- United States

- /

- Renewable Energy

- /

- NYSE:CWEN.A

Does Clearway Energy's Dividend Hike and Surging Profit Strengthen the Investment Case for CWEN.A?

Reviewed by Sasha Jovanovic

- Earlier this week, Clearway Energy, Inc. announced a 1.62% increase to its quarterly dividend, following third quarter results where net income more than doubled from last year on lower tax expenses, new investments, and favorable wind conditions.

- This combination of higher shareholder returns, improved operational performance, and reaffirmed long-term growth objectives reflects Clearway's focus on both immediate and sustained value creation.

- Next, we'll explore how the company's increased dividend and stronger net income may impact its forward-looking investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Clearway Energy Investment Narrative Recap

For Clearway Energy, shareholders typically look for stable cash flows from renewable projects, dividend growth, and disciplined execution of its expansion plans. While the latest dividend hike and strong net income reinforce management's commitment to returns, the most important near-term catalyst, the company's ability to fund expansion efficiently, was not materially changed by the recent news; interest rate risks and access to capital remain central concerns.

The recently announced agreement to acquire an 833MWdc solar portfolio is especially relevant, as it underscores Clearway's pursuit of scale in renewables and its need for ongoing capital. This acquisition is closely linked to the company's catalysts and risks, given its impact on future project returns and financing requirements.

However, investors should also be aware that, even with dividend growth, changes in financing conditions may...

Read the full narrative on Clearway Energy (it's free!)

Clearway Energy's outlook anticipates $1.8 billion in revenue and $166.6 million in earnings by 2028. This is based on an annual revenue growth rate of 8.4% and an increase in earnings of $90.6 million from the current $76.0 million.

Uncover how Clearway Energy's forecasts yield a $36.90 fair value, a 9% upside to its current price.

Exploring Other Perspectives

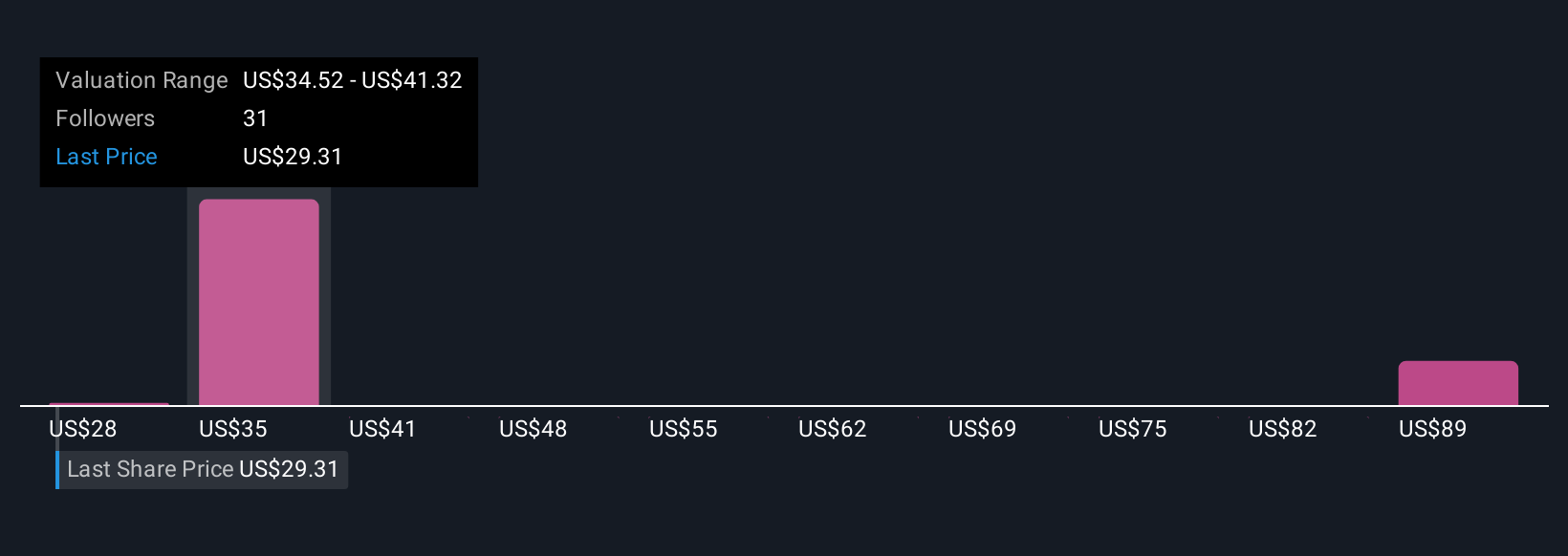

Five private investor fair value estimates from the Simply Wall St Community range from US$14.38 to US$36.90, showing widely different outlooks. Despite this spread, the company's dependence on affordable financing remains a key risk that could shape performance if broader funding conditions shift.

Explore 5 other fair value estimates on Clearway Energy - why the stock might be worth as much as 9% more than the current price!

Build Your Own Clearway Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clearway Energy research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Clearway Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clearway Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWEN.A

Clearway Energy

Operates in the clean energy generation assets business in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success