- United States

- /

- Renewable Energy

- /

- NasdaqGS:TLN

Should You Rethink Talen Energy Stock After a 97% Surge in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Talen Energy stock right now? You’re not alone. After explosive gains of 143.5% over the past year and a jaw-dropping 97% return just since January, this energy player is suddenly front and center in a lot of “what next?” conversations. Whether you already hold shares or are weighing a new position, the stock’s recent action is hard to ignore, especially considering the quick dip of 6% in just the past week. This could be nothing more than a blip, or maybe a hint of shifting sentiment.

It seems like every headline in the power and utility sector these days lands a punch or two, and Talen Energy’s performance appears to capture a lot of that changing landscape. Investors watching the steady rally in year-to-date returns are wondering if this still represents an undervalued gem or if momentum has run a little too far ahead of fundamentals. That’s where the numbers come in: based on our six-part valuation framework, Talen Energy notches a value score of 2, meaning it shows up as undervalued in two out of six checks.

But what does that actually mean for anyone sizing up the stock at its latest closing price of $418.03? In the following sections, we will break down the main valuation approaches to see where Talen Energy stacks up, and even look beyond the usual metrics for a more complete picture of value.

Talen Energy scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Talen Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today's value. This approach aims to tell investors what the company is truly worth based on its ability to generate cash over time.

For Talen Energy, the DCF analysis uses the 2 Stage Free Cash Flow to Equity model. The company's latest reported Free Cash Flow is negative, at $211.8 Million, but analysts project a swift turnaround into strong positive territory. By 2029, annual Free Cash Flow is forecasted to reach $1.97 Billion. Only the first five years of these forecasts are supported by analyst estimates, with long-range projections extrapolated to cover the next decade.

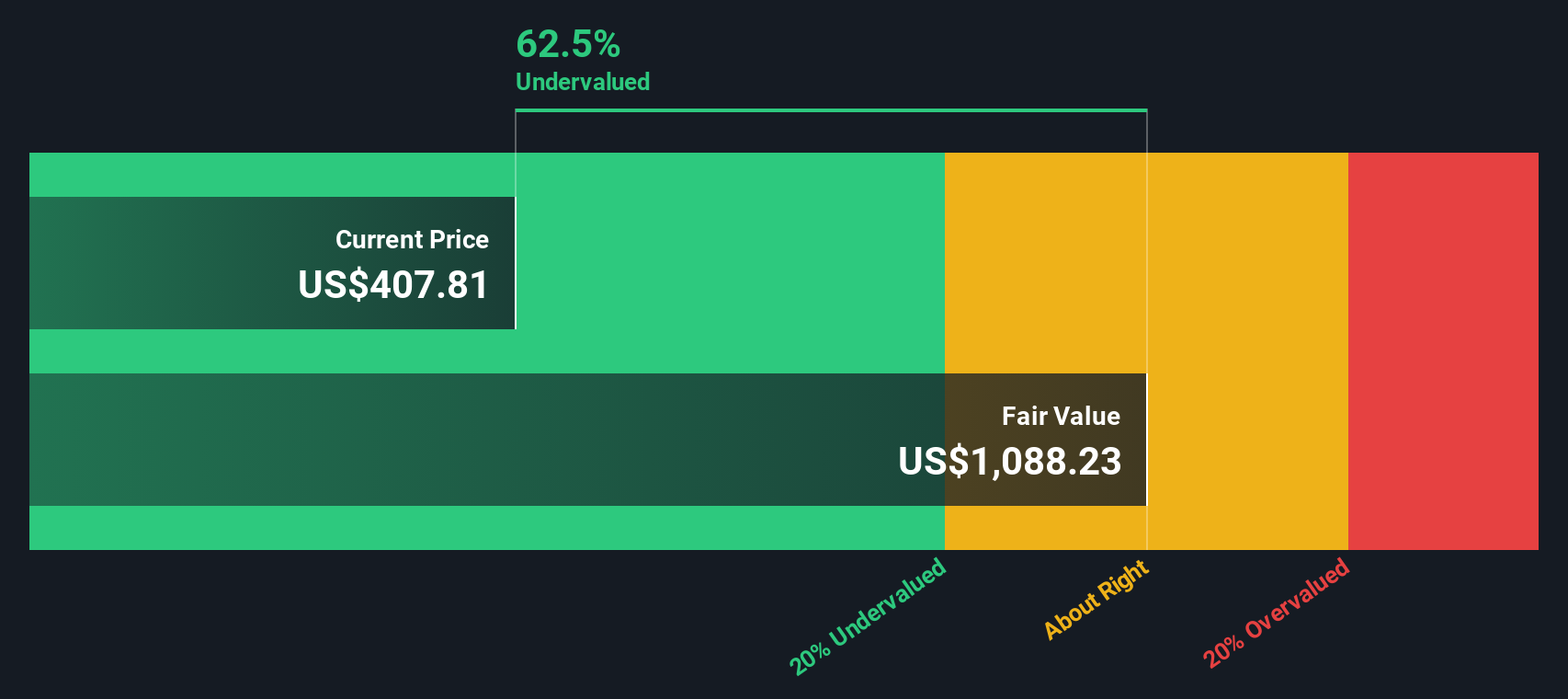

The DCF outcome suggests Talen Energy's intrinsic value is $1,072.22. Compared with its current share price of $418.03, this implies the stock is trading roughly 61% below its estimated fair value and therefore appears significantly undervalued using this methodology.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Talen Energy is undervalued by 61.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Talen Energy Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a classic valuation tool, especially useful for evaluating profitable companies like Talen Energy. It shows how much investors are willing to pay for a dollar of current earnings, making it an easy comparison to gauge if a stock looks expensive or cheap on an earnings basis.

It's important to remember that a “normal” or “fair” PE ratio is not just a fixed number. It is shaped by a company’s expected future growth, profitability, and risk profile. Faster-growing, lower-risk companies typically justify higher PE ratios, while slower or riskier businesses usually trade with lower numbers.

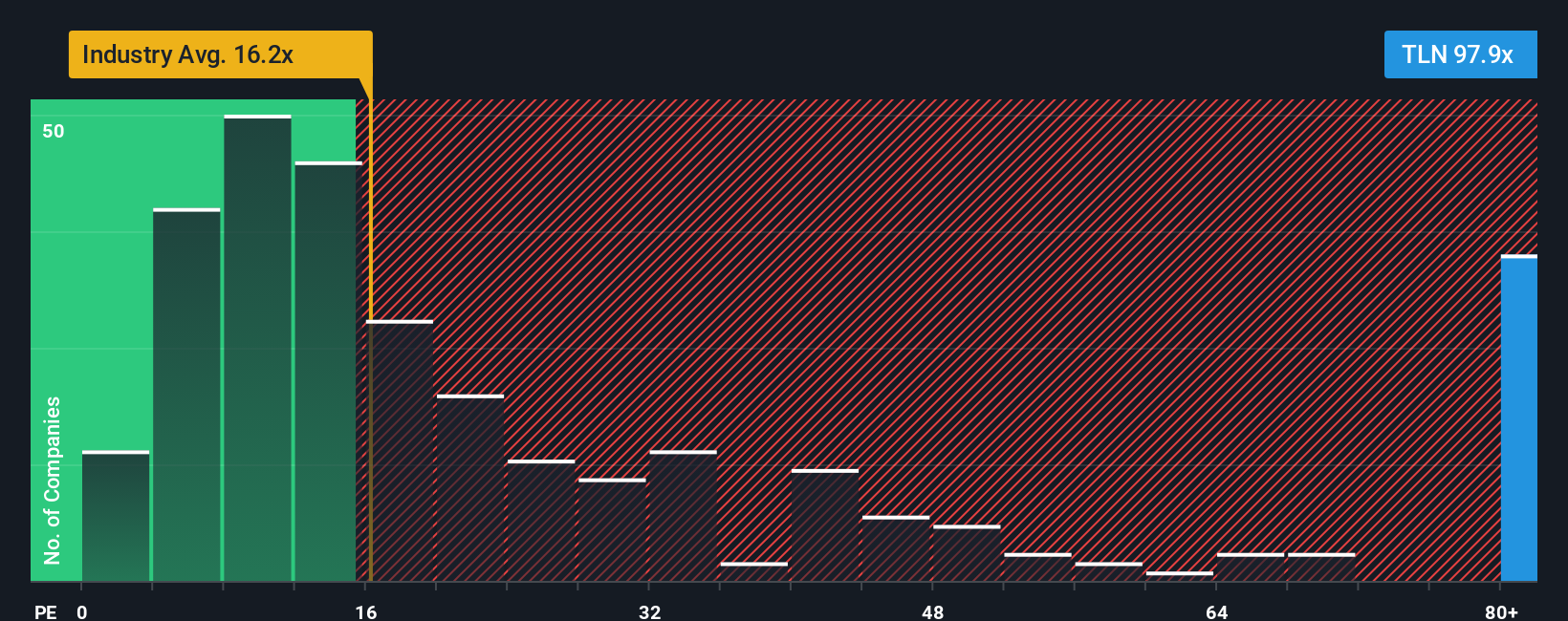

Right now, Talen Energy trades at a PE ratio of 102.13x. In contrast, the renewable energy industry averages only 16.66x, and its direct peer group sits around 18.37x. At first glance, this makes Talen’s multiple look extremely high. However, that is not the complete story.

To refine this view, Simply Wall St has developed the “Fair Ratio,” a custom benchmark that factors in unique elements like earnings growth, industry norms, profit margins, company size, and stock-specific risks. Unlike a basic comparison to peers or industry averages, the Fair Ratio for Talen (78.90x) adjusts expectations based on what actually makes this company different.

Comparing Talen’s current PE ratio of 102.13x with its Fair Ratio of 78.90x suggests the stock is valued generously against its fundamentals at current earning levels and risks. The gap is large enough to point toward some over-optimism.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Talen Energy Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, an approach that lets you connect your unique perspective on Talen Energy’s future directly with the numbers behind its value.

A Narrative is simply your story about where you think a company is heading, captured in your assumptions for key figures like fair value, future revenue, earnings, and profit margins.

This process links a company’s history, strategy, and prospects to a financial forecast, and then to a fair value. This offers a more personal and dynamic view than traditional ratios alone.

Narratives are simple to create and share using the Community page on Simply Wall St, where millions of investors refine their thinking, compare different perspectives, and get real-time updates as new news or results come in.

By comparing the fair value generated by your Narrative with the latest share price, you can make more intentional buy or sell decisions, while being alert to how new developments could shift those judgments at any time.

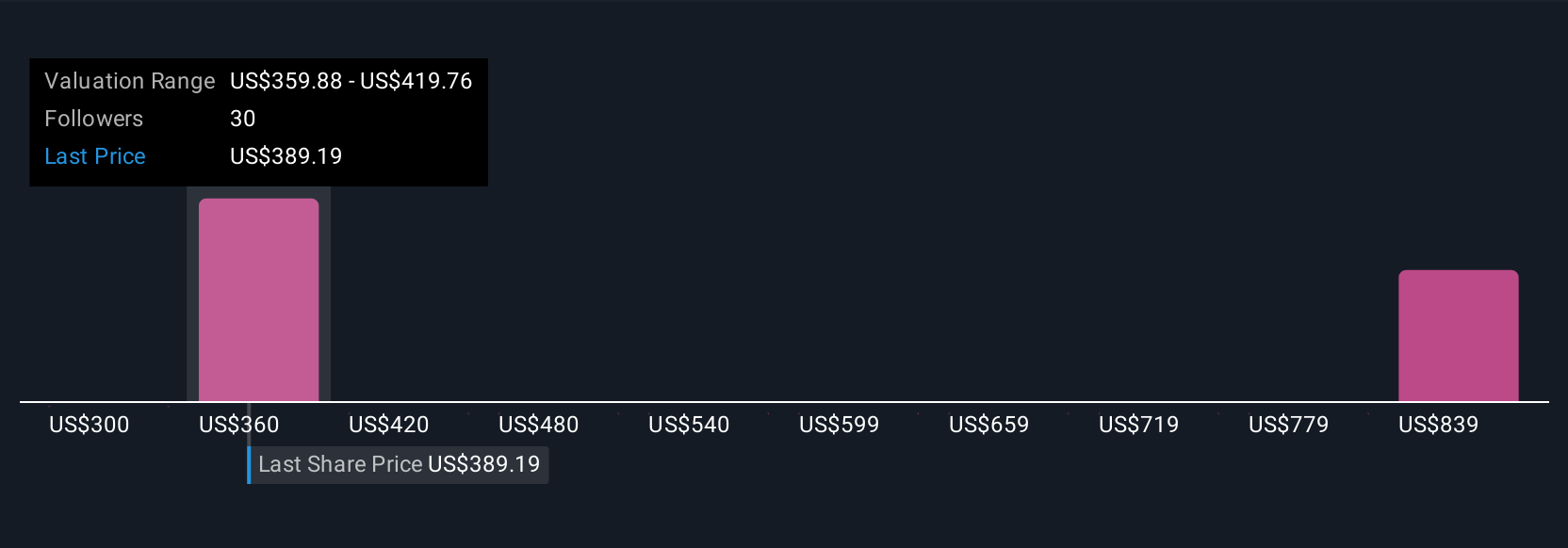

For example, some Talen Energy Narratives project a fair value as high as $450 per share, anticipating strong growth in nuclear supply contracts and data center demand. The most conservative users see a lower value at just $307, warning of high debt and execution risks.

Do you think there's more to the story for Talen Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLN

Talen Energy

An independent power producer and infrastructure company, produces and sells electricity, capacity, and ancillary services into wholesale power markets in the United States.

High growth potential and slightly overvalued.

Market Insights

Community Narratives