- United States

- /

- Water Utilities

- /

- NYSE:CWT

California Water Service Group (CWT): Assessing Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

California Water Service Group (CWT) has seen some movement in its stock over the past month, rising about 4%. Investors keeping an eye on utility names may be curious about what is behind this steady climb and what it could mean going forward.

See our latest analysis for California Water Service Group.

Over the past year, California Water Service Group’s momentum has been mixed. A recent share price rally has countered a longer-term dip. Despite a 3.6% gain in the past 30 days and a 1.7% lift over the past quarter, the one-year total shareholder return stands at -5.5%. This indicates that short-term optimism is still contending with broader challenges.

If you’re curious what else is gaining traction in the market, now might be the perfect chance to broaden your outlook and check out fast growing stocks with high insider ownership

Recent momentum has reignited debate about California Water Service Group’s true value, raising the question: is this a window for investors to buy at a discount, or has the market already priced in future growth potential?

Most Popular Narrative: 15.3% Undervalued

California Water Service Group’s most widely followed valuation narrative points to a fair value well above yesterday’s closing price. This suggests the market may be missing something. The narrative considers recent growth, earnings outlook, and industry-specific catalysts, painting a different picture from the share price.

Accelerating capital investment in water infrastructure and modernization, driven by increasing water scarcity, climate adaptation needs, and urban population growth, positions Cal Water to expand its regulated rate base by a projected ~12% CAGR. This supports sustained long-term revenue and cash flow growth. Expansion into high-growth areas such as Texas and the development of large-scale reuse projects like Silverwood create a pathway for customer base expansion and incremental capital deployment, which is expected to drive future top-line and earnings growth.

Want to see what’s pushing this value projection skyward? There is a bold revenue growth path, upgraded profitability, and an ambitious expansion plan hiding behind the headline numbers. Ready to find out why analysts expect earnings will leap well beyond current levels? Dive in and see the strategic outlook that might reshape your view of California Water Service Group.

Result: Fair Value of $55.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around regulatory delays or rising compliance costs could halt share price momentum. This reminds investors that future growth is not guaranteed.

Find out about the key risks to this California Water Service Group narrative.

Another View: How Does the Market Multiple Stack Up?

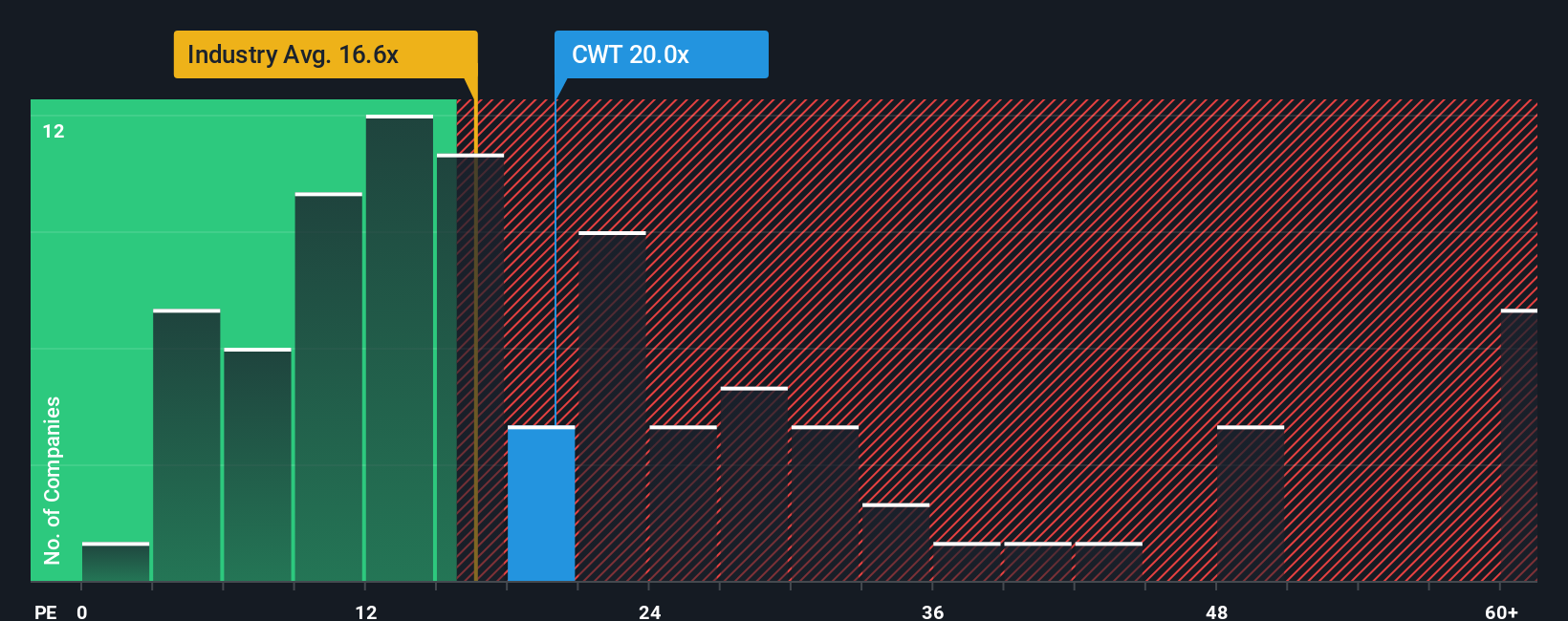

Looking at valuation from a different angle, California Water Service Group’s price-to-earnings ratio of 20.5x is just below the US Water Utilities industry average of 20.9x. However, it stands well above the global average of 16.6x and the company’s fair ratio of 19.4x. This positioning could mean a higher valuation risk if market sentiment shifts. Is the market being too generous, or does it see hidden value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own California Water Service Group Narrative

If you have a different angle or want to weigh the numbers for yourself, you can shape your own narrative, often in just a few minutes. Do it your way

A great starting point for your California Water Service Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why settle for just one opportunity? Make your next move count by checking out innovative stocks and fresh strategies with Simply Wall Street’s powerful tools.

- Tap into tomorrow’s leaders by checking out these 26 AI penny stocks, which are powering advancements in automation, machine learning, and artificial intelligence applications.

- Maximize your portfolio’s potential by targeting reliable passive income with these 20 dividend stocks with yields > 3%, offering yields above 3% and solid fundamentals.

- Seize the opportunity to find overlooked companies trading below their intrinsic worth with these 842 undervalued stocks based on cash flows and strengthen your foundation for future gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWT

California Water Service Group

Through its subsidiaries, provides water utility and other related services in California, Washington, New Mexico, Hawaii, and Texas.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives