- United States

- /

- Other Utilities

- /

- NYSE:BKH

Evaluating Black Hills After 15% Surge and Renewables News in 2025

Reviewed by Bailey Pemberton

- Wondering if Black Hills might actually be a value pick right now? You are not alone. With this type of stock, a closer look could change your mind.

- Shares have climbed 3.8% in the last week and a strong 15.2% across the past month, bringing the year-to-date return to 21.0%. This has sparked interest among investors looking for growth or a shift in risk sentiment.

- Recent headlines highlight positive sentiment around expanding renewable energy initiatives and regulatory clarity. Both factors have supported the recent upward move in share price. There is also growing attention on utilities sector stability as market volatility increases, making news around Black Hills all the more relevant for those watching sector trends.

- If we take a look at the numbers, Black Hills currently scores a 2 out of 6 on our quick valuation check. This suggests there is more to unpack before calling it undervalued. Next, let’s break down what this score really means and explore which valuation methods matter most. Keep in mind, we will reveal an even better way to look for value by the end of this article.

Black Hills scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Black Hills Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach helps investors compare the value of future earnings to the current share price.

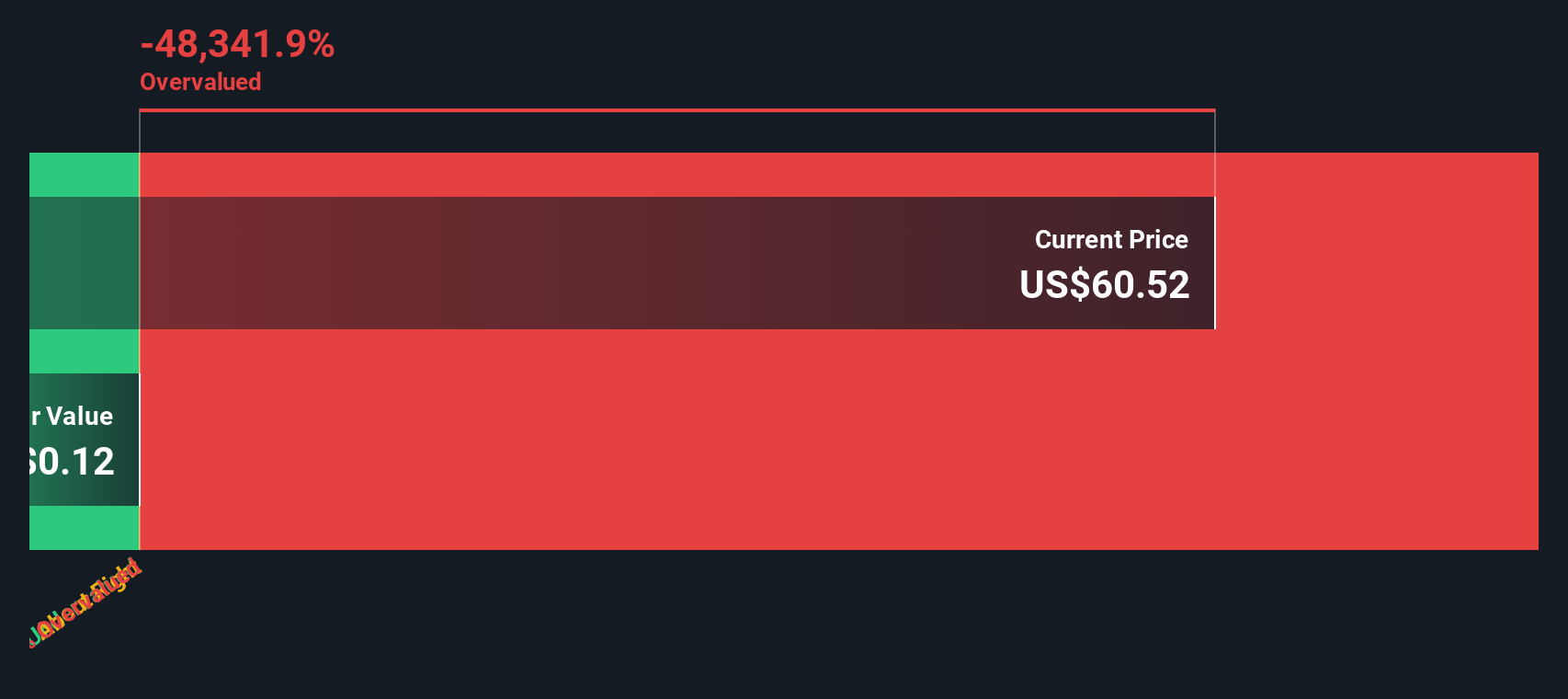

For Black Hills, the most recent reported Free Cash Flow stands at $6.34 million. According to the projections, cash flows are expected to decline in the near future, with estimates dropping to around $3.62 million by 2026 and then tapering further each subsequent year. While analysts typically provide detailed forecasts for up to 5 years, projections for the full decade are extended using Simply Wall St’s model, which anticipates only modest recovery toward the end of the next ten years.

Based on these cash flow forecasts, the DCF analysis calculates an estimated intrinsic value per share significantly below the current market price. In fact, the implied discount suggests that Black Hills is trading at a 14,207.5% premium compared with its calculated fair value using the DCF method.

This suggests that the stock is highly overvalued according to today’s cash flow outlook, and investors may want to be cautious when relying solely on discounted cash flow figures for this utility stock.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Black Hills may be overvalued by 14207.5%. Discover 876 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Black Hills Price vs Earnings

The Price-to-Earnings (PE) ratio is widely considered the go-to valuation measure for profitable companies because it offers a direct comparison between the price investors are paying and the company’s earnings power. When a business is steadily generating profits like Black Hills, the PE ratio gives a useful snapshot of how the market currently values each dollar of those earnings.

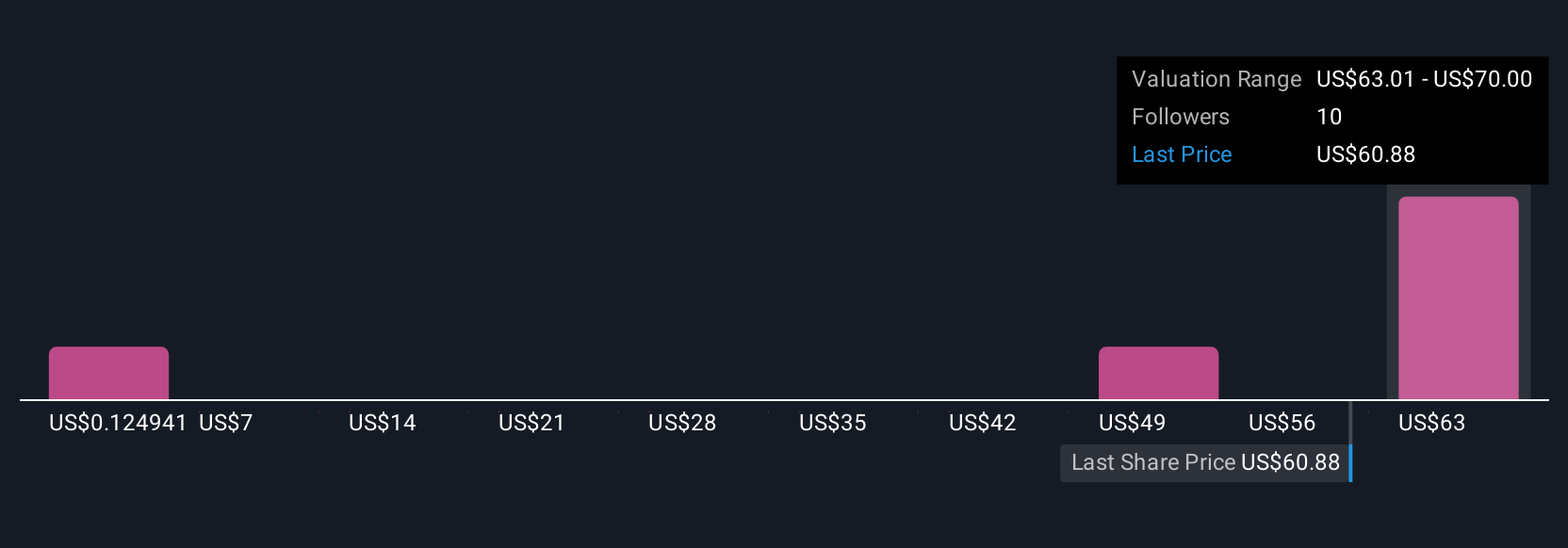

Expectations for future growth and a company’s risk profile both influence what is seen as a “normal” PE ratio. Typically, higher growth or lower risk means investors are willing to accept a higher multiple, while risks or slower growth often keep the ratio subdued. For context, Black Hills’ current PE ratio stands at 18.6x, compared with the average for integrated utilities of 18.1x and a peer group average of 20.2x.

Simply Wall St’s proprietary "Fair Ratio" digs deeper than these benchmarks by accounting for earning growth, sector-specific factors, profit margins, company size, and risk, all tailored to Black Hills’ circumstances. Unlike simple peer or industry averages, the Fair Ratio provides a more sophisticated reference point. For Black Hills, the Fair Ratio is 18.7x, which closely matches the current market PE of 18.6x.

Given this close alignment, the verdict is that Black Hills’ valuation by earnings is about right at today’s levels.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Black Hills Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple concept that brings together your personal story and expectations for a company with its financial outlook and fair value. Rather than focusing only on financial ratios or analyst targets, a Narrative lets you outline your assumptions for key drivers like future revenue, earnings, and profit margins, and show how those beliefs lead to a unique fair value for the stock.

This is more than just numbers, as Narratives connect what’s happening within the business, from merger opportunities to new tech customers, directly to forecasts and investment decisions. On Simply Wall St’s Community page, millions of investors are already using Narratives to express their perspectives and compare their fair value to the current share price, helping make more informed buy or sell decisions. Narratives automatically update when new news or company results are available, making it easy to keep your investment thesis relevant.

For example, some Black Hills investors may see huge growth from new data center deals and set fair values as high as $76.00, while others worry about regulatory risks and prefer a more cautious target of $64.00. Your Narrative helps you decide what you think is fair and what to do next.

Do you think there's more to the story for Black Hills? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Hills might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BKH

Black Hills

Through its subsidiaries, operates as an electric and natural gas utility company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives