- United States

- /

- Other Utilities

- /

- NYSE:AVA

Avista (AVA): Assessing Valuation After a Recent Share Price Pullback

Reviewed by Simply Wall St

Avista (AVA) has been drifting lower recently, with the stock down about 8% over the past month even as its one year return sits near 10%, a setup income focused investors will notice.

See our latest analysis for Avista.

That recent 1 month share price return of negative 8.5% looks more like a pause than a breakdown, given the modest 3.7% year to date share price gain and nearly 9.6% 1 year total shareholder return. This suggests momentum is cooling but not broken.

If Avista's pullback has you rethinking where stable cash flows and insider alignment matter most, this could be a smart moment to explore fast growing stocks with high insider ownership for fresh ideas beyond regulated utilities.

With Avista trading just below analyst targets and showing modest but steady earnings growth, the key question now is whether today’s pause hides undervaluation or if the market is already discounting its next leg of growth.

Most Popular Narrative: 7.2% Undervalued

With Avista last closing at $37.69 against a narrative fair value of $40.60, the story leans toward modest upside driven by long term earnings expansion.

The sharp rise in large industrial and commercial load inquiries over 3,000 megawatts in the pipeline compared to a roughly 2,000 megawatt current peak load signals accelerating electrification and potential for outsized rate base and revenue growth if even a fraction of these loads materialize over the next 3 to 5 years.

Robust, multi year capital investment plans approaching $3 billion, with additional upside from grid expansion projects and new generation needs tied to large load requests, position Avista to earn regulated returns and drive long term earnings expansion.

Want to see how steady revenue growth, rising margins, and a higher future earnings multiple all combine into that upside case? The crucial levers might surprise you.

Result: Fair Value of $40.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, localized wildfire and regulatory risks, along with rising grid modernization costs, could pressure margins and derail the optimistic earnings growth path.

Find out about the key risks to this Avista narrative.

Another Angle on Value

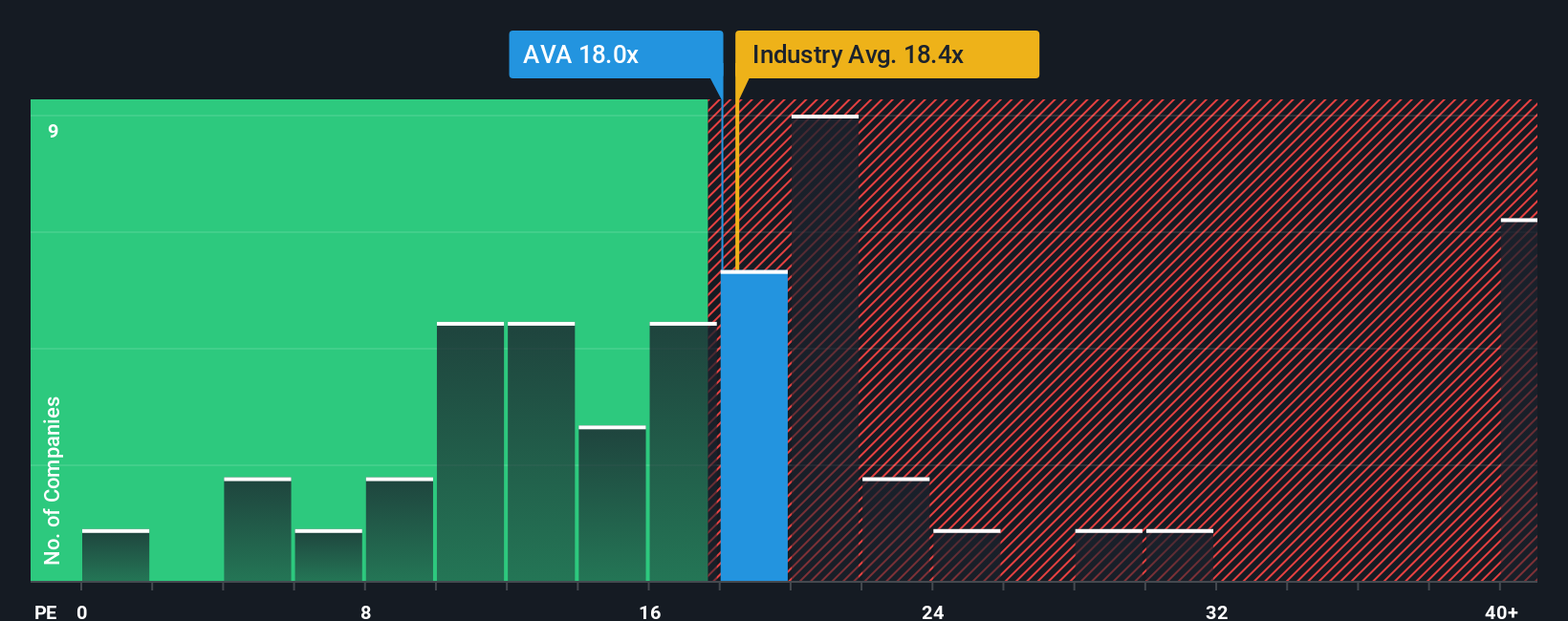

While the narrative fair value suggests Avista is about 7% undervalued, its 16.2x price to earnings multiple sits below the 17.9x industry average, the 26x peer average, and a 19.4x fair ratio. That discount hints at upside, but is it compensation for Avista specific risks?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avista for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avista Narrative

If you see the story differently or simply want to dig into the numbers yourself, you can shape a personalized view in minutes: Do it your way.

A great starting point for your Avista research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you might consider using the Simply Wall St Screener to explore stocks that align with your strategy.

- Target steady income by scanning these 12 dividend stocks with yields > 3% that may offer reliable cash payouts while you wait for capital growth.

- Explore long term growth potential by reviewing these 914 undervalued stocks based on cash flows trading below what their cash flows suggest they are worth.

- Focus on powerful secular trends by reviewing these 24 AI penny stocks positioned at the forefront of intelligent automation and data driven innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVA

Avista

Operates as an electric and natural gas utility company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion