- United States

- /

- Electric Utilities

- /

- NasdaqGS:OTTR

Otter Tail (OTTR): Earnings Expected to Fall 10.2% Annually, Quality Track Record Faces Slow Growth

Reviewed by Simply Wall St

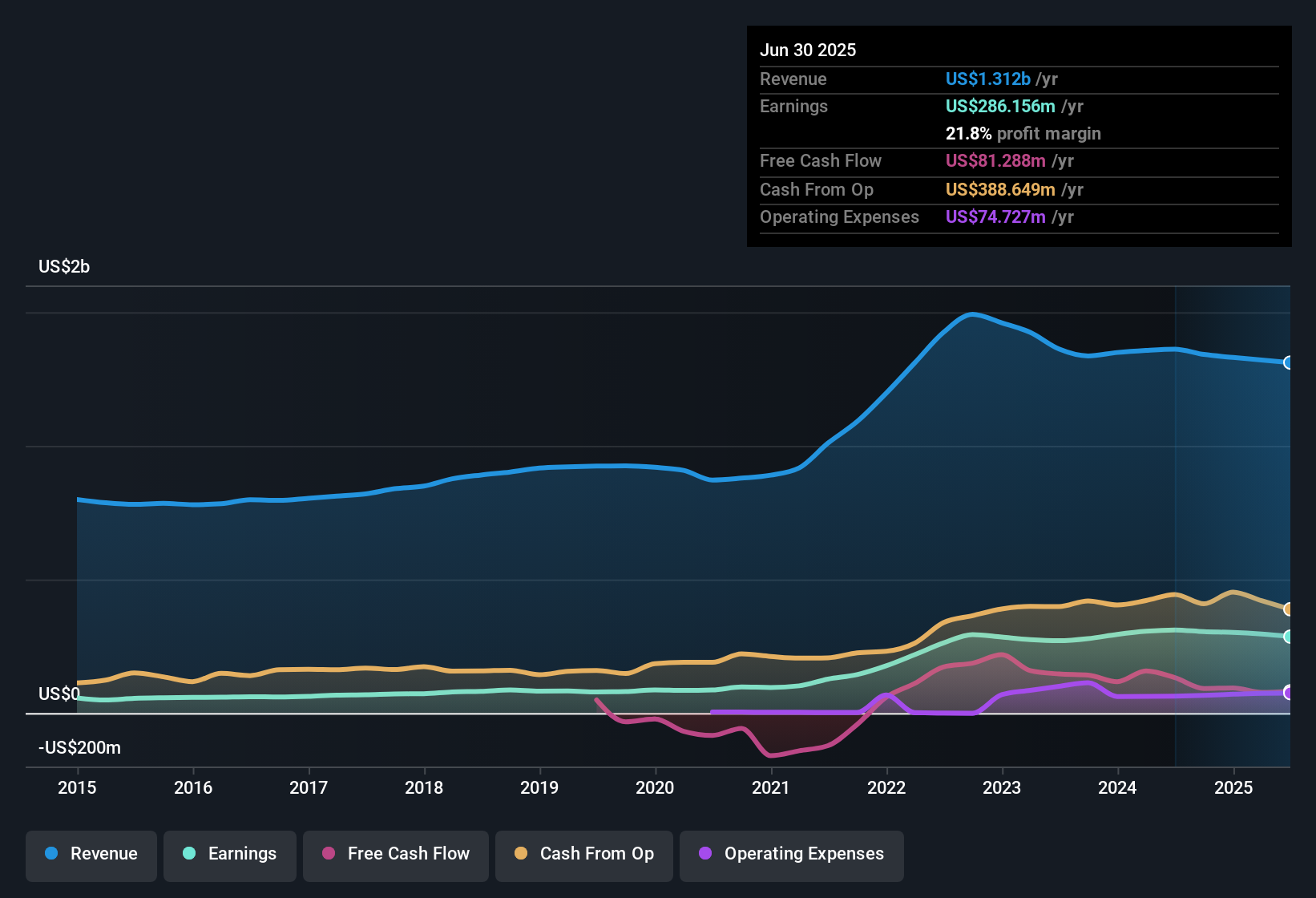

Otter Tail (OTTR) is forecasting revenue growth of just 3.1% per year, notably below the broader US market’s 10.5% rate. Meanwhile, EPS is expected to decline by 10.2% per year over the next three years, following a recent period of negative earnings growth and a slip in net profit margins to 21.5% from last year’s 22.7%. Investors are weighing a favorable valuation, appealing dividend, and Otter Tail’s strong five-year average earnings growth of 18.2% annually against the expectation of slowing profitability and limited top-line expansion.

See our full analysis for Otter Tail.The next section puts these headline numbers side by side with the prevailing narrative at Simply Wall St, highlighting where the market’s expectations and the data align and where they diverge.

See what the community is saying about Otter Tail

Future Margins Face Steep Compression

- Analysts see profit margins falling from 21.8% today to just 13.9% within three years, which would mark a significant hit to Otter Tail's cash-generating power.

- Analysts' consensus view centers on how this margin squeeze plays out:

- Regulatory and legislative changes, such as phaseouts of renewable energy credits and tougher environmental rules, are expected to increase operating costs. This may make it more difficult for Otter Tail to maintain current margin levels.

- Rising capital expenditures, especially with a $1.4 billion investment pipeline, create a risk of amplifying the impact of higher interest rates. These factors could reduce net profits even if revenues grow slightly.

- The consensus narrative urges investors to watch whether Otter Tail can adapt to new cost pressures or if these headwinds will overwhelm its historical margin stability.

📊 Read the full Otter Tail Consensus Narrative.

PE Ratio Sits Well Below Industry

- Otter Tail’s PE ratio of 12.3x is almost half the US electric utilities industry average of 21.6x and far below peers at 24.9x, flagging a valuation discount that stands out.

- Analysts' consensus view highlights a debate about whether this low multiple reflects a real risk or an opportunity:

- Some see the discount as pricing in the company’s shrinking profitability forecast, especially since future EPS is expected to decline by 10.2% per year. Others argue it overstates the downside given Otter Tail’s track record of strong, stable historical earnings growth.

- Maintaining customer rates below the national average and S&P recognition as the lowest-cost investor-owned utility supports the argument that Otter Tail could prove resilient, potentially challenging the market’s cautious stance.

Capital Spending Poised to Reshape Growth Profile

- Management’s $1.4 billion capital plan, focused largely on grid, renewable, and transmission projects, underpins the utility business’s expectation of 9% compounded annual earnings growth even as overall profit is expected to fall.

- Analysts' consensus view raises questions on whether these large investments will actually boost shareholder value:

- Delivering on this growth depends on successful rate recovery and the ability to sign up large new utility customers currently under negotiation. Failing to land these customers or delays in cost recovery could leave Otter Tail with underutilized assets and extra debt service.

- Diversification across utilities, manufacturing, and plastics has historically delivered stable cash flows. The degree to which these investments offset or exacerbate margin pressures will be an important test going forward.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Otter Tail on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Share your perspective in just a few minutes and shape the conversation: Do it your way.

A great starting point for your Otter Tail research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Otter Tail’s rapidly shrinking profit margins and expected earnings decline highlight the risks of relying on companies facing compressed profitability and uncertain growth.

If you want steadier results, use stable growth stocks screener (2082 results) to focus on businesses that have consistently delivered reliable revenue and earnings performance, regardless of market headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OTTR

Otter Tail

Engages in electric utility, manufacturing, and plastic pipe businesses in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion