- United States

- /

- Water Utilities

- /

- NasdaqGS:HTO

How Surging Demand for Energy-Efficient Evaporators Could Reshape H2O America’s (HTO) Investment Narrative

Reviewed by Simply Wall St

- Recent projections indicate that the global vacuum evaporators market will see significant growth by 2030, fueled by more stringent environmental regulations and rising water scarcity concerns.

- Mechanical vapor recompression (MVR) vacuum evaporators are expected to lead technological advancement, with demand from the pharmaceutical sector driving innovation in advanced wastewater treatment solutions.

- Given this strong industry outlook for water treatment technologies, we'll consider how increased demand for energy-efficient evaporators could influence H2O America's investment narrative.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

H2O America Investment Narrative Recap

To want to own H2O America stock today, an investor needs to be confident that regulatory and societal tailwinds for advanced water treatment will help offset current margin pressures and funding needs. The news that demand for energy-efficient evaporators in water treatment is set to accelerate globally could support long-term revenue opportunities, but it does not yet change the short-term picture, where margin compression from rising costs remains a key risk, while ongoing infrastructure investment is still the biggest catalyst for earnings growth. Of the company's recent developments, the Q2 2025 earnings report stands out: H2O America delivered rising sales and net income, buoyed by expanding service and ongoing investment in technology and infrastructure. While the market for advanced evaporators is growing, these financial results underscore that the company’s immediate catalysts remain tied to operational execution and delivering on its capital investment plan, rather than shifts in specific water treatment segments. However, investors should keep in mind that despite these promising industry trends, the risk of rising water production costs outpacing revenues is something you should be aware of...

Read the full narrative on H2O America (it's free!)

H2O America's narrative projects $860.2 million revenue and $125.7 million earnings by 2028. This requires 2.9% yearly revenue growth and a $22.9 million earnings increase from $102.8 million today.

Uncover how H2O America's forecasts yield a $61.67 fair value, a 21% upside to its current price.

Exploring Other Perspectives

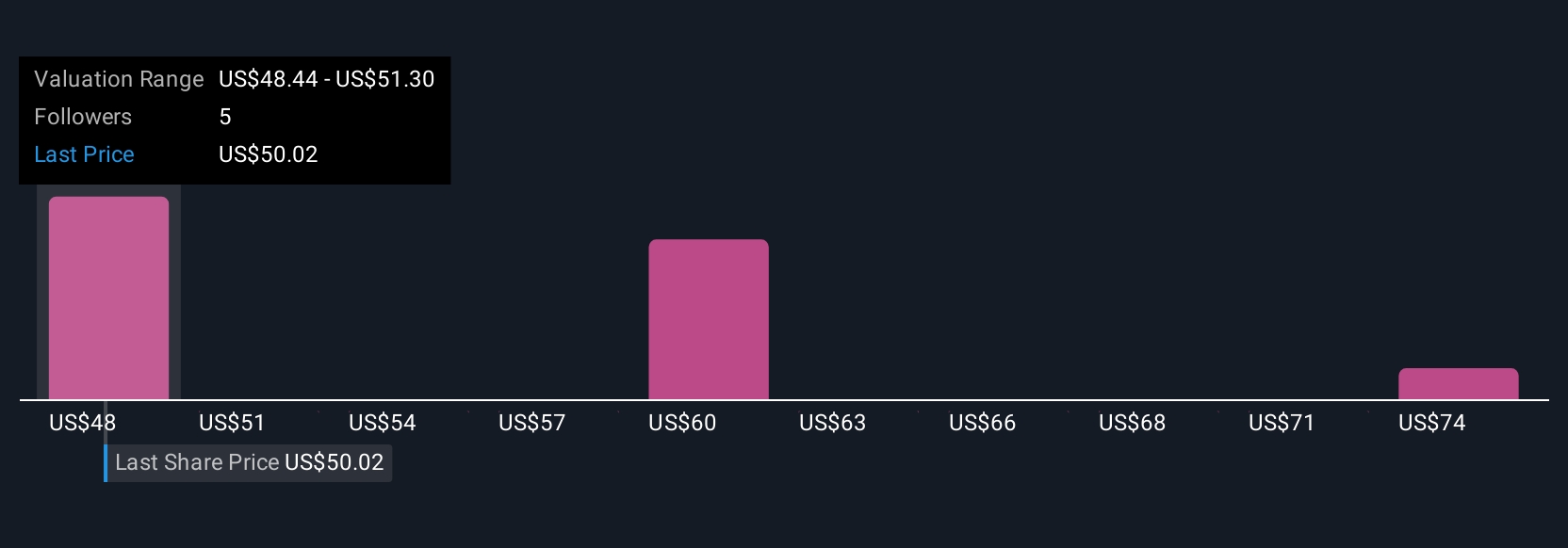

Simply Wall St Community members have fair value estimates ranging from US$48.44 to US$77, based on three unique models. With margin pressures front and center, this breadth of opinion highlights why it’s worth looking at several different views on H2O America’s outlook.

Explore 3 other fair value estimates on H2O America - why the stock might be worth just $48.44!

Build Your Own H2O America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your H2O America research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free H2O America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate H2O America's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if H2O America might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HTO

H2O America

Through its subsidiaries, provides water utility and other related services in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives