- United States

- /

- Electric Utilities

- /

- NasdaqGS:XEL

Xcel Energy (XEL): Assessing Valuation Following Colorado Subsidiary’s Major Revenue Increase Filing

Reviewed by Simply Wall St

On November 21, 2025, Xcel Energy (XEL) saw renewed investor focus after its subsidiary, Public Service Company of Colorado, filed for a $356 million revenue increase with the state utilities commission.

See our latest analysis for Xcel Energy.

Xcel Energy’s share price has steadily climbed in 2025, with momentum picking up after the recent revenue filing and a year-to-date share price return of 21.5%. Over the past year, the total shareholder return reached 15.1%, reflecting growing investor confidence as regulatory actions shape the outlook.

If the prospect of major utility moves has you exploring further, it is a great moment to discover fast growing stocks with high insider ownership.

But with shares nearing analyst price targets and positive returns year-to-date, the key question emerges: Is Xcel Energy undervalued based on future earnings potential, or has the market already priced in its next chapter of growth?

Most Popular Narrative: 8.2% Undervalued

Xcel Energy’s narrative fair value stands at $88.47, above the last closing price of $81.25. This suggests there may be room for upside if consensus projections remain accurate. Market watchers are now scrutinizing assumptions behind these valuations as the company prepares for its next growth phase.

Accelerated investments in clean energy and grid modernization are expected to expand Xcel's regulated asset base, driving sustained earnings growth and improved operational efficiency. Favorable policy incentives and strong regulatory relationships support stable cash flows and higher returns. These factors position the company for continued growth despite market undervaluation.

Want to know what powers this upgrade? The narrative’s secret is that it relies on a future where major upgrades, improved efficiency, and beneficial regulatory conditions could contribute to growth. Curious which financial trends and assumptions support this optimism? Read on for the key dynamics shaping this fair value call.

Result: Fair Value of $88.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainties and region-specific risks could quickly undermine these growth assumptions if outcomes shift or if adverse events materialize unexpectedly.

Find out about the key risks to this Xcel Energy narrative.

Another View: Peer Comparisons Raise Caution

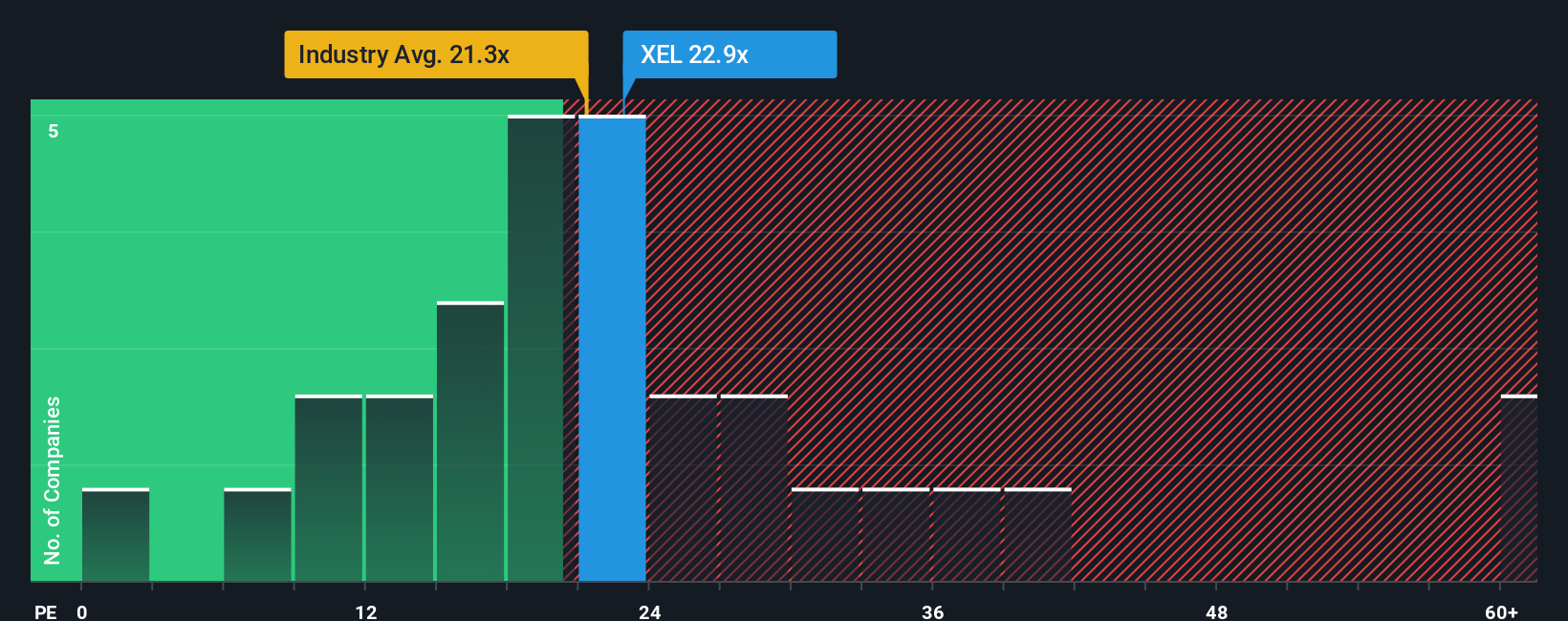

While the narrative suggests Xcel Energy is undervalued, the price-to-earnings ratio tells a different story. Xcel is trading at 25.1x, above peers at 20.6x and the industry average of 20.8x. The fair ratio stands at 24.1x, indicating the stock could be at risk of overvaluation if market sentiment shifts. Could this premium be justified, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Xcel Energy Narrative

If you have a different take on Xcel Energy, or want to deep dive into the numbers yourself, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Xcel Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Investment Opportunities?

Smart investors never stop looking ahead. Make your next move count by tapping into other exciting stock ideas that could propel your strategy this year.

- Uncover new value by scanning for hidden gems among these 929 undervalued stocks based on cash flows and see which companies are flying under Wall Street’s radar.

- Grab income potential by checking out these 15 dividend stocks with yields > 3% with yields above 3% and solid return histories. This may provide steady growth and cash flow.

- Tap into the digital finance revolution with these 82 cryptocurrency and blockchain stocks and stay on top of trends transforming payments, security, and online assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XEL

Xcel Energy

Through its subsidiaries, engages in the generation, purchasing, transmission, distribution, and sale of electricity in the United States.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success