- United States

- /

- Other Utilities

- /

- NYSE:CMS

CMS Energy (CMS): Assessing Valuation After Expanding and Extending Credit Facilities for Greater Financial Flexibility

Reviewed by Simply Wall St

CMS Energy (CMS) and its subsidiary Consumers Energy have just amended and expanded their revolving credit facilities, increasing available funds and extending the borrowing terms. This move strengthens the company's liquidity profile and funding options.

See our latest analysis for CMS Energy.

This boost to CMS Energy’s credit lines comes shortly after a recent preferred stock dividend announcement and marks a period of steady progress for the company. The share price has climbed 12.45% year-to-date, and over the past one, three, and five years, total shareholder return has grown by 9.44%, 36.8%, and 41.77% respectively. These figures suggest momentum that may reflect investor confidence in both near-term and long-term prospects.

If you’re looking for more inspiration beyond the utilities sector, now’s a perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With shares rising and the company’s credit outlook improving, investors might wonder whether CMS Energy is now trading below its intrinsic value or if recent gains already reflect expectations for continued growth. Is there still a buying opportunity, or is the market pricing in the future?

Most Popular Narrative: 4.5% Undervalued

With CMS Energy’s most followed narrative placing fair value at $78.31 per share, the last close of $74.81 looks discounted. Here is how the thesis unfolds and what might be driving expectations higher.

The accelerating demand for electricity, driven in part by large new data center projects and strong population and business growth within Michigan, is set to sustainably boost sales growth above prior forecasts, likely resulting in stronger top-line revenue and rate base expansion.

Why are ambitious growth stories colliding with stable profit assumptions here? The narrative’s math combines a forecasted leap in future earnings, rising margins, and an industry-defying profit multiple. But which projections really move the needle? Click to reveal what powers this fair value call.

Result: Fair Value of $78.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected setbacks in Michigan’s regulatory support or slower than anticipated demand from new data center projects could challenge CMS Energy’s upbeat outlook.

Find out about the key risks to this CMS Energy narrative.

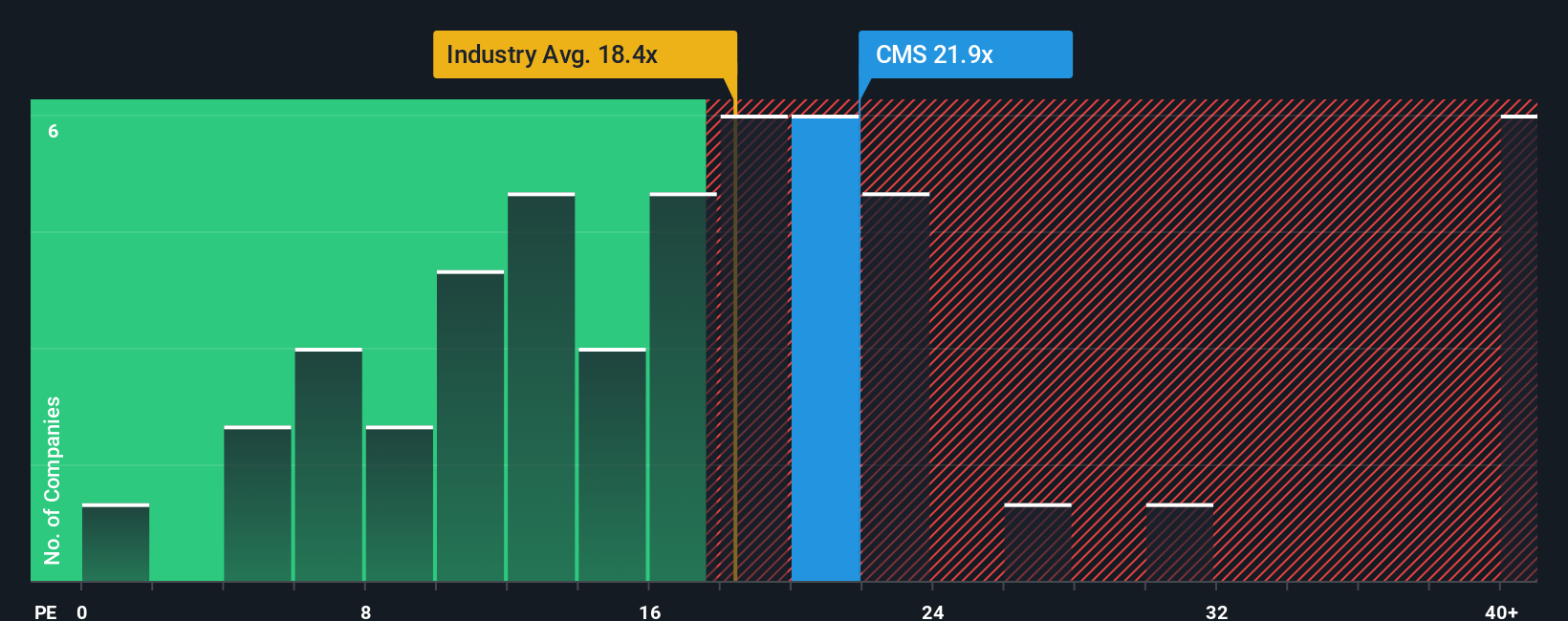

Another View: The Multiples Perspective

Looking at valuation through earnings multiples tells a different story. CMS trades at 22 times earnings, close to the peer average of 22.1 but noticeably above the broader global integrated utilities' average of 18. Compared to its “fair ratio” of 20.8, the stock appears a bit expensive. Could the market be factoring in too much optimism, or does its premium reflect real strength?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CMS Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CMS Energy Narrative

If you find yourself with a different perspective or want to dig deeper into the numbers, you can easily build your own case in just a few minutes using Do it your way.

A great starting point for your CMS Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let the best investment opportunities pass you by. Act now to catch trends and stocks with strong growth, innovation, and income potential using these handpicked ideas:

- Tap into the potential for steady income by checking out these 14 dividend stocks with yields > 3%, where companies offer reliable dividends above 3%.

- Ride the AI wave and fuel your portfolio’s growth with these 26 AI penny stocks, featuring emerging leaders in artificial intelligence applications and solutions.

- Seize unmatched value by uncovering these 924 undervalued stocks based on cash flows, which highlights stocks that stand out for their strong fundamentals and attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMS

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success