- United States

- /

- Other Utilities

- /

- NYSE:BIP

Does Intel Partnership Signal a New Era for Brookfield Infrastructure Partners’ (BIP) Digital Expansion?

Reviewed by Sasha Jovanovic

- Earlier this week, Intel announced a partnership with Brookfield Infrastructure Partners to co-invest in a US$30 billion semiconductor manufacturing facility in Arizona, as part of Brookfield's ongoing expansion into digital infrastructure.

- This move highlights Brookfield Infrastructure Partners' pivotal position in supporting the AI revolution through substantial commitments to data centers, fiber networks, and semiconductor foundries.

- We'll explore how Brookfield's involvement in one of the world's largest chip foundries may enhance its digital infrastructure investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Brookfield Infrastructure Partners Investment Narrative Recap

To invest in Brookfield Infrastructure Partners, you need to believe in the long-term expansion of digital infrastructure and the resilience of inflation-linked cash flows. The partnership with Intel on the US$30 billion Arizona semiconductor facility reinforces Brookfield's push into high-demand sectors, but does not materially change the immediate catalyst: sustained execution on data center and digital asset growth. The largest risk remains disciplined capital allocation amid aggressive competition for deals, where overpaying for assets could pressure returns.

Among recent announcements, the Q2 2025 dividend increase to $0.43 per unit underscores Brookfield's ongoing commitment to returning capital to shareholders. This is particularly relevant, as it highlights management’s confidence in dependable cash generation even while pursuing capital-intensive projects like the Intel joint venture, the very projects at the core of its digital growth strategy.

However, despite these growth opportunities, investors should also recognize the potential impact of rising leverage and higher borrowing costs on margins if interest rates remain elevated...

Read the full narrative on Brookfield Infrastructure Partners (it's free!)

Brookfield Infrastructure Partners is projected to reach $14.5 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes a 12.3% annual revenue decline and an increase in earnings of around $1.06 billion from the current $38 million level.

Uncover how Brookfield Infrastructure Partners' forecasts yield a $40.55 fair value, a 18% upside to its current price.

Exploring Other Perspectives

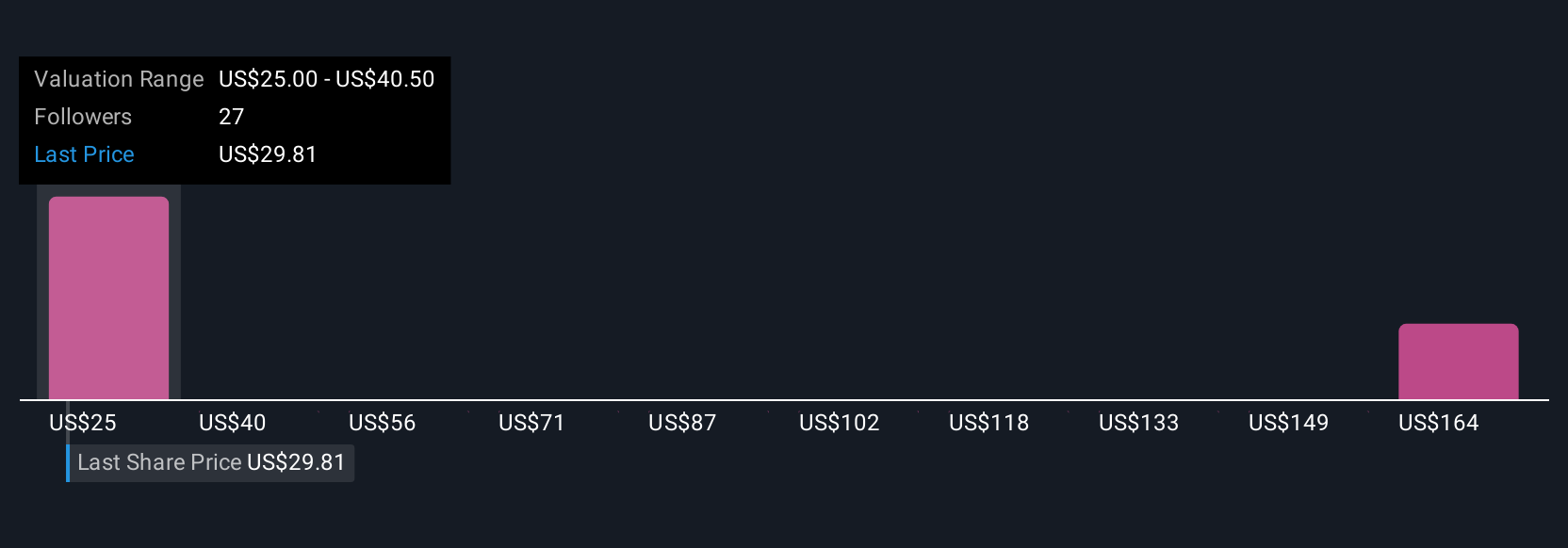

Fair value estimates from six members of the Simply Wall St Community span from US$25.03 to US$181.43 per unit. These wide-ranging opinions highlight how views on Brookfield’s capital recycling and the risks of overpaying for new assets can shape very different outlooks for performance, so be sure to check out multiple viewpoints before making up your mind.

Explore 6 other fair value estimates on Brookfield Infrastructure Partners - why the stock might be worth over 5x more than the current price!

Build Your Own Brookfield Infrastructure Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Brookfield Infrastructure Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Infrastructure Partners' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brookfield Infrastructure Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIP

Brookfield Infrastructure Partners

Engages in the utilities, transport, midstream, and data businesses.

Average dividend payer and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion