- United States

- /

- Water Utilities

- /

- NYSE:CWT

California Water Service Group's (NYSE:CWT) Share Price Not Quite Adding Up

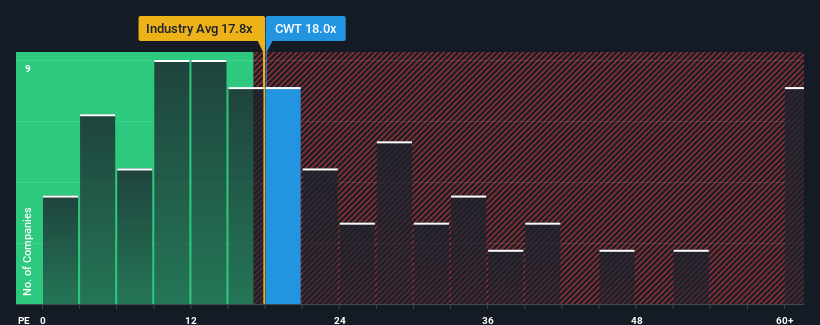

There wouldn't be many who think California Water Service Group's (NYSE:CWT) price-to-earnings (or "P/E") ratio of 18x is worth a mention when the median P/E in the United States is similar at about 18x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, California Water Service Group has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for California Water Service Group

How Is California Water Service Group's Growth Trending?

In order to justify its P/E ratio, California Water Service Group would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 167%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 3.1% each year over the next three years. That's not great when the rest of the market is expected to grow by 10% each year.

In light of this, it's somewhat alarming that California Water Service Group's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

What We Can Learn From California Water Service Group's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of California Water Service Group's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for California Water Service Group that you need to be mindful of.

If these risks are making you reconsider your opinion on California Water Service Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CWT

California Water Service Group

Through its subsidiaries, provides water utility and other related services in California, Washington, New Mexico, Hawaii, and Texas.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives