- United States

- /

- Electric Utilities

- /

- NYSE:ALE

ALLETE (ALE): Evaluating Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for ALLETE.

ALLETE’s recent momentum builds on a solid stretch, with a 6% share price return over the past month adding to a steady gain for shareholders. The company’s 1-year total shareholder return is just under 10%, while its three- and five-year returns have been even more robust. This points to a business that has rewarded patient investors as market sentiment grows more positive.

If you’re weighing similar opportunities beyond the utility sector, now is a good time to broaden your perspective and discover fast growing stocks with high insider ownership

But with ALLETE’s recent gains and another year of positive returns, is the share price still a bargain for value-seeking investors? Or has the market already factored in the company’s future growth potential?

Price-to-Earnings of 21.3x: Is it justified?

ALLETE is currently valued at a price-to-earnings (P/E) ratio of 21.3x, matching the US Electric Utilities industry average. However, compared to peers and its estimated 'fair' multiple, investors might question if the current level is sustainable.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of annual earnings. For utilities, the P/E can reflect expectations about stability and growth. Comparative P/E analysis is vital to avoid overpaying for slow-growth sectors.

At 21.3x, ALLETE trades right in line with the rest of the industry. This suggests the market sees its prospects as average within the sector. Its ratio also closely matches the estimated fair price-to-earnings ratio of 21.8x, indicating there may be little room for further upside unless growth outperforms expectations. This 'fair' level is a data-driven benchmark for where the market could possibly re-rate the stock.

Explore the SWS fair ratio for ALLETE

Result: Price-to-Earnings of 21.3x (ABOUT RIGHT)

However, revenue and net income growth could slow, or valuation sentiment might shift. This could challenge the outlook for further share price gains.

Find out about the key risks to this ALLETE narrative.

Another View: Discounted Cash Flow Model

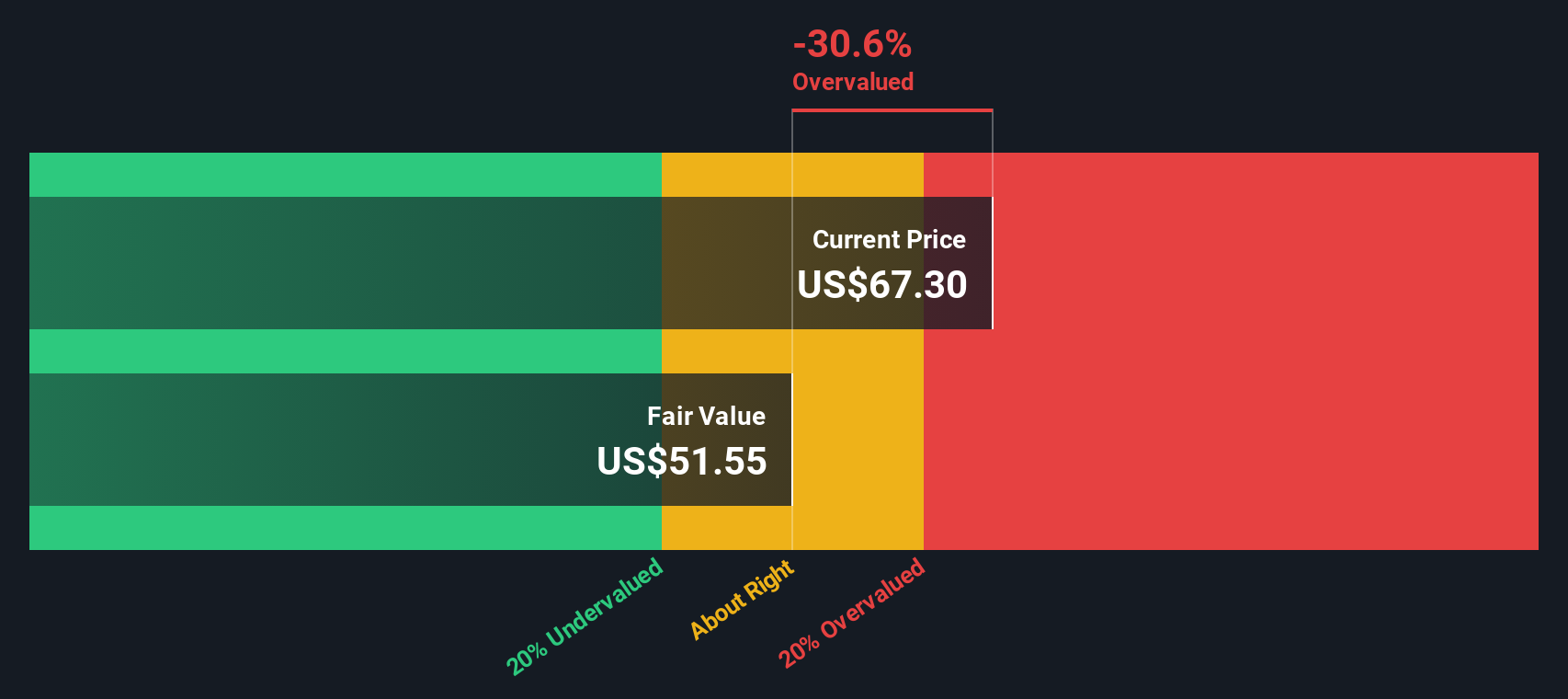

While traditional valuation compares ALLETE’s share price to earnings, our SWS DCF model looks at the company’s future cash flows to estimate true worth. On this basis, ALLETE’s current price of $67.37 sits well above our fair value estimate of $51.55, suggesting it may be overvalued. Could this be a caution flag, or does the market know something the model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ALLETE for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ALLETE Narrative

Keep in mind, you can always dig into the numbers yourself and pull together your own perspective on ALLETE’s future in just minutes. Do it your way

A great starting point for your ALLETE research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next big opportunity could be just a click away. Don’t limit yourself to one stock when you can uncover powerful trends shaping the market.

- Tap into market moves with these 887 undervalued stocks based on cash flows that show exceptional value based on cash flows and financial strength.

- Catch impressive yields by checking out these 19 dividend stocks with yields > 3% offering strong income potential with attractive dividend yields above 3%.

- Stay on the frontier of technology as you browse these 26 quantum computing stocks and explore companies transforming industries through quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALE

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.