- United States

- /

- Gas Utilities

- /

- NYSE:CPK

Should You Be Adding Chesapeake Utilities (NYSE:CPK) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Chesapeake Utilities (NYSE:CPK), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Chesapeake Utilities with the means to add long-term value to shareholders.

Our free stock report includes 2 warning signs investors should be aware of before investing in Chesapeake Utilities. Read for free now.Chesapeake Utilities' Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. Chesapeake Utilities has grown its trailing twelve month EPS from US$4.75 to US$5.15, in the last year. That's a modest gain of 8.6%.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Chesapeake Utilities shareholders can take confidence from the fact that EBIT margins are up from 24% to 30%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

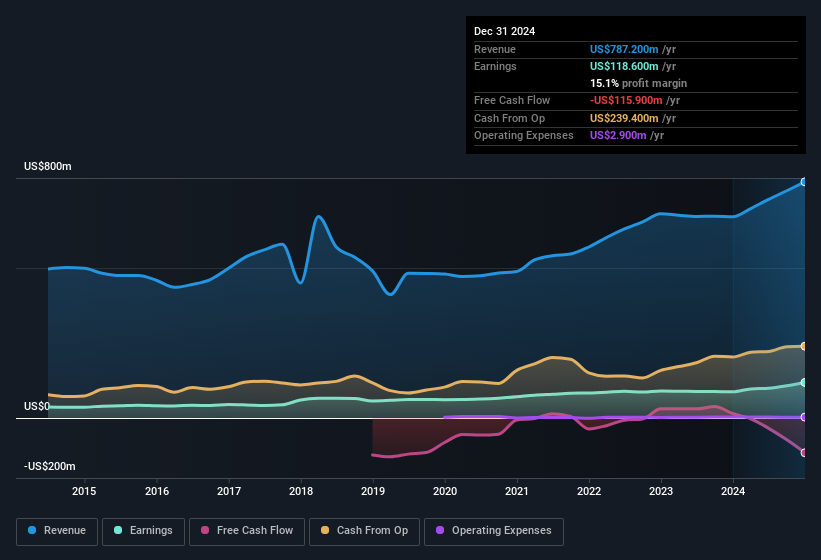

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

View our latest analysis for Chesapeake Utilities

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Chesapeake Utilities' future profits.

Are Chesapeake Utilities Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Chesapeake Utilities insiders have a significant amount of capital invested in the stock. With a whopping US$57m worth of shares as a group, insiders have plenty riding on the company's success. This would indicate that the goals of shareholders and management are one and the same.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Chesapeake Utilities with market caps between US$2.0b and US$6.4b is about US$7.6m.

The Chesapeake Utilities CEO received US$4.2m in compensation for the year ending December 2024. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Chesapeake Utilities Worth Keeping An Eye On?

One important encouraging feature of Chesapeake Utilities is that it is growing profits. The fact that EPS is growing is a genuine positive for Chesapeake Utilities, but the pleasant picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Before you take the next step you should know about the 2 warning signs for Chesapeake Utilities (1 is a bit concerning!) that we have uncovered.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CPK

Chesapeake Utilities

Operates as an energy delivery company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026