- United States

- /

- Other Utilities

- /

- NYSE:BIP

Is Brookfield Infrastructure Partners' (BIP) Profitability Comeback and Distribution Growth Shaping a New Investment Case?

Reviewed by Sasha Jovanovic

- Brookfield Infrastructure Partners reported a return to profitability for the third quarter ended September 30, 2025, with net income of US$210 million and sales of US$5.98 billion, alongside the announcement of increased quarterly and preferred distributions payable in December.

- Analyst upgrades and positive insider sentiment have followed these results, as investors focus on the expanding role of data infrastructure assets in supporting Brookfield Infrastructure Partners' growth plans.

- We'll examine how Brookfield Infrastructure Partners' return to profitability and distribution growth may enhance its long-term investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Brookfield Infrastructure Partners Investment Narrative Recap

To be a shareholder in Brookfield Infrastructure Partners, you need to believe in the essential role of global infrastructure expansion, especially digital assets and utilities, in delivering steady returns and inflation-protected cash flows. The latest news of a return to profitability and rising distributions strengthens the short-term story, but does not materially reduce the biggest risk: exposure to acquisition-driven balance sheet expansion and the potential pressure from higher interest rates on leveraged deals.

Among recent announcements, the 6% increase in the quarterly distribution stands out. This underscores the company's focus on rewarding unitholders, which aligns closely with the positive momentum from its profitable quarter, but should be considered alongside future cash flow coverage and ongoing capital requirements.

Yet, despite this solid headline, investors should also be aware that balance sheet risk from ongoing acquisitions might...

Read the full narrative on Brookfield Infrastructure Partners (it's free!)

Brookfield Infrastructure Partners is forecast to achieve $14.5 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes a 12.3% annual decline in revenue and a substantial increase in earnings from $38.0 million currently, an improvement of about $1.06 billion.

Uncover how Brookfield Infrastructure Partners' forecasts yield a $40.55 fair value, a 15% upside to its current price.

Exploring Other Perspectives

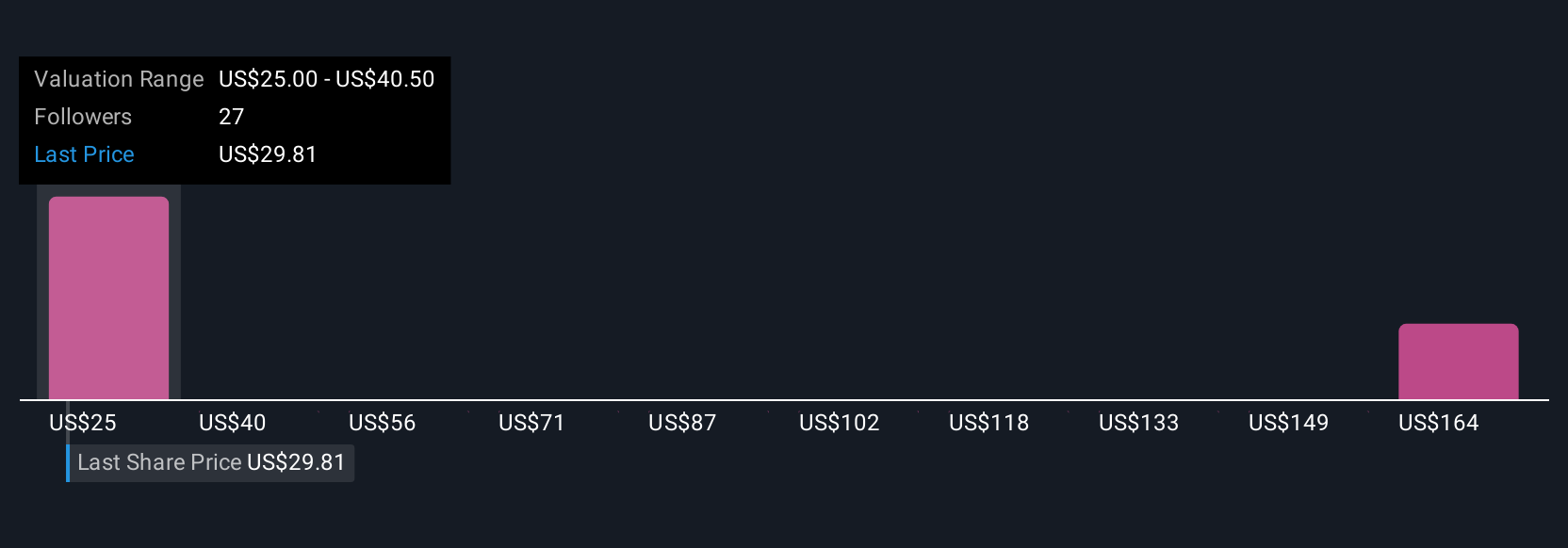

Six different members of the Simply Wall St Community have estimated Brookfield Infrastructure Partners’ fair value to range widely from US$25.03 to US$159.13 per unit. While many see meaningful opportunities from digital infrastructure investment, others focus on the risks of funding rapid growth in an increasingly expensive environment, explore the full spectrum of these viewpoints.

Explore 6 other fair value estimates on Brookfield Infrastructure Partners - why the stock might be worth over 4x more than the current price!

Build Your Own Brookfield Infrastructure Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brookfield Infrastructure Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Infrastructure Partners' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Infrastructure Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIP

Brookfield Infrastructure Partners

Engages in the utilities, transport, midstream, and data businesses.

Average dividend payer with acceptable track record.

Market Insights

Community Narratives