- United States

- /

- Electric Utilities

- /

- NasdaqGS:MGEE

Did Dividend and Debt Moves Just Shift MGE Energy's (MGEE) Capital Allocation Narrative?

Reviewed by Sasha Jovanovic

- MGE Energy's board declared a regular quarterly dividend of US$0.475 per share, payable on December 15, 2025, for shareholders of record as of December 1, 2025, and announced a private placement of US$50 million in senior unsecured notes with staggered maturities through 2055.

- These actions reflect MGE Energy's focus on maintaining shareholder returns while securing long-term capital for future initiatives or operational needs.

- With new debt issuance expanding available resources, we'll consider how capital management could shape the company's long-term investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is MGE Energy's Investment Narrative?

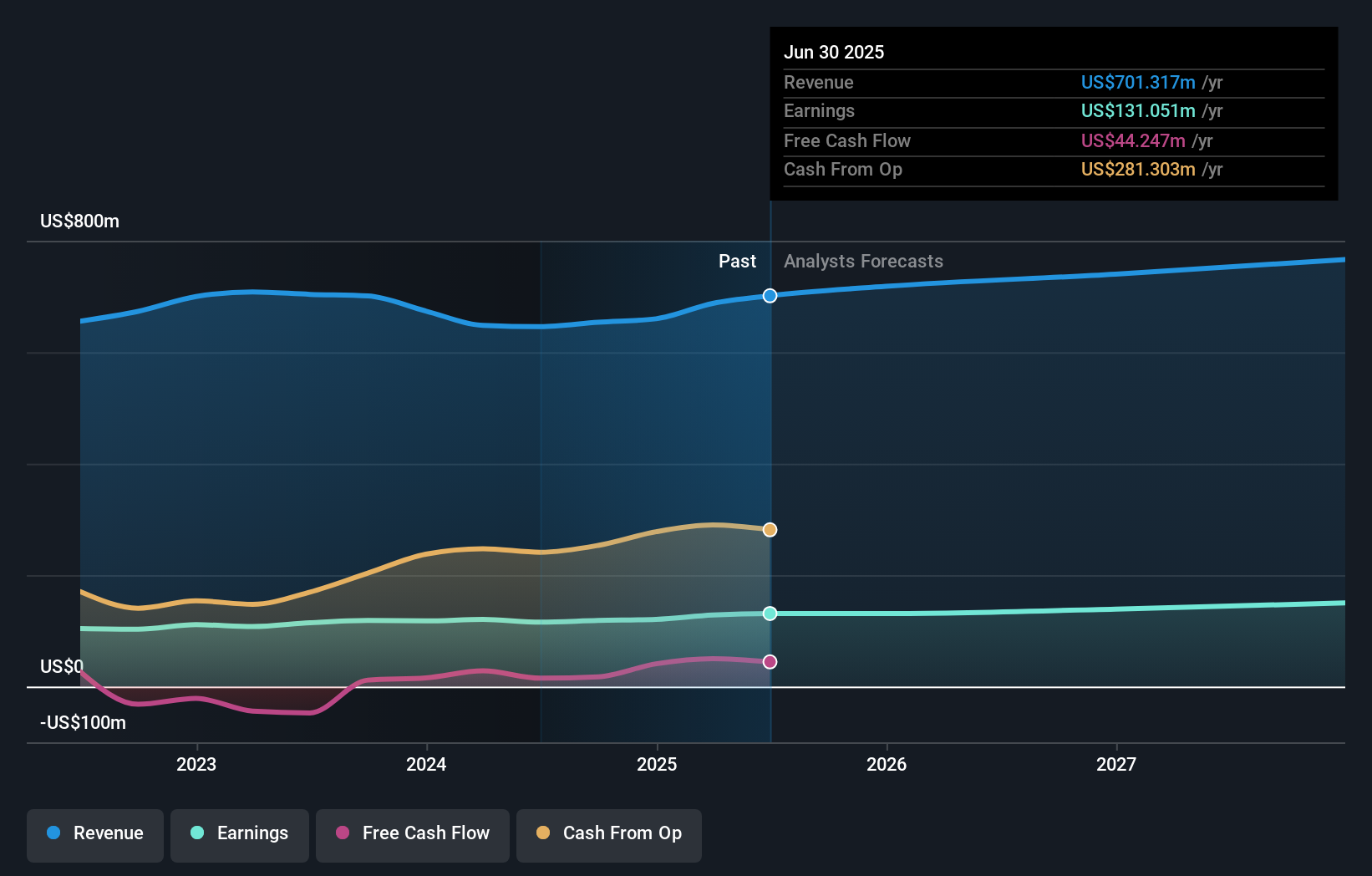

If you’re considering MGE Energy, it’s essential to believe in its stability, prudent capital allocation, and a steady approach to creating value through dividends and modest growth. The latest board decision to declare a regular quarterly dividend and arrange a US$50 million senior notes private placement continues the company’s playbook of prioritizing shareholder distributions while investing for the long haul. For near-term catalysts, investors often look at reliable earnings, recent dividend hikes, or opportunities in debt-financed growth, but this fresh capital raise and dividend confirmation mostly reaffirm the status quo rather than shift it. The biggest risks still include MGE’s relatively slow growth forecast, its high leverage following the new debt issuance, and a dividend that remains less than fully covered by free cash flow. Today’s announcement doesn’t radically alter the short-term outlook, risks and catalysts look much as they did before this news.

But do not overlook the implications of elevated debt on future cash flow flexibility.

MGE Energy's shares have been on the rise but are still potentially undervalued by 10%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on MGE Energy - why the stock might be a potential multi-bagger!

Build Your Own MGE Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MGE Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MGE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MGE Energy's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGEE

MGE Energy

Through its subsidiaries, operates as a public utility holding company in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives