- United States

- /

- Renewable Energy

- /

- NYSE:AES

A Fresh Look at AES (AES) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for AES.

After a somewhat challenging year, AES has recently picked up momentum with an 8.9% 1-month share price return and a year-to-date gain of 11.5%. Even so, total shareholder return remains negative over the past 12 months. This reflects the impact of broader market uncertainties as well as company-specific developments. The recent share price climb hints that the market may be warming to AES’s outlook. This suggests investors are re-evaluating its long-term value and risk profile.

If you’re watching sector shifts and want to spot more potential movers, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

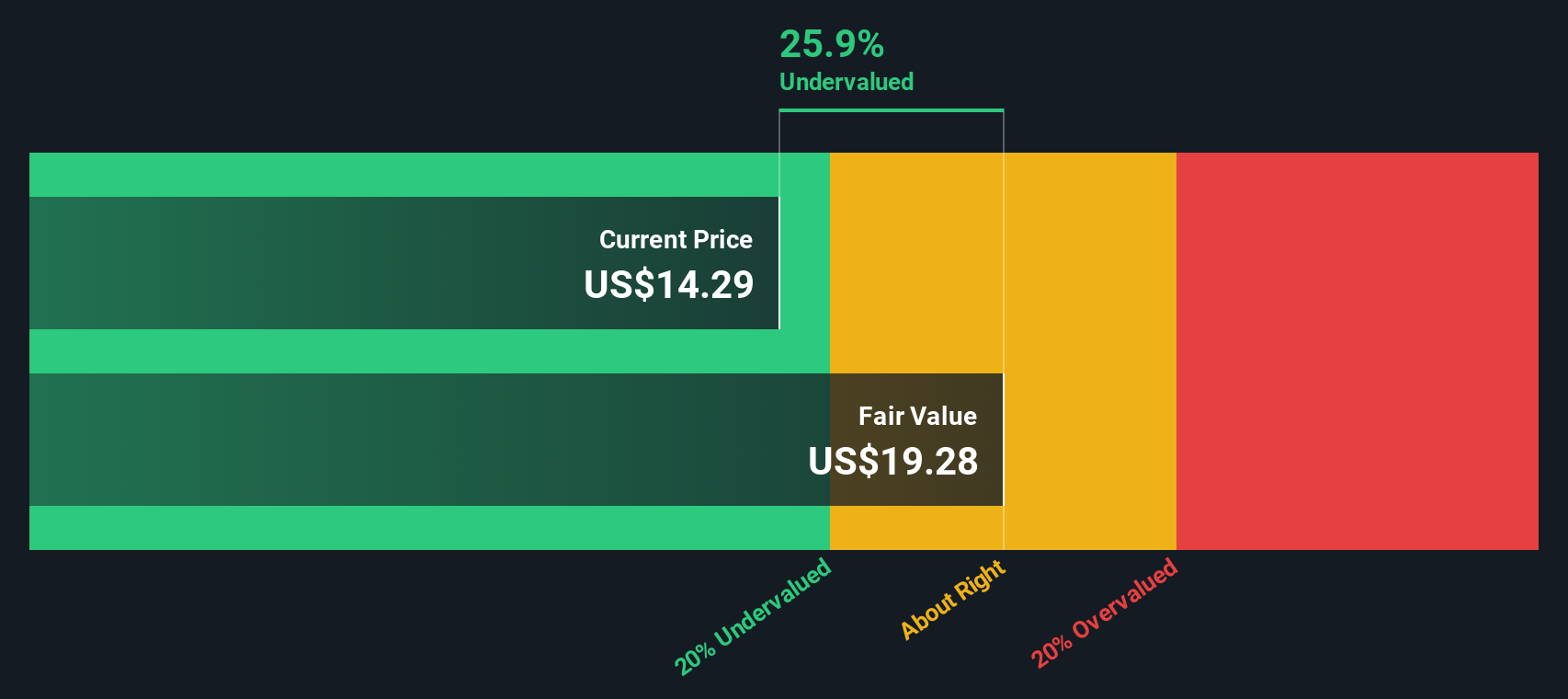

With recent gains and a modest uptick in fundamentals, the key question now is whether AES stock is undervalued at current levels or if investors have already factored in the company’s outlook, which could leave limited room for upside.

Most Popular Narrative: 0.6% Overvalued

AES’s current share price sits slightly above what the most-followed narrative considers fair, creating a tight valuation gap that demands a closer look at the details behind this call.

AES's leading, long-term pipeline of renewables and energy storage projects, backed by robust, multi-year Power Purchase Agreements (PPAs) with data center and corporate customers, positions the company to capitalize on rapidly rising electricity demand from AI/data centers. This supports accelerating revenue growth and increasing visibility on future cash flows.

What’s really fueling that price target? Behind the scenes: aggressive earnings projections, margin trends, and a future profit multiple that diverges from industry averages. The narrative’s math depends on factors the market may not be expecting. Break down the full argument and see which growth assumptions are creating this slim valuation cushion.

Result: Fair Value of $14.46 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on government incentives, along with the possibility of supply chain disruptions, could quickly challenge the case for steady profit growth.

Find out about the key risks to this AES narrative.

Another View: Discounted Cash Flow Paints a Different Picture

While the consensus price target approach suggests AES is trading near fair value, our DCF model points to a different conclusion. The SWS DCF analysis calculates AES’s fair value at $19.28, around 24.5% above the current share price. This hints the stock may be meaningfully undervalued. Which model should guide your next move?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own AES Narrative

If you see things differently or want to dig into the data yourself, you can craft your own take on AES in just a few minutes. Do it your way.

A great starting point for your AES research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors don’t stop at just one stock. Expand your horizons with handpicked opportunities and let your money work harder with ideas others might overlook.

- Multiply your yield potential by targeting companies offering stable returns. Start with these 17 dividend stocks with yields > 3%.

- Ride the AI innovation wave and capitalize on tomorrow’s leaders when you check out these 27 AI penny stocks.

- Position yourself for outsized gains by seeking out shares priced below their real worth through these 877 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AES

AES

Operates as a power generation and utility company in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives