- United States

- /

- Other Utilities

- /

- NasdaqGS:NWE

How Investors Are Reacting To NorthWestern Energy (NWE) Ahead of Projected 8.9 Percent Revenue Growth

Reviewed by Sasha Jovanovic

- NorthWestern Energy Group is expected to report its quarterly results on October 29, with analysts projecting an 8.9% year-over-year revenue increase for the period ending September 30, 2025.

- This anticipated growth, paired with a consensus "buy" rating and no sell recommendations, reflects considerable optimism among analysts ahead of the earnings announcement.

- We’ll examine how positive analyst sentiment and expectations for robust revenue growth may influence NorthWestern Energy Group’s investment case going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

NorthWestern Energy Group Investment Narrative Recap

To be a shareholder in NorthWestern Energy Group, you need to believe in stable demand for regulated utility services, the company's ability to secure positive outcomes from rate cases, and the long-term prospects offered by infrastructure upgrades and regional growth in data center load. The recent news of an expected 8.9% revenue increase this quarter may support near-term optimism, but does not materially change the critical short-term catalyst, resolution of ongoing rate cases and regulatory approvals, nor does it alter the leading risk tied to policy shifts around coal generation. Among recent announcements, the pending US$3.6 billion all-stock merger with Black Hills Corporation stands out as highly relevant. If completed, this transaction is positioned to expand NorthWestern’s market reach and could offer greater customer and geographic diversification, which has been a historical risk. Investors are closely watching how the combined company approaches regulatory challenges and realizes potential synergy amid ongoing policy and infrastructure uncertainties. Yet, in contrast to upbeat revenue forecasts, investors should be mindful of evolving state and federal decarbonization policies, as these could...

Read the full narrative on NorthWestern Energy Group (it's free!)

NorthWestern Energy Group is projected to achieve $1.8 billion in revenue and $249.8 million in earnings by 2028. This outlook is based on a 5.5% annual revenue growth rate and reflects an increase in earnings of $24.3 million from the current level of $225.5 million.

Uncover how NorthWestern Energy Group's forecasts yield a $59.40 fair value, a 4% downside to its current price.

Exploring Other Perspectives

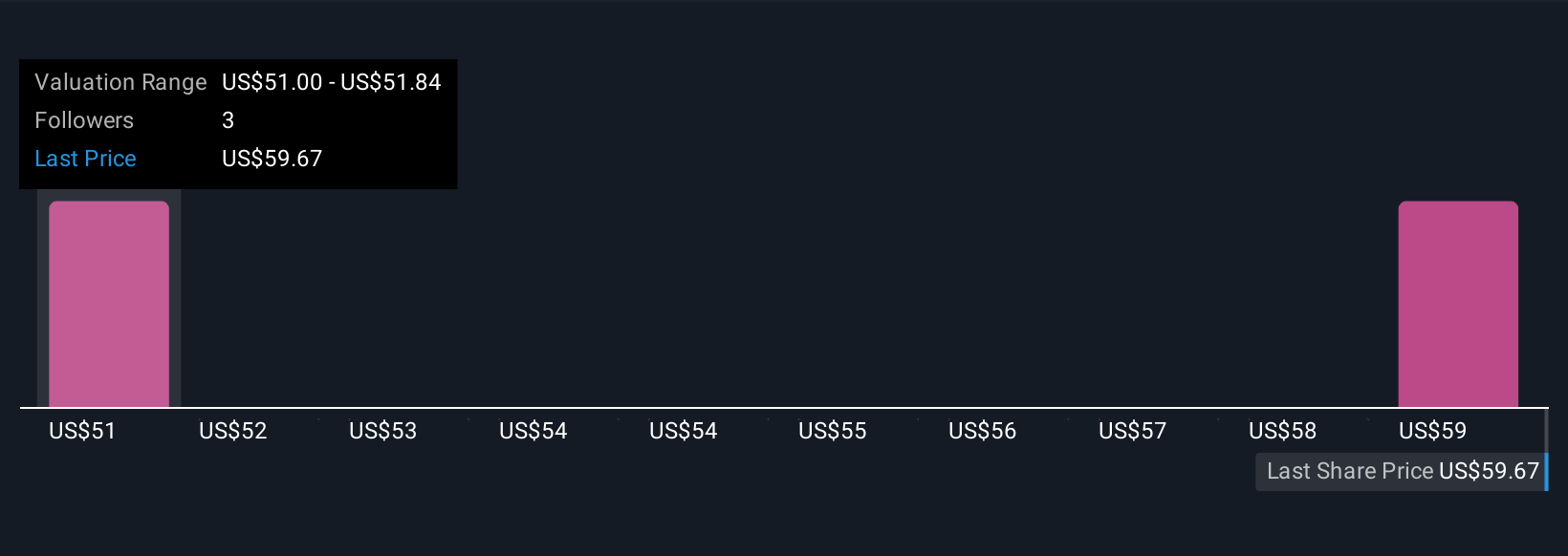

Simply Wall St Community contributors have set fair values for NorthWestern Energy Group between US$51 and US$59.40, based on three independent forecasts. While projections differ, concerns over regulatory risk and coal exposure remain central issues shaping the company’s future cash flows and earnings.

Explore 3 other fair value estimates on NorthWestern Energy Group - why the stock might be worth as much as $59.40!

Build Your Own NorthWestern Energy Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NorthWestern Energy Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free NorthWestern Energy Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NorthWestern Energy Group's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWestern Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NWE

NorthWestern Energy Group

NorthWestern Energy Group, Inc., doing business as NorthWestern Energy, provides electricity and natural gas to residential, commercial, and various industrial customers.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives