- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

Talen Energy (TLN) Is Up 6.6% After Boosting and Extending $2B Share Buyback Program - What's Changed

Reviewed by Simply Wall St

- On September 8, 2025, Talen Energy announced it had expanded its equity buyback authorization to US$2.00 billion and extended the program through December 31, 2028.

- This extension and increase in the buyback plan highlight management’s focus on capital returns and confidence in the company’s future financial strength.

- We’ll explore how Talen Energy’s expanded buyback program could enhance its investment case and reinforce its commitment to shareholder value.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Talen Energy Investment Narrative Recap

To be a Talen Energy shareholder right now, you have to believe in a story of long-term power demand growth, particularly from data centers, and the company’s ability to manage transition risks as it expands its clean energy portfolio. The expanded buyback plan may improve short-term sentiment but is unlikely to shift the most pressing current risk: Talen’s continued reliance on fossil fuel generation and the potential impact of faster policy-driven decarbonization, which remains material for future margins.

The new US$2.00 billion buyback authorization follows a stretch in which Talen paused repurchases and is most relevant when considered alongside its June 2025 nuclear supply deal with Amazon, a move that supports earnings stability yet underscores the company’s focus on capital allocation while navigating early clean energy transition efforts. Investors tracking catalysts like stable contracted revenue may appreciate that this buyback signals financial confidence, though the underlying portfolio and regulatory risk dynamics do not change overnight.

By contrast, it’s worth noting for investors that accelerating decarbonization policies could still reshape margin forecasts and asset values...

Read the full narrative on Talen Energy (it's free!)

Talen Energy's outlook anticipates $4.2 billion in revenue and $1.1 billion in earnings by 2028. This is based on a 25.1% annual revenue growth rate and a $913 million earnings increase from the current $187 million figure.

Uncover how Talen Energy's forecasts yield a $401.74 fair value, in line with its current price.

Exploring Other Perspectives

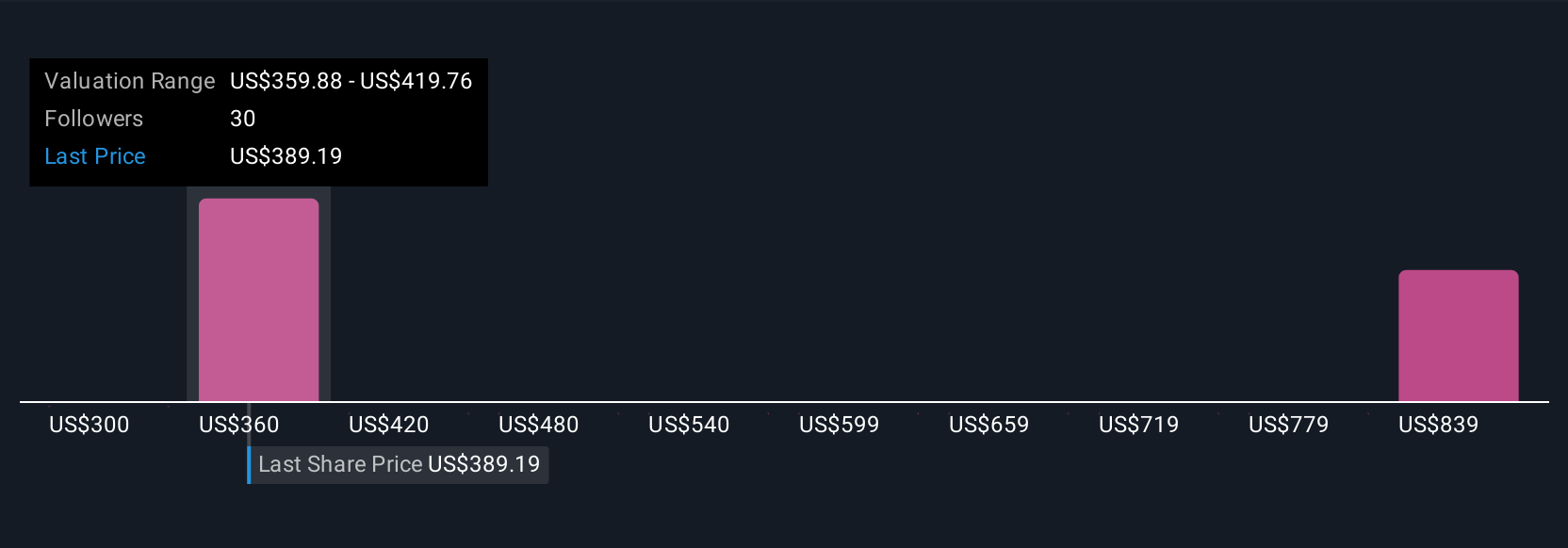

Four recent fair value estimates from the Simply Wall St Community range widely from US$300 to US$1,034 per share. Some see strong future earnings growth, though regulatory and commodity risks remain significant for Talen’s business outlook; explore these varied perspectives for a fuller picture.

Explore 4 other fair value estimates on Talen Energy - why the stock might be worth 25% less than the current price!

Build Your Own Talen Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talen Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Talen Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talen Energy's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential and slightly overvalued.

Market Insights

Community Narratives