- United States

- /

- Electric Utilities

- /

- NasdaqGS:EXC

Exelon (NasdaqGS:EXC) Announces Melissa Washington's Appointment As SVP Of Governmental Affairs

Reviewed by Simply Wall St

Melissa Y. Washington's appointment as Senior Vice President at ComEd, a subsidiary of Exelon (NasdaqGS:EXC), is a significant leadership change, expected to steer strategic initiatives but had little direct impact on the share price last week. Exelon's 1% decline is aligned with broader market trends, where the market remained flat over the week. While the executive transition might have added weight to Exelon's performance, it did not deviate significantly from the market's overall behavior. Exelon’s price move reflects these broader market dynamics rather than being directly influenced by the executive changes, adding context to its flat performance.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

The recent appointment of Melissa Y. Washington as Senior Vice President at ComEd, a subsidiary of Exelon (NasdaqGS:EXC), may have implications for the company’s strategic direction, potentially affecting revenue and earnings forecasts. Despite the appointment, the share price experienced a 1% decline, aligning with broader market trends. This indicates that the executive change did not significantly influence immediate market perceptions but could impact longer-term strategic initiatives.

Over a longer-term period of five years, Exelon's total shareholder return, including both share price and dividends, amounted to 105.72%. This demonstrates a substantial return for shareholders, particularly in comparison to the past year's performance where Exelon exceeded the US Market's return of 10.4% and the US Electric Utilities industry's return of 14.7%. Such a performance suggests resilience and growth in shareholder value over the longer period.

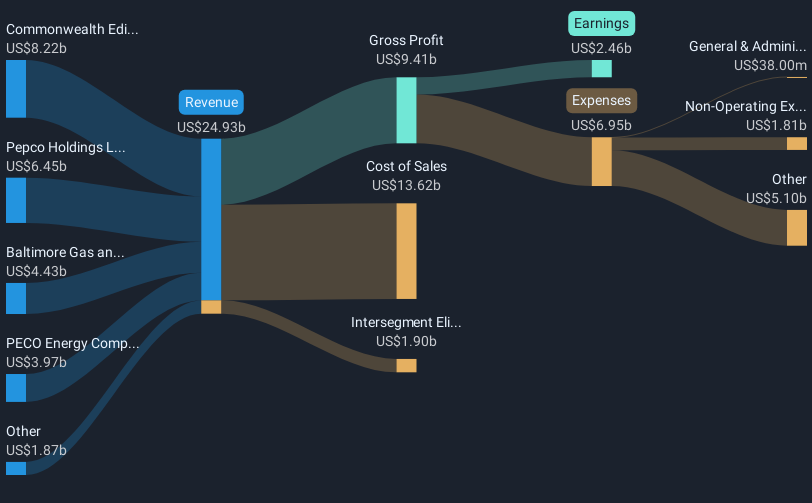

The legislative advancements in Maryland and Exelon's US$38 billion investment plan are key drivers of potential future revenue and earnings growth. Analysts project that these initiatives will boost Exelon's revenue and earnings, with estimated earnings growth of 6.19% per year. The current share price of US$46.29 is slightly below the consensus analyst price target of US$47.53, suggesting limited upside potential in the near term, but reflecting a fair valuation by the market relative to anticipated growth projections. Investors should consider how these factors might play into future revenue streams and market perceptions.

Learn about Exelon's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exelon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXC

Exelon

A utility services holding company, engages in the energy distribution and transmission businesses.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives