- United States

- /

- Electric Utilities

- /

- NasdaqGS:LNT

What Alliant Energy (LNT)'s Quarterly Dividend Declaration Means For Shareholders

Reviewed by Simply Wall St

- On July 18, 2025, Alliant Energy Corporation’s Board of Directors declared a quarterly cash dividend of US$0.5075 per share, payable on August 15, 2025, to shareholders of record as of July 31, 2025.

- This ongoing commitment to shareholder returns signals Alliant Energy’s continued focus on financial stability and rewarding its investor base.

- Let's explore how the recent dividend affirmation may impact Alliant Energy’s investment outlook, especially regarding shareholder confidence and value proposition.

Alliant Energy Investment Narrative Recap

To be a shareholder in Alliant Energy, you need to have confidence in the company's steady utility operations, ongoing capital investment in renewables, and the stability of regulated earnings. The recent dividend declaration provides modest short-term reassurance regarding Alliant’s capital allocation discipline, though it does not materially impact the core catalysts or the underlying risks right now, such as sensitivity to interest rates, regulatory shifts, or weather-driven margin pressures.

Among Alliant’s latest announcements, the Board’s reaffirmation of its 2025 earnings guidance in early July is most relevant. This recent update, in tandem with successive dividend affirmations, highlights the management’s confidence in the company’s financial trajectory, which remains anchored by growing data center load, supportive rate structures, and long-term economic development efforts in its key states.

However, investors should be mindful that, unlike dividend declarations, risks tied to interest rate trends could influence funding costs and ultimately...

Read the full narrative on Alliant Energy (it's free!)

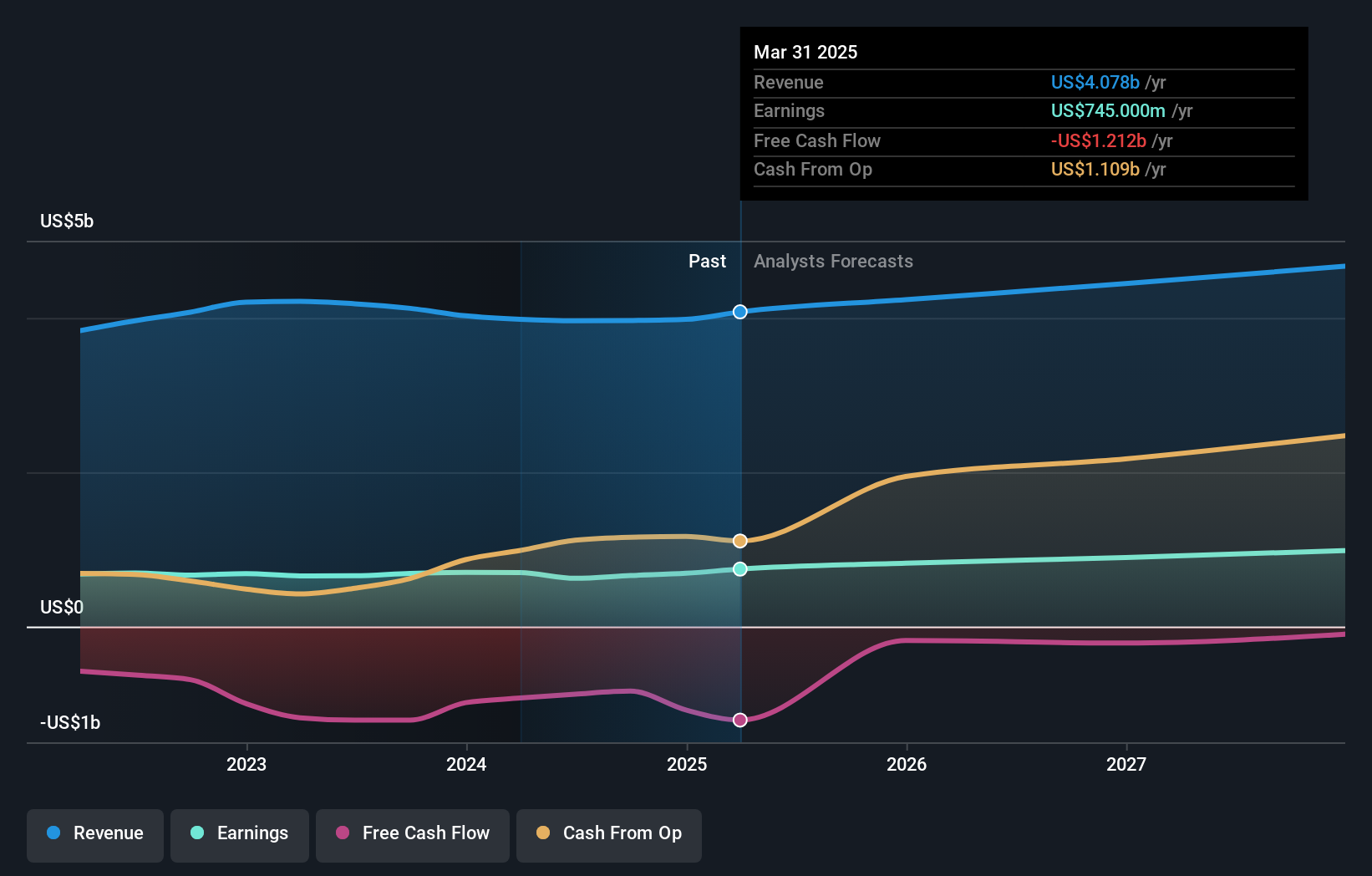

Alliant Energy's outlook anticipates $4.8 billion in revenue and $974.6 million in earnings by 2028. This is based on a 6.2% annual revenue growth rate and a $284.6 million increase in earnings from the current $690.0 million.

Uncover how Alliant Energy's forecasts yield a $66.46 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for Alliant Energy ranging from US$64.64 to US$66.46 per share. While opinions differ, continuing reliance on tax credits for renewables introduces uncertainty that could affect future returns.

Explore 2 other fair value estimates on Alliant Energy - why the stock might be worth just $64.64!

Build Your Own Alliant Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alliant Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alliant Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alliant Energy's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LNT

Alliant Energy

Operates as a utility holding company that provides regulated electric and natural gas services in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives