- United States

- /

- Electric Utilities

- /

- NasdaqGS:MGEE

Evaluating MGE Energy (MGEE): Is the Current Valuation Justified?

Reviewed by Kshitija Bhandaru

See our latest analysis for MGE Energy.

MGEE’s share price has gradually retreated over the past year, hinting at fading momentum as investors weigh solid fundamentals against evolving risks. The most recent 1-year total shareholder return of -7% puts long-term gains in perspective, especially after several years of steady progress.

If you're interested in the kinds of companies building lasting momentum, now is a good moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares hovering near their recent lows and some key value metrics flashing positive, the big question is whether MGEE is trading at an attractive discount or if the market has already factored in its future prospects. Is there untapped value for investors, or are expectations right where they should be?

Price-to-Earnings of 23.1x: Is it justified?

MGEE commands a price-to-earnings ratio of 23.1x, which stands out as higher than both its electric utility peers and the broader sector average. With the last close at $82.68, investors are paying a premium for each dollar of earnings compared to similar companies.

The price-to-earnings (P/E) ratio shows how much investors are willing to pay for $1 of MGEE’s current earnings. For utilities, this metric helps gauge whether future earnings growth or reliability justify the current market price.

A P/E of 23.1x reflects greater expectations for future profitability than what the overall US Electric Utilities industry commands, where the average is 21x. It also exceeds the peer group’s 20.7x. This suggests the market may be overestimating MGEE’s growth trajectory based on its recent results. Furthermore, the estimated “fair” P/E ratio sits notably lower at 17.6x, reinforcing how stretched this valuation appears compared to both industry standards and analytical models. This is a level the market could shift toward if sentiment changes.

Explore the SWS fair ratio for MGE Energy

Result: Price-to-Earnings of 23.1x (OVERVALUED)

However, slower annual revenue growth and a share price trading below analyst targets could pull sentiment lower if business momentum stalls further.

Find out about the key risks to this MGE Energy narrative.

Another View: Discounted Cash Flow Offers a Different Angle

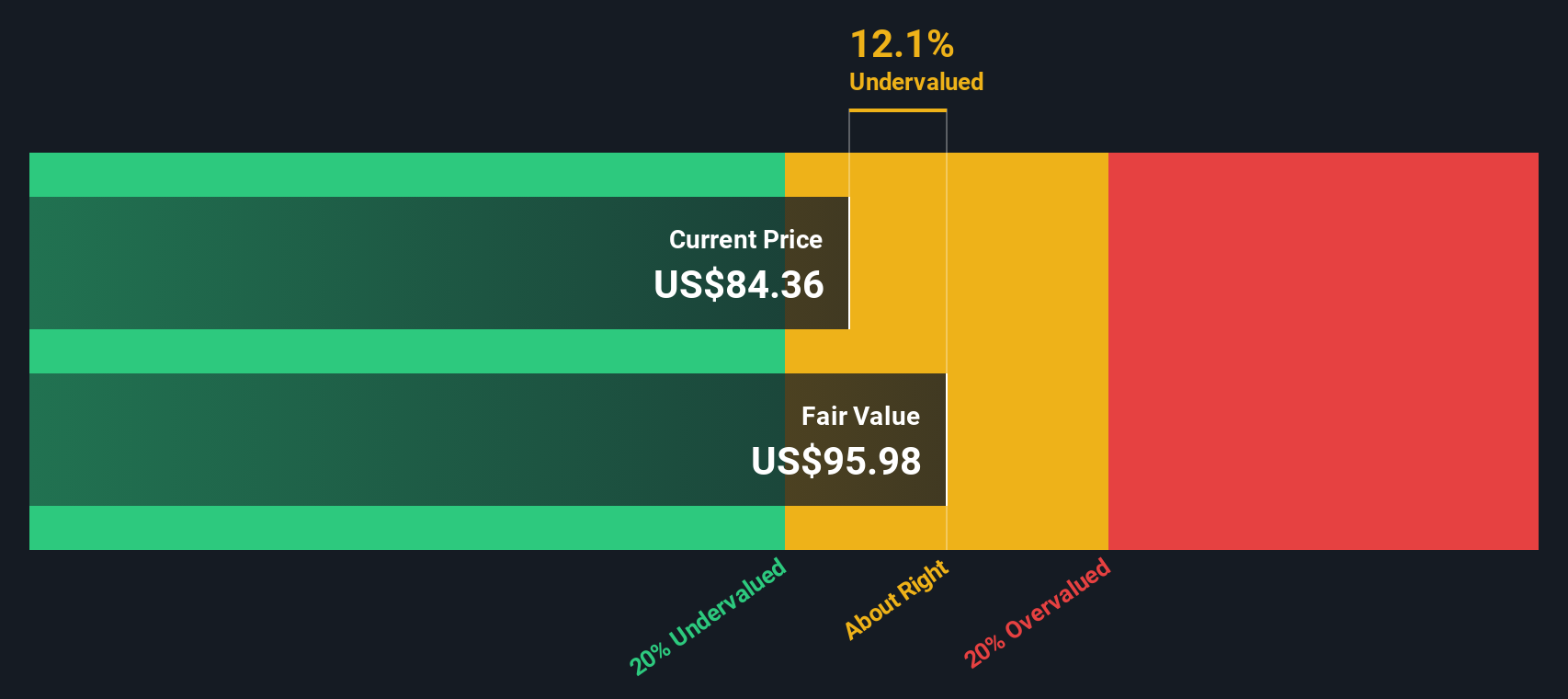

While MGEE appears overvalued based on its price-to-earnings ratio, our DCF model presents a different perspective. The SWS DCF model estimates MGEE's fair value at $95.98, which is about 13.9% higher than its current price. Does this fundamental approach indicate potential for further upside, or is the market exercising caution for valid reasons?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MGE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MGE Energy Narrative

If you think there’s another side to this story, or you’d rather dive into the data yourself, you can shape your own in just a few minutes with Do it your way.

A great starting point for your MGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio with opportunities that stand out from the crowd. These strategies target growth, innovation, and reliable income that investors shouldn’t overlook.

- Access the potential for future breakthroughs by tapping into these 26 quantum computing stocks, a leader in revolutionary computing solutions.

- Boost your income stream and stability by checking out these 19 dividend stocks with yields > 3%, which offers strong yields for the long term.

- Harness the growing power of machine learning with these 24 AI penny stocks, driving advancements in artificial intelligence applications across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGEE

MGE Energy

Through its subsidiaries, operates as a public utility holding company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives