- United States

- /

- Other Utilities

- /

- NYSE:AEE

Is Ameren’s Recent 17.7% Rally Justified Amid Grid Modernization Push?

Reviewed by Bailey Pemberton

- Wondering if Ameren is actually a bargain, or if that recent price tag is telling a bigger story? You are not alone, and now is a good moment to dig in.

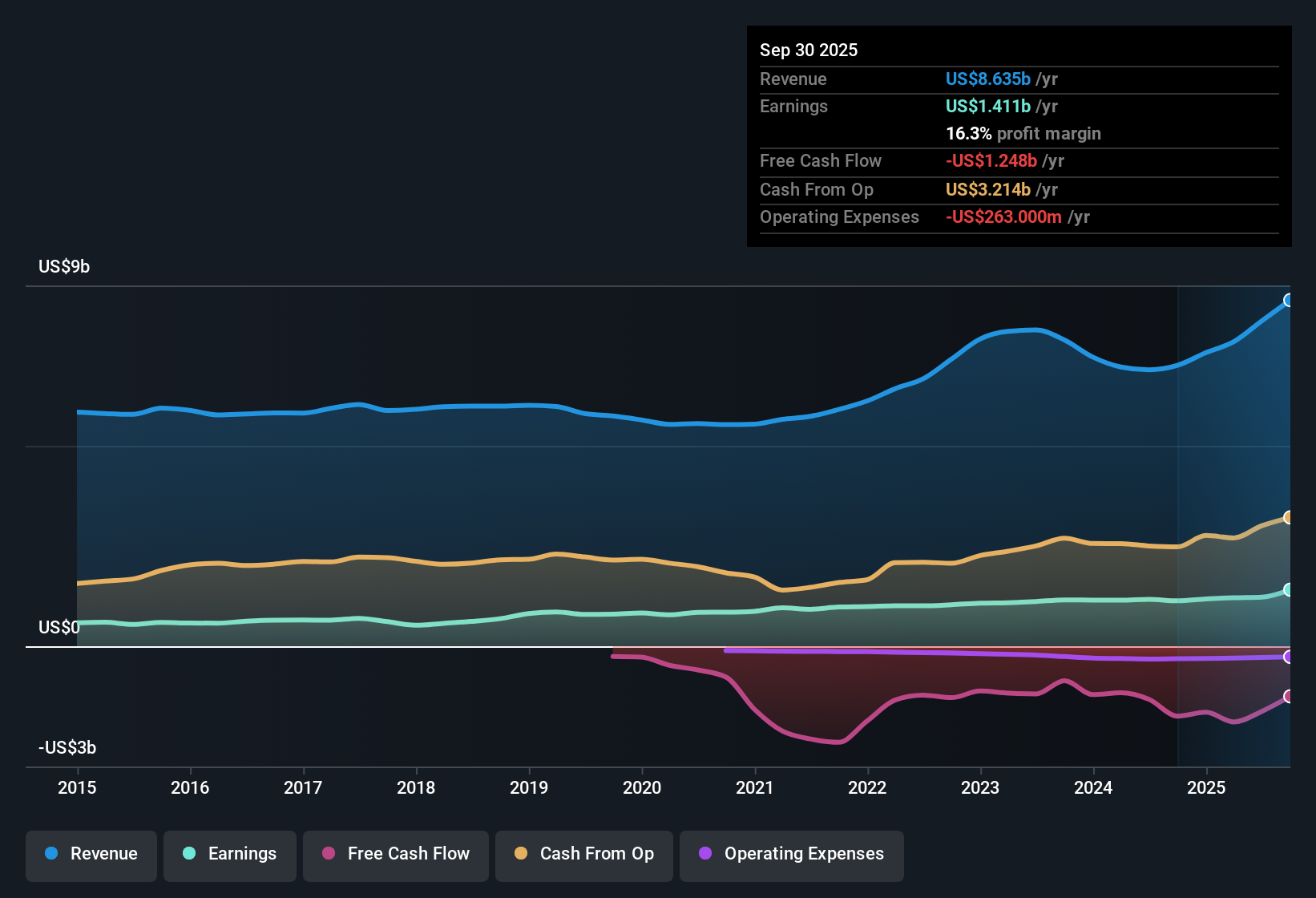

- The stock has climbed 2.7% in the past week and boasts a 17.7% gain year-to-date, which hints that investors are starting to see renewed potential.

- Much of this optimism is linked to growing interest in utilities as a defensive play. Headlines highlight industry-wide tailwinds from infrastructure upgrades and strong grid demand forecasts. Recent industry news about regulatory support for modernization projects has placed stocks like Ameren firmly in the spotlight.

- Ameren scores just 2 out of 6 on our value checks, which might seem underwhelming, but these numbers do not always capture the whole story. Let us walk through the different valuation approaches before diving into a smarter way to size up value that goes beyond the usual metrics.

Ameren scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ameren Dividend Discount Model (DDM) Analysis

The Dividend Discount Model, or DDM, is a valuation method focused specifically on the company’s ability to generate dividends and the expected growth of those dividends into the future. It is most useful for steady, dividend-paying firms like Ameren, since the model projects future dividend payments and discounts them back to today’s value to estimate what the business may really be worth right now.

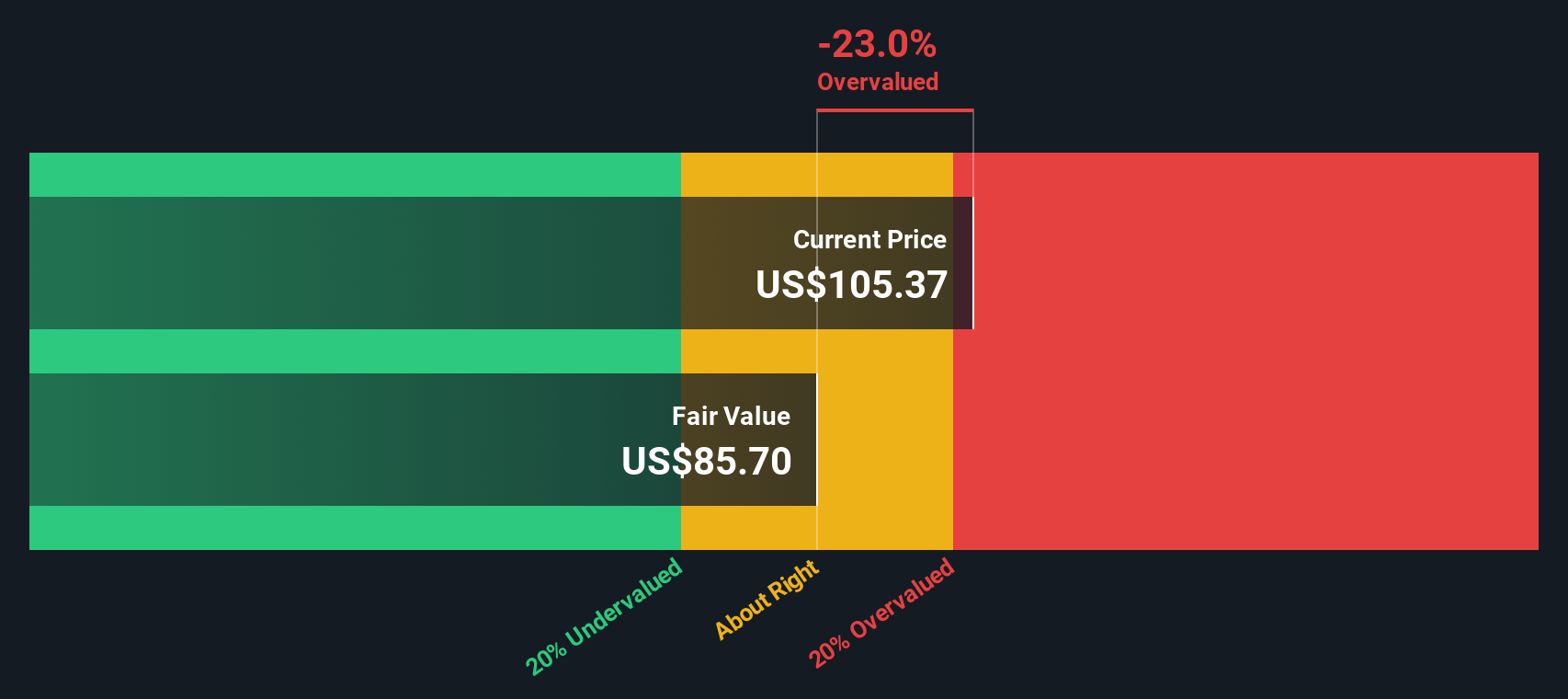

For Ameren, the DDM uses some key assumptions: the company has a dividend per share of $3.17, a return on equity of 10.45%, and a payout ratio of nearly 58%. Expected annual growth in dividends has been capped at 3.26%, with the source noting that this is a more conservative estimate than earlier projections.

Based on those inputs, the DDM calculates Ameren’s intrinsic fair value at $85.70 per share. This is significantly below the current share price, implying the stock is about 22% overvalued by this measure. In simple terms, investors are currently paying a premium for Ameren relative to its projected dividend stream, even factoring in modest growth ahead.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Ameren may be overvalued by 22.3%. Discover 876 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ameren Price vs Earnings

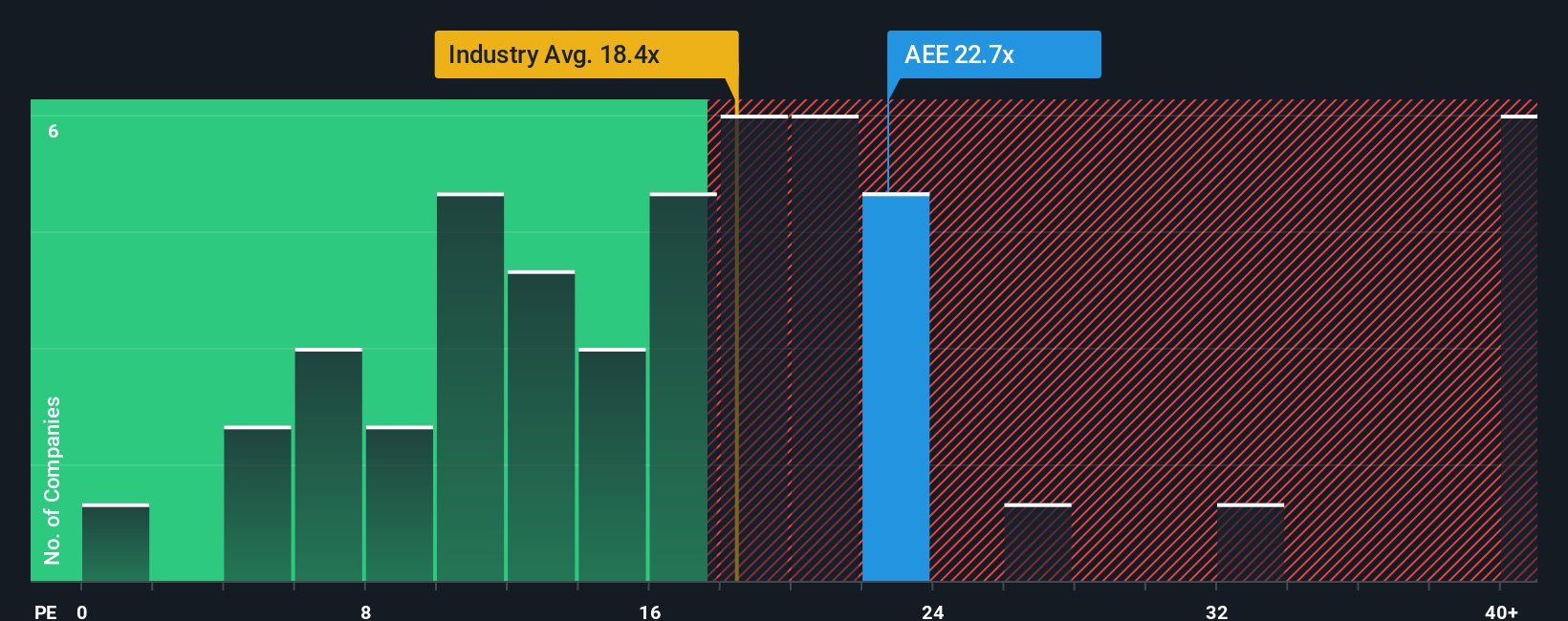

The price-to-earnings (PE) ratio is a widely used measure for valuing profitable companies like Ameren, as it reflects how much investors are willing to pay today for a dollar of current earnings. The PE ratio is particularly useful because it accounts for both the company’s profitability and the market’s expectations of its future growth.

A “normal” or “fair” PE ratio can vary, depending largely on an individual company’s expected earnings growth and the risks it faces. Businesses with faster-growing profits or lower risk profiles typically deserve higher PE ratios, while slower growth or riskier prospects tend to warrant lower multiples.

Ameren currently trades on a PE ratio of 20.08x. Comparing this to the Integrated Utilities industry’s average of 18.08x and the average among selected peers at 21.87x, Ameren sits in the middle of the pack, neither particularly cheap nor especially expensive by these benchmarks.

Enter the Simply Wall St “Fair Ratio,” a proprietary metric that crunches even more data: it incorporates the company’s earnings growth, profit margins, size, risks, and the specifics of its industry. For Ameren, this Fair Ratio is calculated at 20.63x, offering a more tailored perspective than broad peer or industry comparisons alone. This approach is especially helpful as it avoids the common pitfalls of relying solely on averages, giving a fuller picture of Ameren’s relative value.

Since Ameren’s actual PE ratio (20.08x) is very close to its Fair Ratio, the shares appear priced about right by this method.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ameren Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. In simple terms, a Narrative is your own story or viewpoint about a company, which you express by setting fair value and making assumptions about its future revenue, earnings, and profit margins. Narratives connect what you believe about Ameren’s future to a specific financial forecast and then translate that into a fair value estimate.

Narratives are easy to create and explore using Simply Wall St’s Community page, where millions of investors share their perspectives and update them as new information such as news or earnings becomes available. With Narratives, you can compare your fair value with the current share price to decide if it’s time to buy, hold, or sell. Each Narrative updates dynamically as conditions change, helping you react and refine your investment stance in real time.

For example, some investors have a bullish story for Ameren, expecting rapid data center growth, leading to a fair value of $121 per share. Others are more cautious, focusing on regulatory and cost risks, and estimate fair value around $90. Whichever camp you fall into, Narratives offer a smarter, more personal way to make investment decisions that reflect how you see the future playing out.

Do you think there's more to the story for Ameren? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEE

Ameren

Operates as a public utility holding company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives