- United States

- /

- Renewable Energy

- /

- NYSE:CWEN.A

Clearway Energy (CWEN.A) Margin Falls to 5.3%, Undercuts Bullish Profit Growth Narratives

Reviewed by Simply Wall St

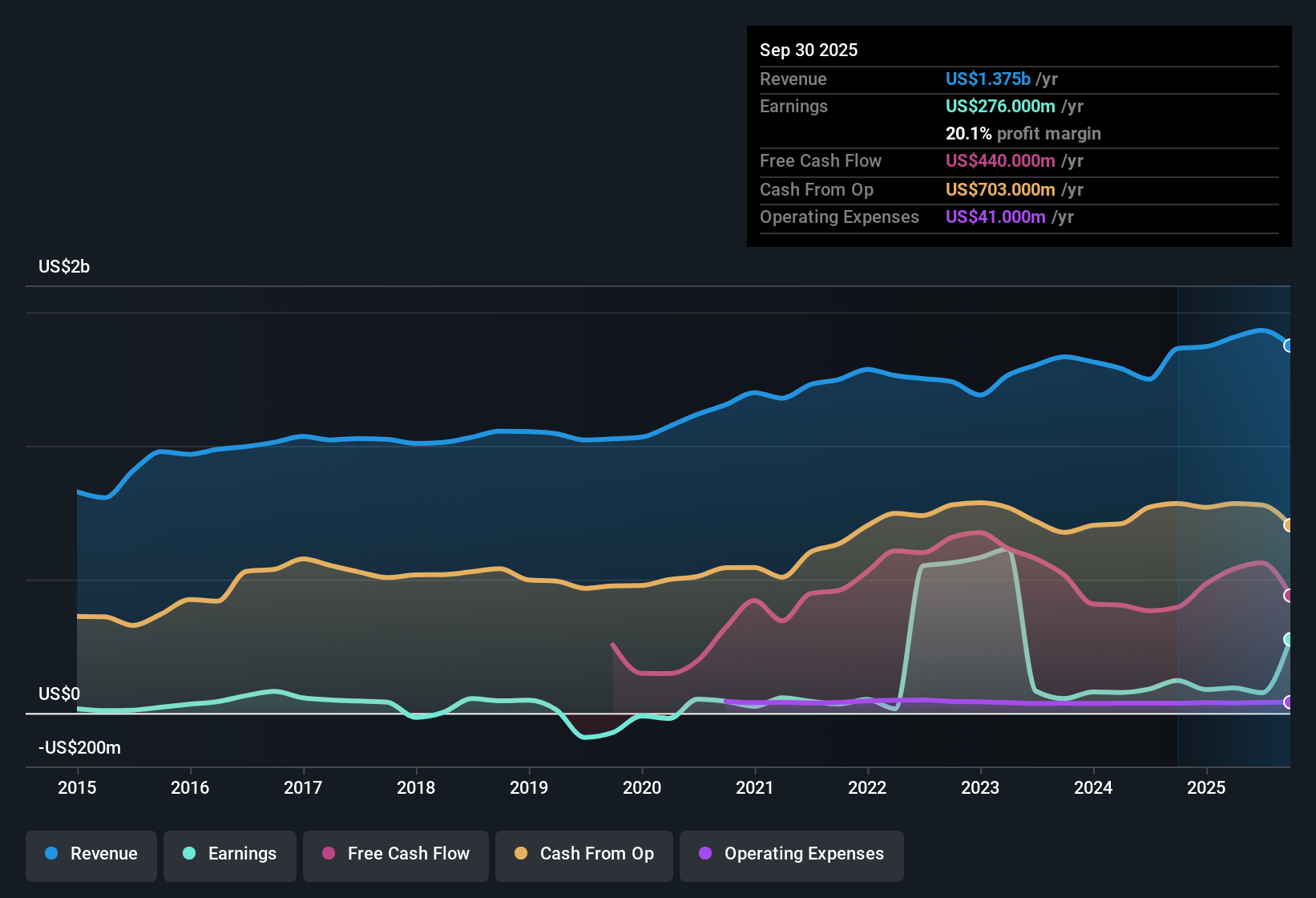

Clearway Energy (CWEN.A) posted a net profit margin of 5.3%, a decline from last year’s 7.2%. Average earnings growth over the past five years has been just 1.2% per year, but the most recent results show negative year-over-year earnings growth. Looking ahead, earnings are forecast to grow at an impressive 23.1% annually, which is well ahead of the US market average. Revenue is expected to rise 9.6% per year, slightly lagging the broader market. Investors face mixed signals as the stock trades below discounted cash flow estimates but appears expensive by price-to-earnings. This reflects sharp growth forecasts alongside pressure on margins.

See our full analysis for Clearway Energy.Now, let’s see how these headline figures compare with the prevailing market narratives and community perspectives at Simply Wall St, and whether the numbers back up the story investors are telling.

See what the community is saying about Clearway Energy

Margin Expansion in Analyst Forecasts

- Analysts expect Clearway’s profit margin to rise from 5.3% today to 9.1% within three years, which would outpace the margin growth seen at most US peers.

- According to analysts' consensus view, stable cash flow from long-term data center and utility contracts, combined with a diversified asset mix across wind, solar, and battery storage, are cited as major drivers for this forecasted margin improvement.

- Consensus narrative highlights Clearway’s significant project pipeline and favorable financing as factors expected to support sustainable earnings growth and resilience, particularly as clean energy demand accelerates.

- However, continued reliance on regional policy and stable contract structures remains a watchpoint for maintaining these targets.

- What stands out is that the consensus view sees margin expansion as achievable, yet highlights the need to sustain operating efficiency and investment pace as decarbonization trends accelerate.

- Increasing corporate demand for renewable power agreements and eligibility for federal tax credits are critical levers for margin upside.

- Rising competition and evolving technology in energy storage are acknowledged as risks that could slow or limit these gains.

Profit Growth Leans on Long-Term Projects

- Forecasts show Clearway’s earnings increasing from $76.0 million now to $166.6 million by September 2028, with annual revenue growth estimated at 8.4% over the next three years.

- Analysts' consensus view emphasizes that robust, long-dated contracts and an active project pipeline are behind these profit projections.

- Strategic expansion into battery storage and grid-relevant assets is expected to further support both top-line and margin growth as grid modernization continues.

- There is wide analyst disagreement: the most bullish see $191.3 million in 2028 earnings, while the most bearish expect only $40.9 million, indicating profit growth may depend heavily on the pace and reliability of new project execution.

DCF Discount Contrasts With High PE Ratio

- Clearway trades at $32.57 per share, well below its DCF fair value of $60.39. The stock’s price-to-earnings ratio is 50.5x, much higher than the renewable energy industry’s average of 17.6x and slightly above the peer average of 48.9x.

- Analysts' consensus narrative suggests that strong earnings growth justifies a premium multiple, but notes this premium only makes sense if Clearway sustains its margin and profit expansion targets.

- The analyst price target is set at $36.70, or 12.7% above the current share price, underscoring the market’s cautious optimism despite the high headline multiple.

- For these numbers to hold up, Clearway’s growth pipeline and contract advantages must deliver consistent margin gains without disruptions from policy, financing, or contract pricing risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Clearway Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from another angle? Take just a few minutes to craft your perspective and shape the next narrative. Your view could redefine the conversation. Do it your way

A great starting point for your Clearway Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Although Clearway Energy’s growth prospects are strong, its high price-to-earnings ratio and pressured margins highlight valuation risk if expansion falls short.

If you’re searching for more compelling value, seek out these 839 undervalued stocks based on cash flows delivering better fundamentals at more attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWEN.A

Clearway Energy

Operates in the clean energy generation assets business in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives