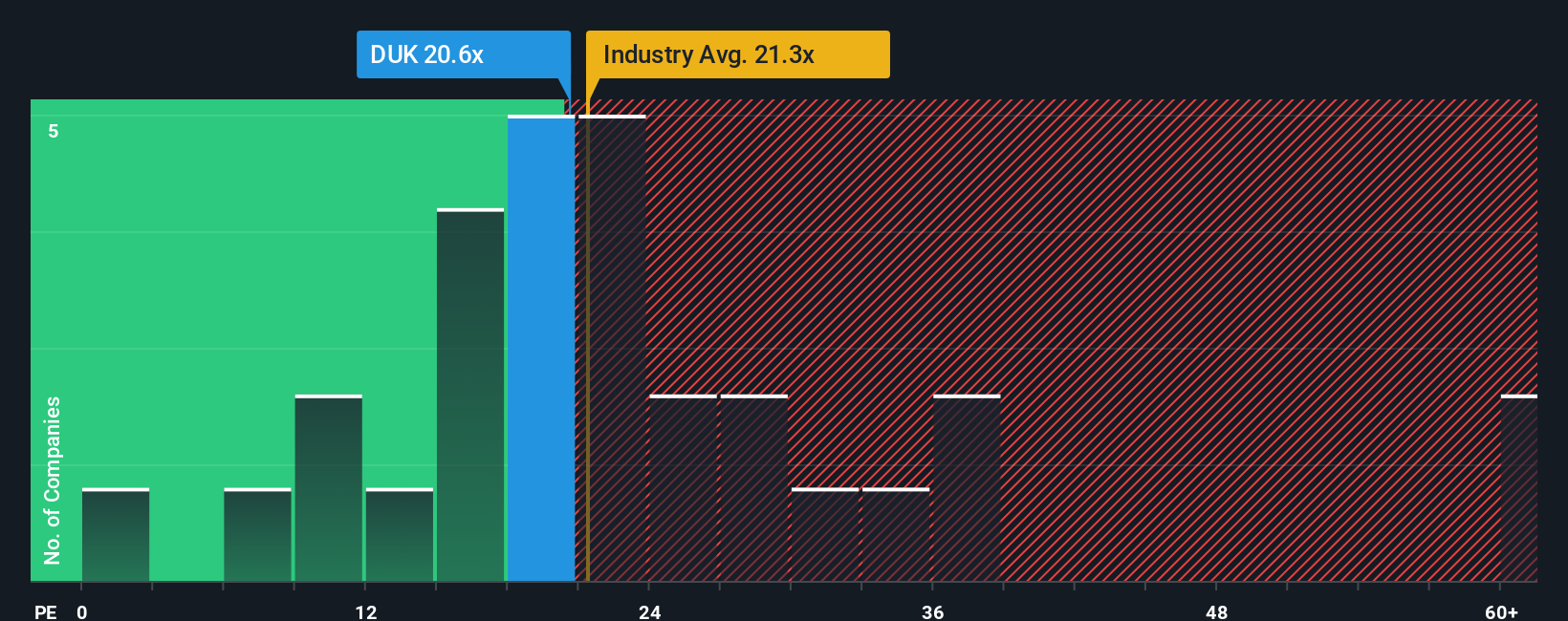

Approach 2: Duke Energy Price vs Earnings (PE Ratio) Analysis

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing established, profitable companies like Duke Energy because it offers a direct look at how much investors are paying for each dollar of current earnings. For a mature utility, a sensible PE ratio captures the market's expectations for future growth, as well as its relative stability and risk compared to other stocks.

Growth prospects and business risk play a big role in what counts as a “normal” or reasonable PE ratio. If investors expect stronger earnings growth or see less risk in a company, the stock typically commands a higher PE. However, if growth is sluggish, even a low ratio could be justified.

Currently, Duke Energy trades at a PE of 21.2x. That is close to the electric utilities industry average of 21.4x and below the peer average of 26.8x. To bring in an even more tailored benchmark, Simply Wall St calculates a proprietary “Fair Ratio” for Duke Energy of 22.0x, reflecting its specific earnings growth profile, profit margins, risk levels, industry, and market size. This Fair Ratio goes beyond surface-level comparisons and aims for a truly apples-to-apples assessment that recognizes Duke’s unique characteristics instead of lumping it in with the broader sector.

With Duke’s actual PE nearly matching its Fair Ratio, the stock looks fairly valued using this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Duke Energy Narrative

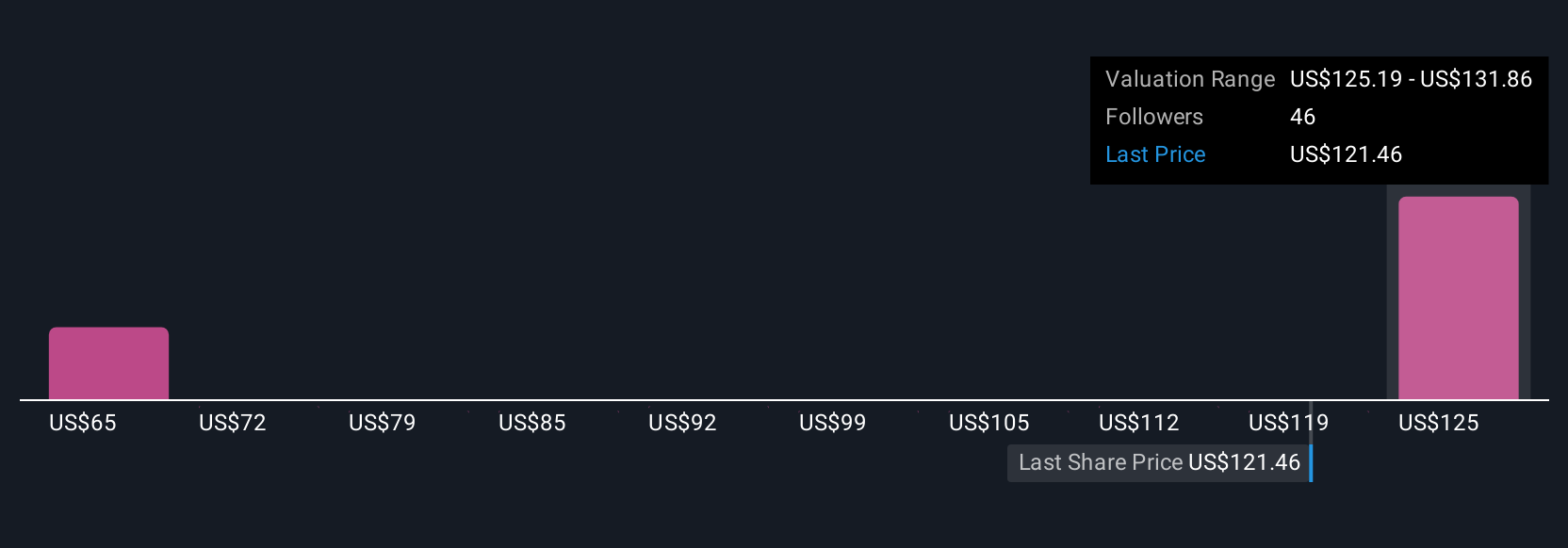

Earlier we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your story about a company, connecting your own outlook and assumptions about Duke Energy’s future (such as what you expect for revenue, profit margins, or its regulatory wins) with real numbers and a resulting fair value. Narratives make investing more approachable by linking the company’s story directly to a financial forecast and then showing you how that translates into what you might consider a fair price.

With Simply Wall St’s Narratives tool, found on the Community page and used by millions of investors, you can easily compare your view of Duke Energy with others. The platform shows you the fair value behind every Narrative, updating automatically when big news or earnings are released. This matters because it lets you act confidently. You can buy when you see value above the current price, or sell when the market gets ahead of itself. For example, among recent Narratives for Duke Energy, some investors calculate fair values as high as $133.54 per share, favoring clean energy investments and strong growth, while others set it as low as $64.78, focused on dividend constraints and slower profit growth. This underlines how your perspective drives your decision.

Do you think there's more to the story for Duke Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DUK

Duke Energy

Through its subsidiaries, operates as an energy company in the United States.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives