- United States

- /

- Other Utilities

- /

- NYSE:BIP

Brookfield Infrastructure Partners (NYSE:BIP) Valuation: Assessing Hidden Value After Series 3 Preferred Redemption News

Reviewed by Simply Wall St

Brookfield Infrastructure Partners (NYSE:BIP) revealed plans to redeem all outstanding Series 3 Preferred Units for cash on December 31, 2025. The company is focusing on assets with steady and predictable cash flows, following recent pressure in fixed-income markets.

See our latest analysis for Brookfield Infrastructure Partners.

Against the backdrop of steady operations and strategic moves like the Series 3 redemption, Brookfield Infrastructure Partners' share price has climbed 13.3% year-to-date and notched a 13.5% return over the past 90 days. Its one-year total shareholder return sits at 7.5%, reflecting momentum that has been gradually building, even as macro pressures weighed on parts of the infrastructure sector.

If you’re wondering what else is drawing investor interest right now, consider broadening your search and discover fast growing stocks with high insider ownership

With Brookfield Infrastructure Partners trading at a 15% discount to analyst price targets and recent preferred share volatility, the real question becomes whether the market is overlooking hidden value or is already factoring in next year’s growth story.

Most Popular Narrative: 13.3% Undervalued

Compared to Brookfield Infrastructure Partners' last close at $36.09, the narrative consensus fair value of $41.64 suggests the market has not fully priced in its evolving story. Different analyst perspectives about future growth and execution bring added intrigue into the mix.

Active capital recycling, selling partial stakes in mature assets at compelling multiples and redeploying proceeds into higher-yielding, growth-oriented opportunities, enhances return on invested capital, underpins ongoing distributable earnings expansion, and provides built-in upside to net margins.

How does this company turn backend asset shuffles into real bottom-line growth? The secret sauce is a bold plan for both margins and high-yield reinvestment. Want the inside scoop on the numbers fueling this valuation? Uncover the full strategy, revealing the financial moves that could reshape its future fair value.

Result: Fair Value of $41.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as increased acquisition activity or higher leverage could challenge Brookfield Infrastructure Partners' growth if market conditions shift unexpectedly.

Find out about the key risks to this Brookfield Infrastructure Partners narrative.

Another View: Valuation Through Earnings Ratios

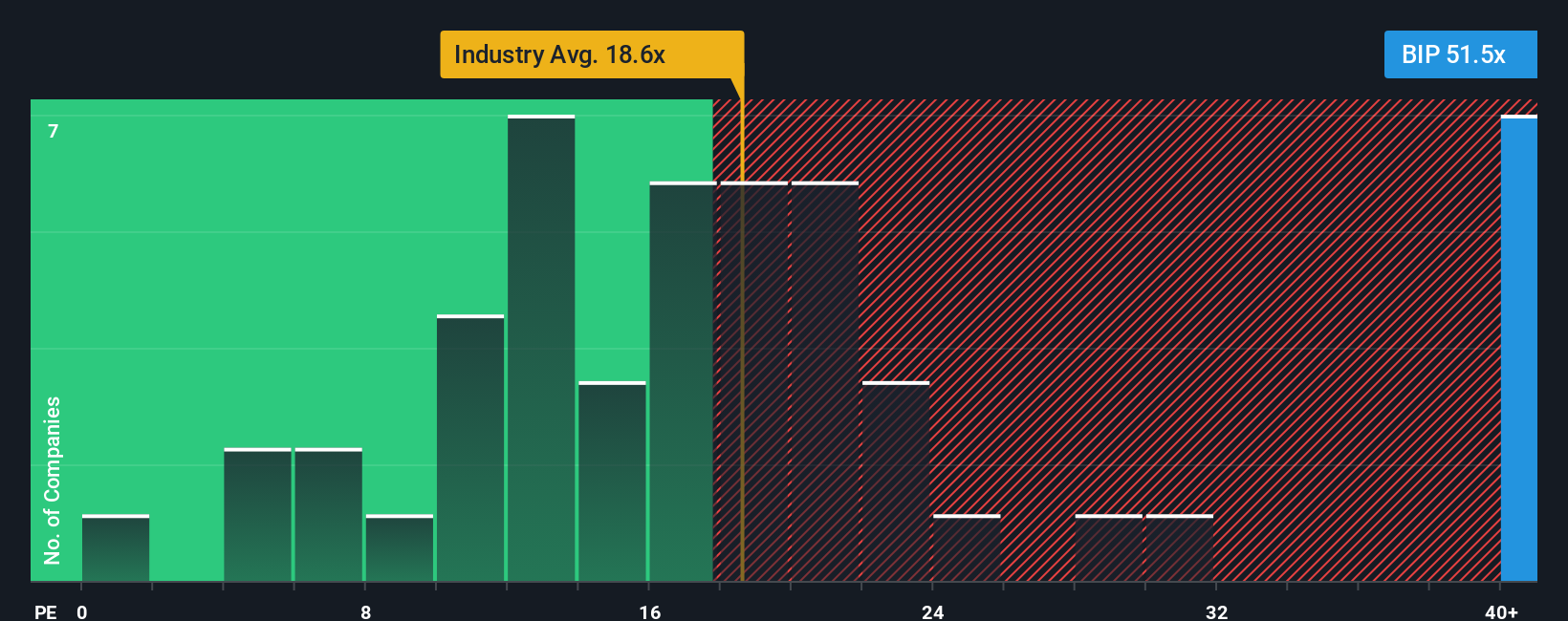

Looking from another angle, Brookfield Infrastructure Partners is trading at an earnings ratio of 51.5 times, which is far higher than both the global industry average of 17.7 times and the peer average of 22.7 times. With a fair ratio estimated at just 0.3 times, this wide gulf signals the market may be pricing in substantial future growth, but also increases the stakes should results disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brookfield Infrastructure Partners Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can start building your own viewpoint in just minutes. Discover new angles as you go. Do it your way

A great starting point for your Brookfield Infrastructure Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Timely Investment Opportunities?

Smart investors know that the next big winner rarely waits. If you want to stay ahead, check new ideas expertly surfaced by the Simply Wall Street Screener.

- Spot companies offering stable yields and future income by reviewing these 15 dividend stocks with yields > 3% with strong returns above 3%.

- Uncover potential in innovative healthcare by scanning these 30 healthcare AI stocks that could be driving the next wave of medical breakthroughs with AI advancements.

- Take advantage of undervalued opportunities by considering these 933 undervalued stocks based on cash flows which may transform your portfolio with overlooked cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Infrastructure Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIP

Brookfield Infrastructure Partners

Engages in the utilities, transport, midstream, and data businesses.

Average dividend payer with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success