- United States

- /

- Other Utilities

- /

- NYSE:D

Dominion’s $50 Billion Clean Energy Push Might Change The Case For Investing In Dominion Energy (D)

Reviewed by Sasha Jovanovic

- Dominion Energy recently announced plans to invest over US$50 billion through 2029 to address growing power demand, including advancing the major 2.6 GW Coastal Virginia Offshore Wind project, which is expected to begin delivering power in early 2026 and reach full operation by the end of next year.

- This substantial commitment reflects Dominion’s effort to capitalize on long-term electricity demand trends, particularly as data center expansion and clean energy initiatives gain momentum in its core service regions.

- Let’s explore how Dominion’s bold clean energy investment pipeline and regulatory progress may shape the company’s long-term investment outlook.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Dominion Energy Investment Narrative Recap

To be a stakeholder in Dominion Energy, you need to believe in the company's ability to deliver consistent returns through regulated utility growth and large-scale clean energy investments, while effectively managing cost and regulatory risks. The recent US$50 billion investment update underscores the company’s pursuit of long-term demand trends, but it does not materially alter the immediate focus on the successful and cost-efficient completion of the Coastal Virginia Offshore Wind project, nor does it diminish ongoing exposure to rising project expenses or regulatory hurdles.

Among recent announcements, Dominion’s reaffirmation of its 2025 operating earnings guidance following the investment news stands out. This maintains near-term visibility for investors but does not address longer-term uncertainties tied to offshore wind project costs and regulatory recovery, factors that could directly impact future earnings outcomes.

However, investors should be aware that if cost overruns on the Coastal Virginia Offshore Wind project escalate without full regulatory cost recovery…

Read the full narrative on Dominion Energy (it's free!)

Dominion Energy's outlook anticipates $17.8 billion in revenue and $3.6 billion in earnings by 2028. This is based on a 5.3% annual revenue growth rate and a $1.1 billion increase in earnings from the current $2.5 billion figure.

Uncover how Dominion Energy's forecasts yield a $62.15 fair value, in line with its current price.

Exploring Other Perspectives

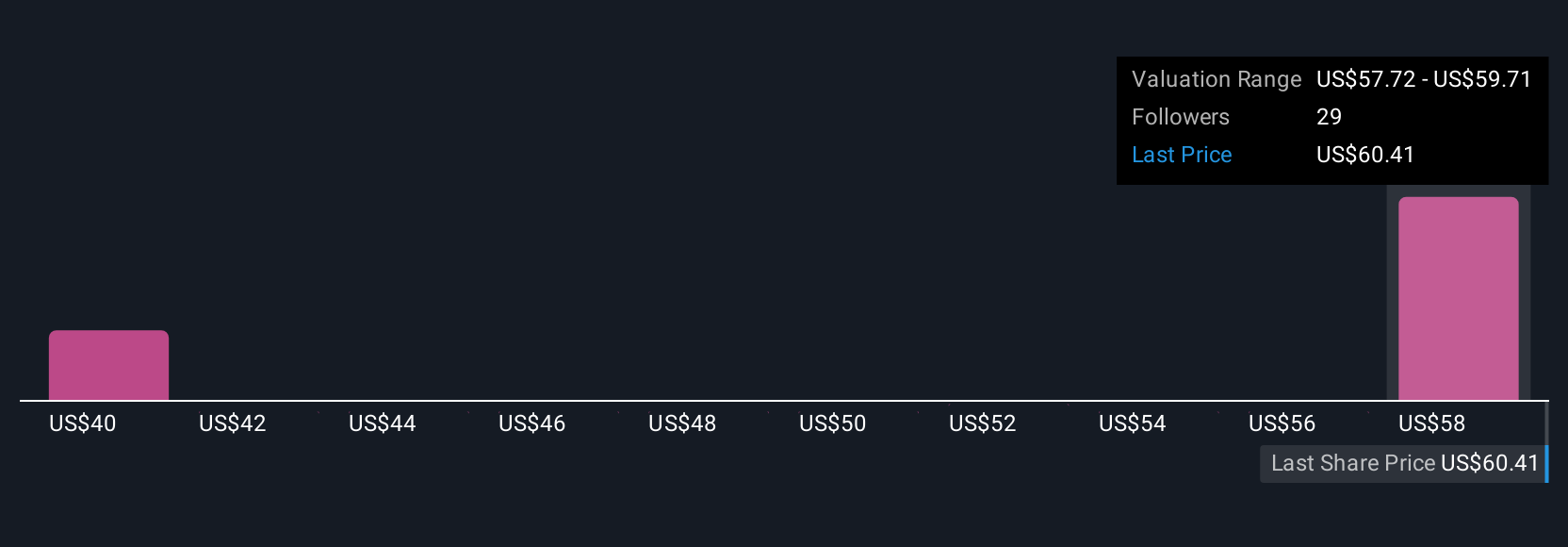

Fair value estimates from three Simply Wall St Community members range widely from US$37.76 to US$62.15 per share. With ongoing high capital spending requirements and a need for prudent debt management, the path forward can look very different depending on your outlook, so take time to explore the full set of opinions.

Explore 3 other fair value estimates on Dominion Energy - why the stock might be worth as much as $62.15!

Build Your Own Dominion Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dominion Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dominion Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dominion Energy's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:D

Dominion Energy

Provides regulated electricity and natural gas services in the United States.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives