- United States

- /

- Other Utilities

- /

- NYSE:CNP

A Look at CenterPoint Energy’s (CNP) Valuation Following Its $53 Billion Expansion Plan and Strong Earnings Growth

Reviewed by Simply Wall St

CenterPoint Energy (CNP) announced third quarter earnings with notable jumps in both sales and net income, following its commitment to a $53 billion investment plan to expand operations over the next decade.

See our latest analysis for CenterPoint Energy.

Shares of CenterPoint Energy have steadily climbed, with a year-to-date price return of 23.40% and a one-year total shareholder return of 37.29%. This reflects building momentum as investors look to the company’s robust expansion strategy and improving earnings growth outlook.

If CenterPoint’s recent surge got your attention, it could be the perfect time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares hitting new highs on optimism over CenterPoint’s aggressive expansion plans and higher earnings, the key question remains: is the current stock price undervaluing its growth prospects, or has the market already priced in the future upside?

Most Popular Narrative: 8.5% Undervalued

CenterPoint Energy's latest consensus narrative pegs its fair value above the last close. This suggests that robust expansion and resilient operations could unlock further shareholder gains.

Progress on regulatory filings, such as recent rate case settlements, will stabilize the rate base over 80% through 2029. This regulatory certainty is expected to improve net margins and earnings predictability.

Want to know what powers this ambitious price estimate? Several key forecasts, backed by big earnings and margin moves, are fueling this valuation's foundation. Find out which assumptions the narrative is betting on and see if you agree with their bold outlook.

Result: Fair Value of $42.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory delays or unexpected asset management challenges could slow CenterPoint’s earnings momentum and add uncertainty to the company’s aggressive growth narrative.

Find out about the key risks to this CenterPoint Energy narrative.

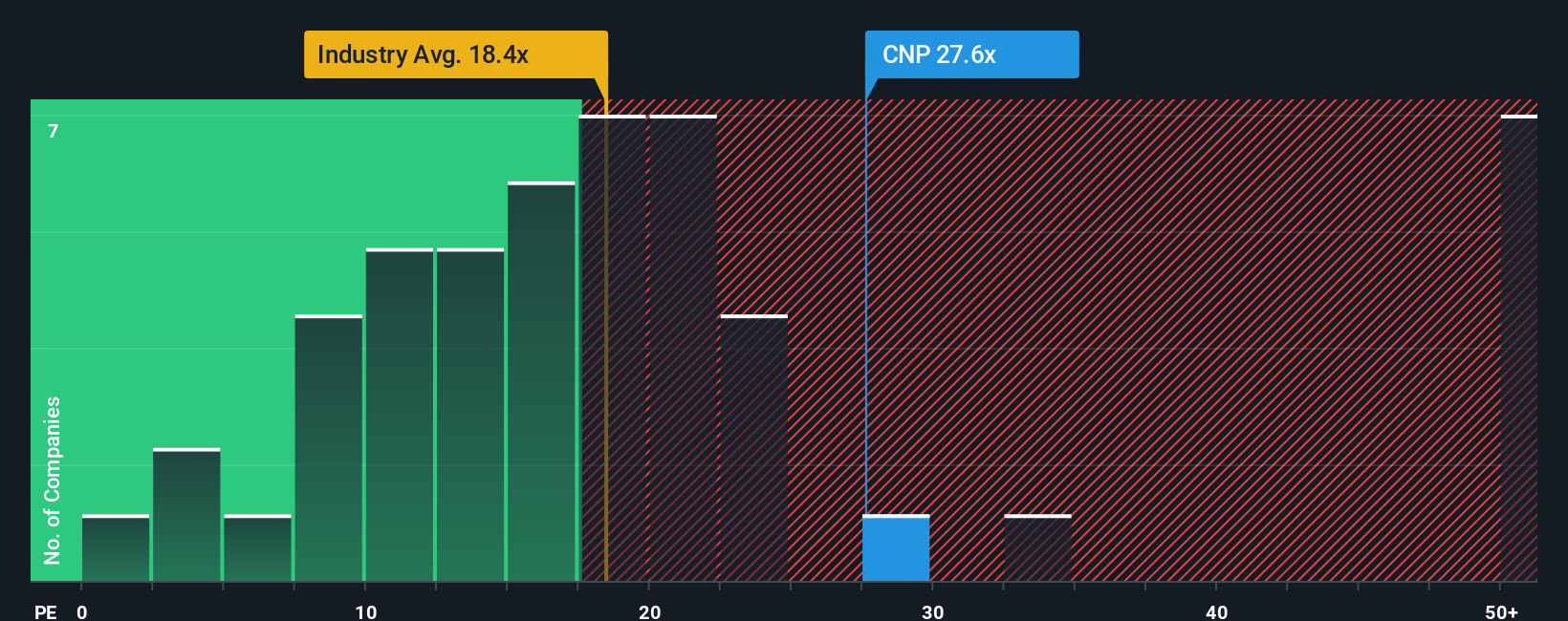

Another View: Market Ratios Send a Different Signal

Looking at market ratios, CenterPoint Energy’s current price-to-earnings ratio is 24.5x. This is markedly higher than both the estimated fair ratio of 22.7x and the average for similar peers at 22x. This premium suggests investors are already pricing in a great deal of optimism. Could this limit the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CenterPoint Energy Narrative

If you see things differently or want to back up your own view, you can dive into the numbers yourself and build a narrative in just minutes. Do it your way

A great starting point for your CenterPoint Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know opportunity is everywhere. Challenge yourself to think bigger and stay ahead in the market by tapping into handpicked stock ideas you won’t want to miss.

- Unleash your potential for strong, reliable income with stocks yielding over 3% when you seize these 20 dividend stocks with yields > 3%.

- Fuel your portfolio’s growth by targeting innovations in artificial intelligence with these 25 AI penny stocks.

- Supercharge your strategy by finding companies priced below their true worth using these 836 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNP

CenterPoint Energy

Operates as a public utility holding company in the United States.

Solid track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives