- United States

- /

- Other Utilities

- /

- NYSE:D

Dominion Energy (D): Assessing Valuation as Clean Energy Investments Drive Renewed Investor Focus Ahead of Earnings

Reviewed by Simply Wall St

Dominion Energy (D) is making headlines as it steps up clean energy investments, with more than $50 billion planned through 2029. The company's Coastal Virginia Offshore Wind project, along with growing demand for power, are drawing investor attention ahead of quarterly results.

See our latest analysis for Dominion Energy.

Momentum is gradually building for Dominion Energy, as highlighted by its 90-day share price return of 3.65% and a year-to-date share price gain of 11.76%. While long-term total shareholder returns have been more modest, with a 5.95% total return over the past year, the company’s clean energy investments and strong fundamental outlook have put it back on investors’ radar in recent months.

If Dominion’s focus on large-scale renewables got you interested, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with shares rebounding and analyst price targets just above current levels, the question is whether Dominion Energy is now undervalued or if the market has already accounted for its future growth in the current price.

Most Popular Narrative: 2.2% Undervalued

With Dominion Energy closing at $60.80 and a widely followed fair value of $62.15 per share, the consensus view sees modest upside. This is fueling debate on whether recent momentum is signaling a shift.

Large-scale investments in regulated renewables, especially the Coastal Virginia Offshore Wind (CVOW) project, position Dominion to benefit from the accelerating energy transition. This approach earns stable regulated returns and expands rate base, with a positive impact on long-term earnings.

Curious how one mega-project and a focus on stable earnings might push Dominion’s value higher? The narrative’s fair value hinges on forecasts that challenge the status quo for regulated utilities. Want to discover the key numbers behind this surprising upside? The full narrative pulls back the curtain on the projections shaping this target price.

Result: Fair Value of $62.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, project cost overruns or unfavorable regulatory decisions could challenge Dominion’s earnings outlook and disrupt the current growth narrative.

Find out about the key risks to this Dominion Energy narrative.

Another View: Comparing Value Through Multiples

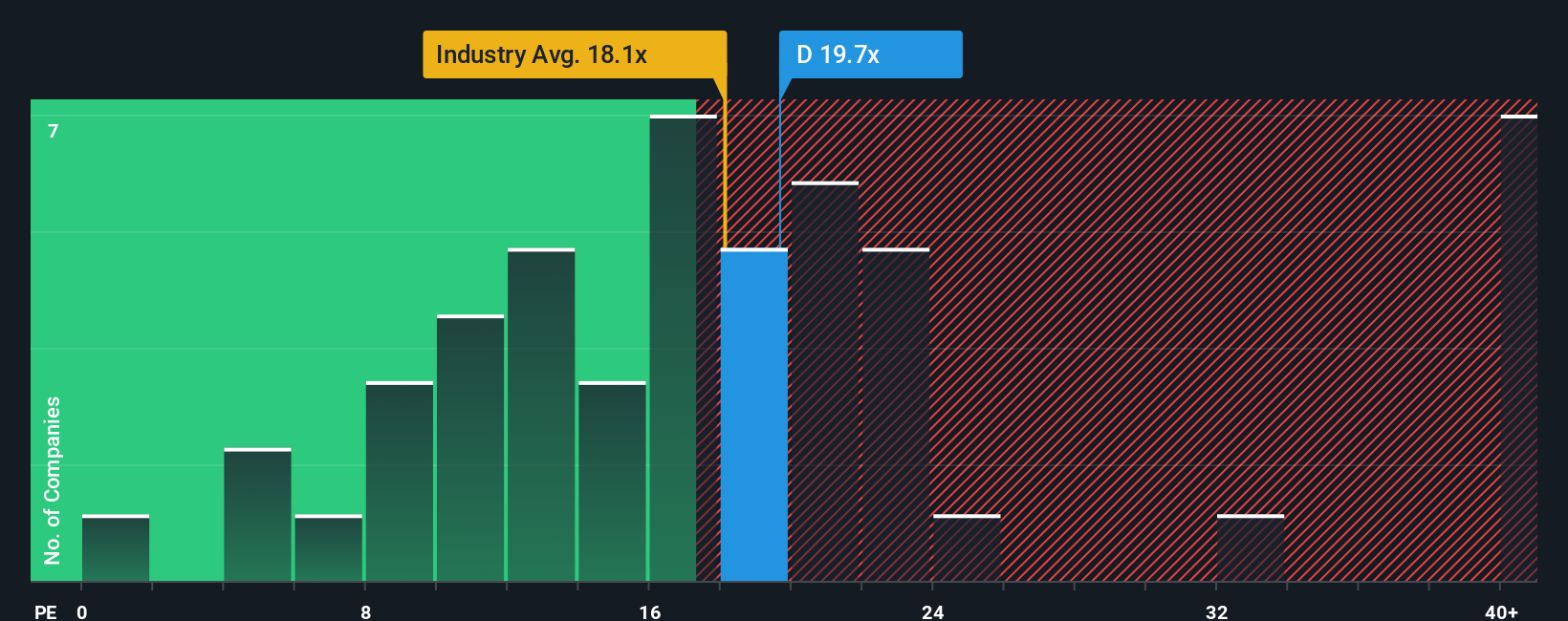

Looking at Dominion Energy's price-to-earnings ratio of 20.4x, it stands higher than the industry average of 18.3x but below its peer average of 21.3x. The fair ratio is 23x, suggesting that the stock might have some cushion before being considered overvalued. However, there appears to be less room for upside than some bullish forecasts imply. Could this be where investors need to weigh both optimism and risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dominion Energy Narrative

If you want to dig deeper or challenge the consensus, you can tap into the data and shape a narrative of your own in a few short minutes. Do it your way

A great starting point for your Dominion Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next opportunity slip by. Use the Simply Wall Street Screener to instantly pinpoint stocks making waves across different sectors and riding powerful trends.

- Capture growth as you browse these 27 AI penny stocks, leading the surge in artificial intelligence advancements and reshaping entire industries through automation and data-driven technologies.

- Secure income by checking out these 19 dividend stocks with yields > 3%, which are delivering consistent yields above 3%, making them suitable for building a reliable cash flow into your portfolio.

- Step ahead of the crowd and scan these 3568 penny stocks with strong financials to uncover small-cap gems with strong fundamentals and significant breakout potential before they hit the spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:D

Dominion Energy

Provides regulated electricity and natural gas services in the United States.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives