- United States

- /

- Renewable Energy

- /

- NasdaqGS:RNW

ReNew Energy Global (NasdaqGS:RNW) Valuation After New 150 MW Google Solar Deal in Rajasthan

Reviewed by Simply Wall St

ReNew Energy Global (NasdaqGS:RNW) just inked a long term deal with Google for a 150 MW solar project in Rajasthan, a fresh signal that big tech demand is driving its next growth leg.

See our latest analysis for ReNew Energy Global.

Yet despite this high profile Google deal and the recent decision to walk away from a planned acquisition, the stock's 30 day share price return of minus 27.26 percent and 1 year total shareholder return of minus 20.95 percent show that sentiment has been weak, even as the latest move hints at a potential inflection in growth expectations.

If this kind of deal making has you thinking more broadly about where growth could come from next, it might be worth exploring fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

With revenue still growing, earnings under pressure and the share price trading at a steep discount to analyst targets, is ReNew Energy Global quietly undervalued here, or are markets already pricing in its future growth potential?

Most Popular Narrative: 31.2% Undervalued

Against a last close of $5.47, the most popular narrative pins ReNew Energy Global's fair value near $7.95, implying a sizeable upside gap that hinges on its ability to turn growth investments into durable earnings.

Continued cost optimization, disciplined project bidding, and AI driven asset management are resulting in higher plant utilization and lower O&M costs, reflected in rising EBITDA margins and improved net margins.

The availability of green finance and supportive government policy frameworks (such as large scale renewable auctions and corporate procurement targets) provide a favorable financing environment and stable project pipeline, which should enable continued revenue and earnings growth, while reducing refinancing risk over time.

Curious how steady margin expansion, faster than market revenue growth and a firm discount rate combine to justify that higher price tag, and what earnings path they are banking on to get there? Dig into the full narrative to see the exact growth glide path behind this valuation call.

Result: Fair Value of $7.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution setbacks or intensifying bidding competition could squeeze margins and delay projects, quickly undermining the upbeat growth and valuation narrative.

Find out about the key risks to this ReNew Energy Global narrative.

Another View: Multiples Paint A Tougher Picture

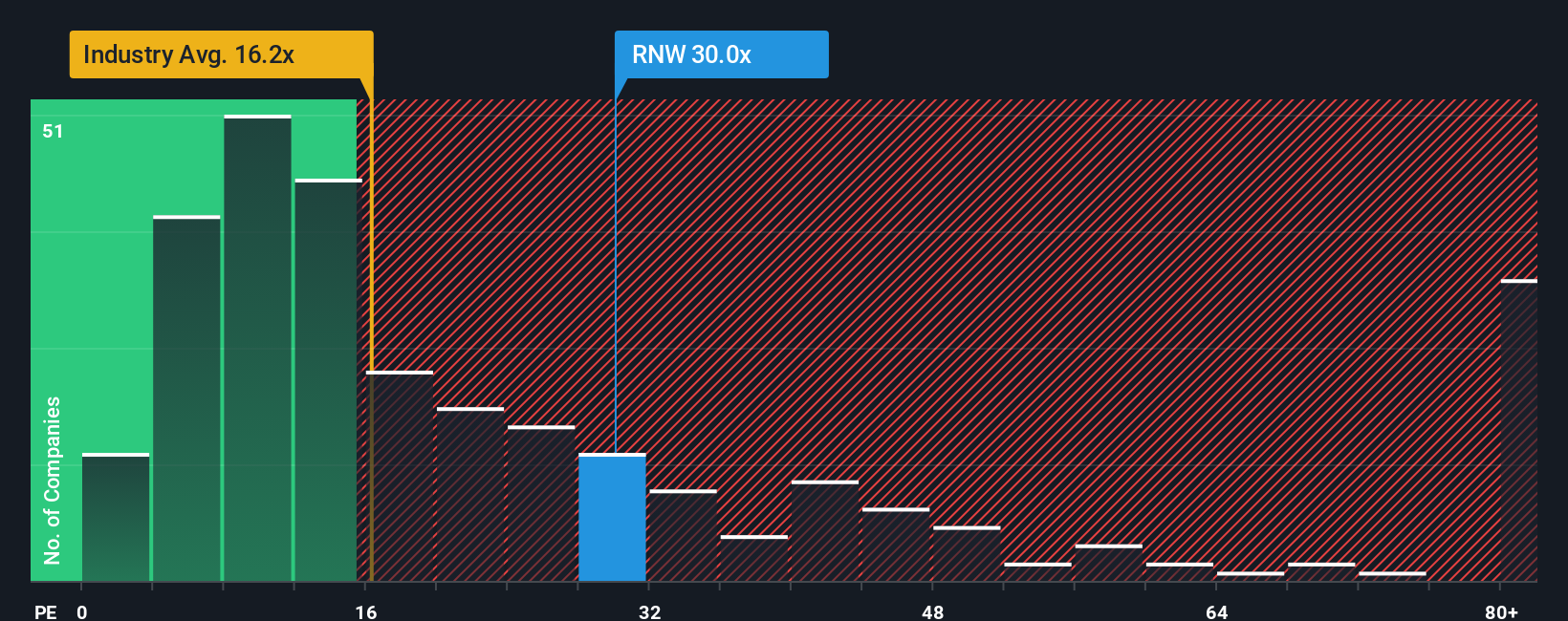

On earnings, the story looks less generous. ReNew trades on a price to earnings ratio of 21.2 times, above its fair ratio of 17 times and pricier than the broader global renewable energy group at 16.7 times. This hints that near term setbacks could still drag the multiple lower.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ReNew Energy Global Narrative

If you see the story differently or want to stress test the numbers yourself, you can quickly build a personalized narrative in minutes, Do it your way.

A great starting point for your ReNew Energy Global research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before markets move on without you, identify your next opportunities using focused stock lists that highlight quality, momentum, and potential mispricing in minutes.

- Pinpoint early stage potential by reviewing these 3629 penny stocks with strong financials that may be positioned to turn financial strength into meaningful upside as sentiment shifts.

- Explore the AI adoption trend through these 24 AI penny stocks that focus on companies where intelligent automation supports real, scalable revenue growth.

- Strengthen your core portfolio with these 898 undervalued stocks based on cash flows that trade below their cash flow potential, before the market fully reprices them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RNW

ReNew Energy Global

Engages in the generation of power through non-conventional and renewable energy sources in India.

Proven track record with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion