- United States

- /

- Other Utilities

- /

- NYSE:CMS

Will Strong Q3 Results and Upbeat Guidance Change CMS Energy's (CMS) Investment Narrative?

Reviewed by Sasha Jovanovic

- On October 30, 2025, CMS Energy reported higher third-quarter sales of US$2.02 billion and net income of US$277 million, along with raising its adjusted earnings guidance for 2025 and initiating 2026 guidance in a show of management confidence.

- The company’s updated guidance and continued constructive regulatory outcomes highlight its emphasis on operational strength and long-term earnings visibility for stakeholders.

- We’ll explore how CMS Energy’s upward revision of its earnings outlook could reshape the assumptions behind the company’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CMS Energy Investment Narrative Recap

At its core, the CMS Energy investment story is about confidence in sustained earnings growth driven by regulatory support, favorable rate cases, and ongoing demand from Michigan’s economic expansion. The recent boost in third-quarter results and raised full-year guidance underscores management’s upbeat outlook, but this does not fundamentally change the importance of consistent regulatory outcomes, which remain the key short-term catalyst and primary risk to the business at this stage. One of the most relevant recent developments is the board’s affirmation of the quarterly dividend at 54.25 cents per share. For many shareholders, the stability and growth of dividend payments are tied closely to underlying earnings performance and regulatory certainty, both of which saw positive signals in the latest quarterly report. Yet, despite strong results, investors should be mindful that, if regulatory support weakens in Michigan, cost recovery and returns could come under pressure...

Read the full narrative on CMS Energy (it's free!)

CMS Energy is projected to generate $9.2 billion in revenue and $1.4 billion in earnings by 2028. Achieving these figures requires annual revenue growth of 4.6% and an earnings increase of $0.4 billion from the current $1.0 billion.

Uncover how CMS Energy's forecasts yield a $77.58 fair value, a 6% upside to its current price.

Exploring Other Perspectives

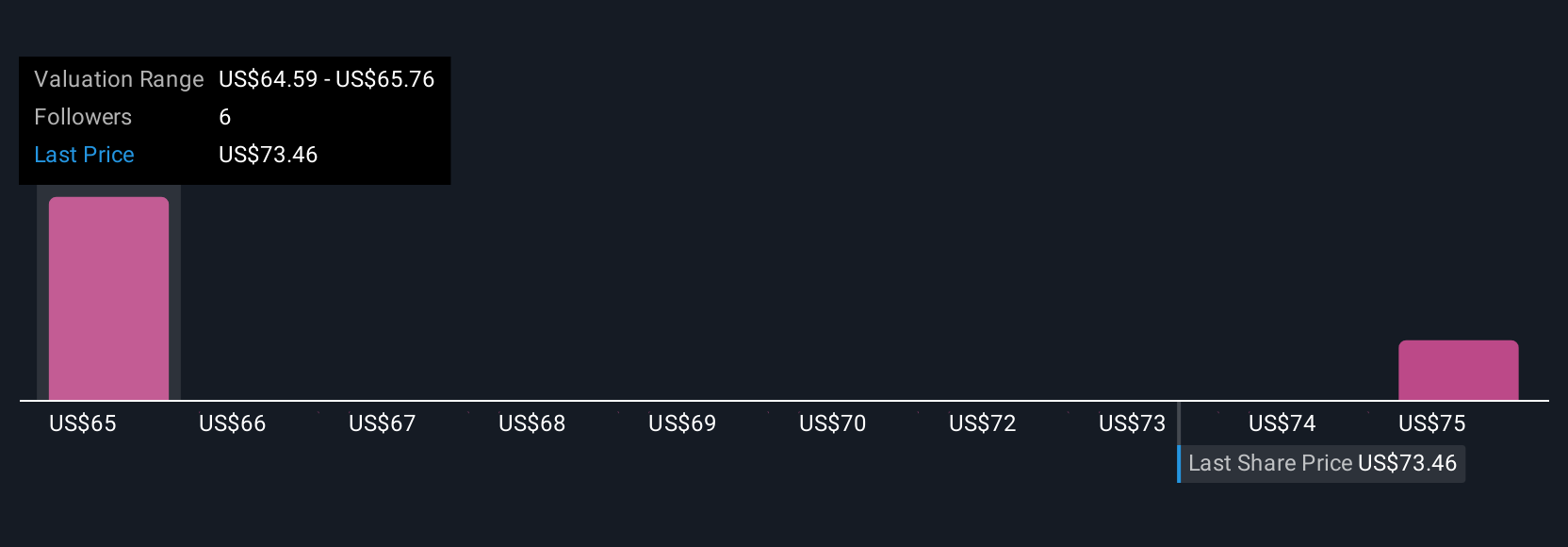

Two independent fair value estimates from the Simply Wall St Community currently span from US$65.18 to US$77.58 per share. As opinions vary widely, consider how continued constructive regulation remains essential for CMS Energy’s earnings and long-term outlook.

Explore 2 other fair value estimates on CMS Energy - why the stock might be worth as much as 6% more than the current price!

Build Your Own CMS Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CMS Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CMS Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CMS Energy's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMS

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives