- United States

- /

- Other Utilities

- /

- NYSE:D

Dominion Energy (NYSE:D) Valuation in Focus After Strong Earnings and Upbeat 2025 Guidance Update

Reviewed by Simply Wall St

Dominion Energy (NYSE:D) just reported higher sales and net income for both the latest quarter and nine-month period compared to last year. The company also provided a refined 2025 operating earnings guidance that emphasizes expectations at or above the midpoint.

See our latest analysis for Dominion Energy.

Dominion Energy’s latest guidance update and steady fundamental growth seem to be catching investors’ eyes, with the stock delivering a total shareholder return of 13.6% over the past year. While recent shelf registrations and stable buyback activity have kept headlines coming, the real story is how momentum has gradually built this year. This has outpaced the broader utilities sector and suggests that confidence in the company’s long-term outlook is on the rise.

If Dominion’s progress has you thinking about other compelling opportunities, now could be the right time to broaden your watchlist and discover fast growing stocks with high insider ownership

With shares trading near their price target after a year of steady gains, investors now face a critical question: Is Dominion Energy undervalued at this level, or is the market already factoring in the company’s future growth?

Most Popular Narrative: 4.3% Undervalued

Dominion Energy's last close of $61.37 sits just below the most popular narrative's fair value estimate of $64.13. This relatively narrow gap suggests market optimism is creeping higher. The stage is set as analysts see forward momentum but expect continued scrutiny on how future margins and growth play out.

Large-scale investments in regulated renewables, especially the Coastal Virginia Offshore Wind (CVOW) project, position Dominion to benefit from the accelerating energy transition. This allows the company to earn stable regulated returns and expand its rate base, with a positive impact on long-term earnings.

What bold revenue and earnings growth forecasts are analysts baking into this target? The entire valuation rides on signature projects, margin gains, and a growth runway not widely expected in classic utilities. Want to discover which crucial financial levers might turn this fair value into reality? Find out what’s driving analyst consensus by reading the complete narrative.

Result: Fair Value of $64.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as rising project costs and potential regulatory setbacks could quickly challenge the current optimism supporting Dominion Energy's fair value outlook.

Find out about the key risks to this Dominion Energy narrative.

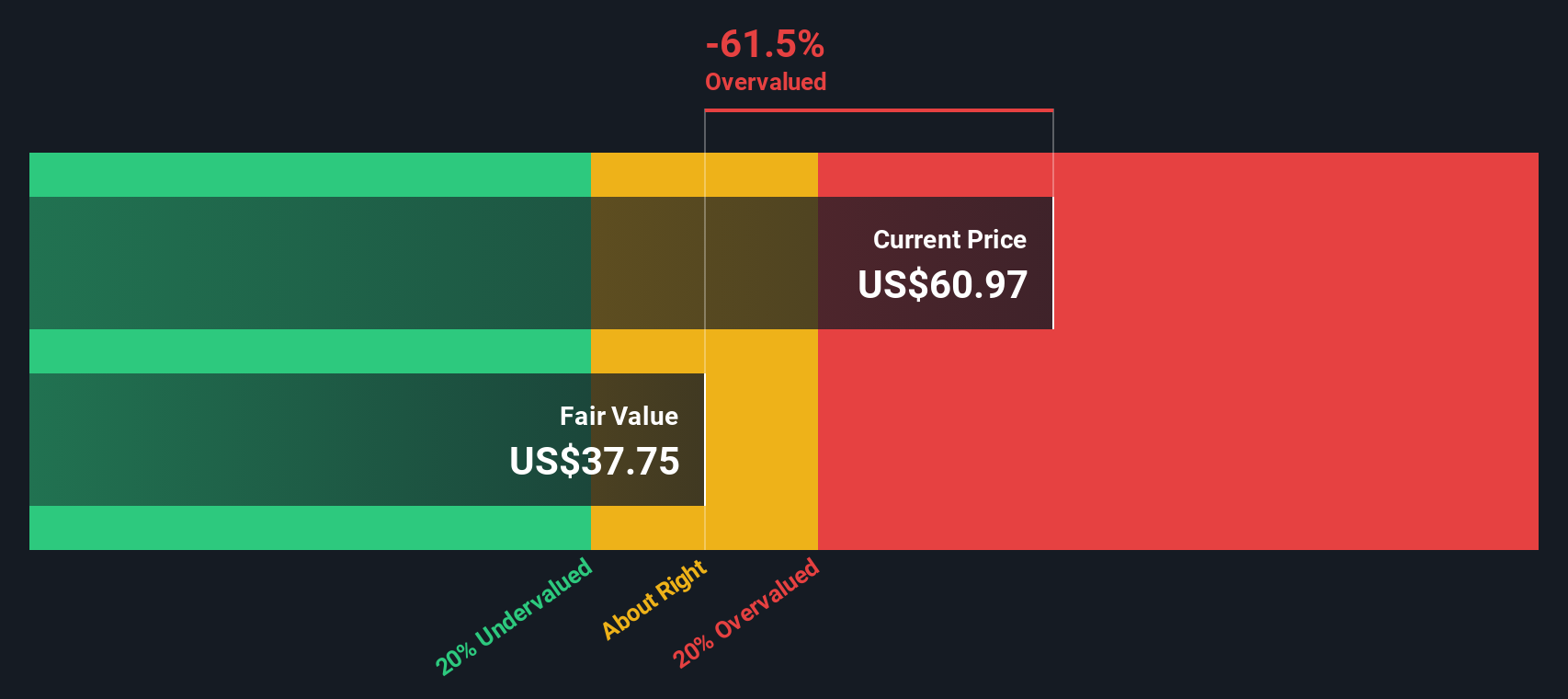

Another View: SWS DCF Model Paints a Different Picture

While analyst targets suggest Dominion Energy still holds some upside, our SWS DCF model comes to a very different conclusion. On this basis, the shares appear overvalued compared to the model’s fair value estimate. This raises the question of whether recent momentum has pushed the price ahead of fundamentals. Which valuation approach do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dominion Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dominion Energy Narrative

Whether you want to dig deeper into Dominion Energy’s numbers or chart your own course, you have the tools to craft a narrative in just minutes. Do it your way

A great starting point for your Dominion Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your horizons and give yourself an edge by targeting unique investment themes that could put you ahead of other investors. The market is filled with overlooked and fast-moving opportunities. Turn knowledge into action before others catch on.

- Unlock the potential of future medical breakthroughs by tapping into these 32 healthcare AI stocks and spot emerging leaders shaping healthcare’s next frontier.

- Accelerate your income growth by considering these 14 dividend stocks with yields > 3% featuring companies with robust yields already rewarding shareholders.

- Ride the momentum of tomorrow’s disruptors by accessing these 25 AI penny stocks and see which innovators are setting the pace in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:D

Dominion Energy

Provides regulated electricity and natural gas services in the United States.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives