- United States

- /

- Electric Utilities

- /

- NasdaqGS:EVRG

Has Evergy's 24% 2024 Rally Left Further Upside After Strong Dividend Growth?

Reviewed by Bailey Pemberton

Thinking about what to do with your Evergy shares? You are definitely not alone. With the stock sitting at $76.62 after a run that has seen it climb 3.4% over the past week and an impressive 24.3% year-to-date, investors are starting to wonder whether there is still room for more growth, or if it is time to lock in those gains. What is particularly striking is that over the last five years, Evergy is up a solid 76.9%, which would make any long-term investor feel pretty good about their decision.

Much of this momentum comes as the broader market has shifted its perception of risk and growth potential for utility companies. Defensive stocks like Evergy are seeing renewed interest as investors look for stability and steady returns, especially in periods when other sectors feel overheated. But is the stock running ahead of its value, or is there something the market is still missing?

Diving into the numbers, Evergy currently has a valuation score of 0 out of 6, meaning it is not considered undervalued under any of the traditional valuation checks. That is a clear signal for us to dig deeper, because price alone does not tell the whole story.

Let us break down how Evergy measures up against a few key valuation methods, and stay tuned until the end for a smarter way to get a truly holistic picture of this company's worth that most investors overlook.

Evergy scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Evergy Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a valuation method that estimates a company’s intrinsic value by forecasting future dividends and discounting them back to their present value. This approach is particularly relevant for utility companies like Evergy, which are known for stable dividend payments.

According to the model, Evergy’s annual dividend per share is currently $2.91. The company maintains a return on equity (ROE) of 8.38% with a dividend payout ratio of about 71%. This means that most, but not all, of the company’s earnings are being returned to shareholders as dividends. Based on these inputs, the expected annual growth rate of future dividends is projected at 2.4%, calculated as (1 minus payout ratio) multiplied by ROE. This growth figure suggests modest but reliable dividend increases in the years ahead.

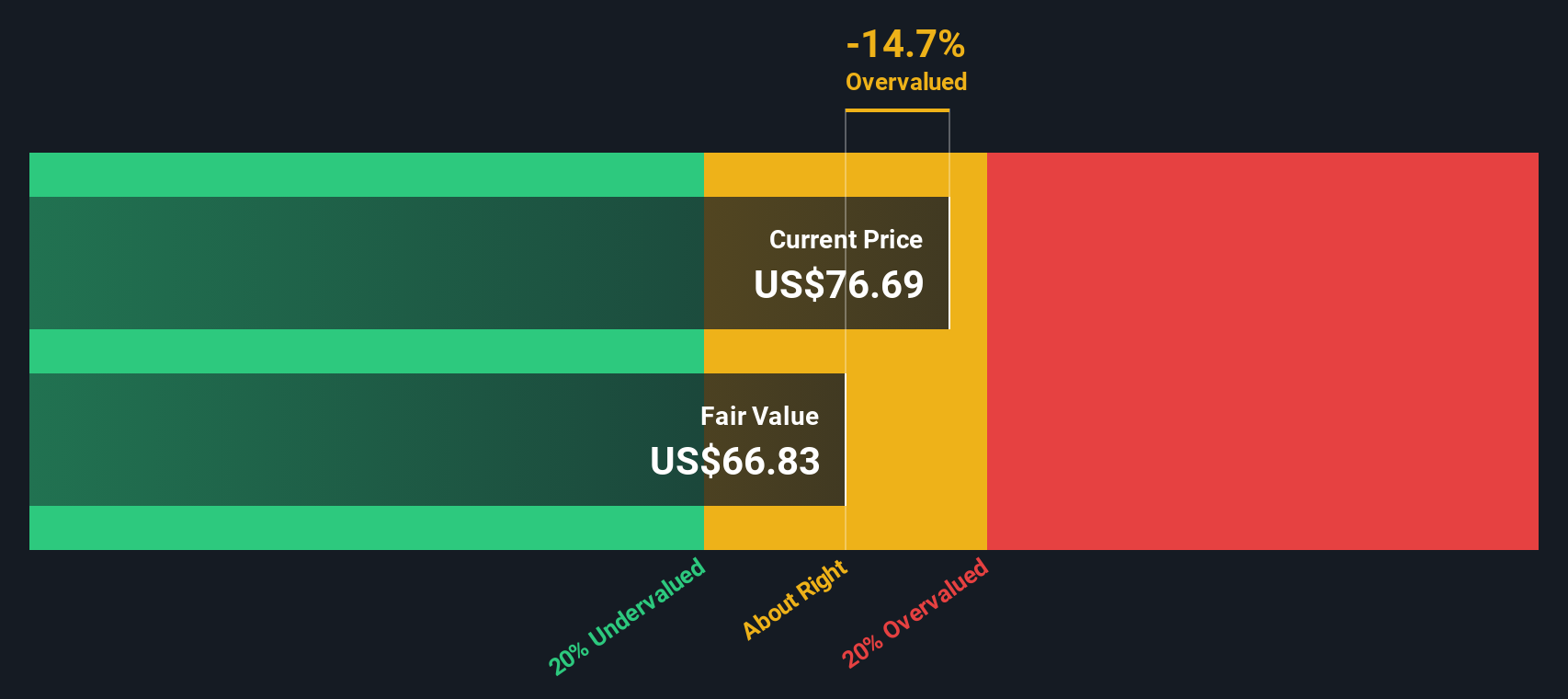

The outcome of this analysis gives an estimated intrinsic value for Evergy shares of $66.99. At a recent share price of $76.62, the stock comes in around 14.4% above the fair value suggested by the DDM. This signals that Evergy may currently be overvalued from the standpoint of future dividend potential.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Evergy may be overvalued by 14.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Evergy Price vs Earnings

For companies like Evergy that generate consistent profits, the Price-to-Earnings (PE) ratio is arguably the most practical benchmark for valuation. The PE ratio indicates how much investors are willing to pay for each dollar of company earnings, making it especially relevant for established, profitable businesses in mature sectors such as utilities.

Determining what a “normal” PE ratio should be is not always straightforward. Growth prospects, profitability, and business risks all play a role in shaping what investors consider a fair multiple. Companies with higher expected growth or lower perceived risk can warrant higher PEs, while those facing headwinds often trade at discounts.

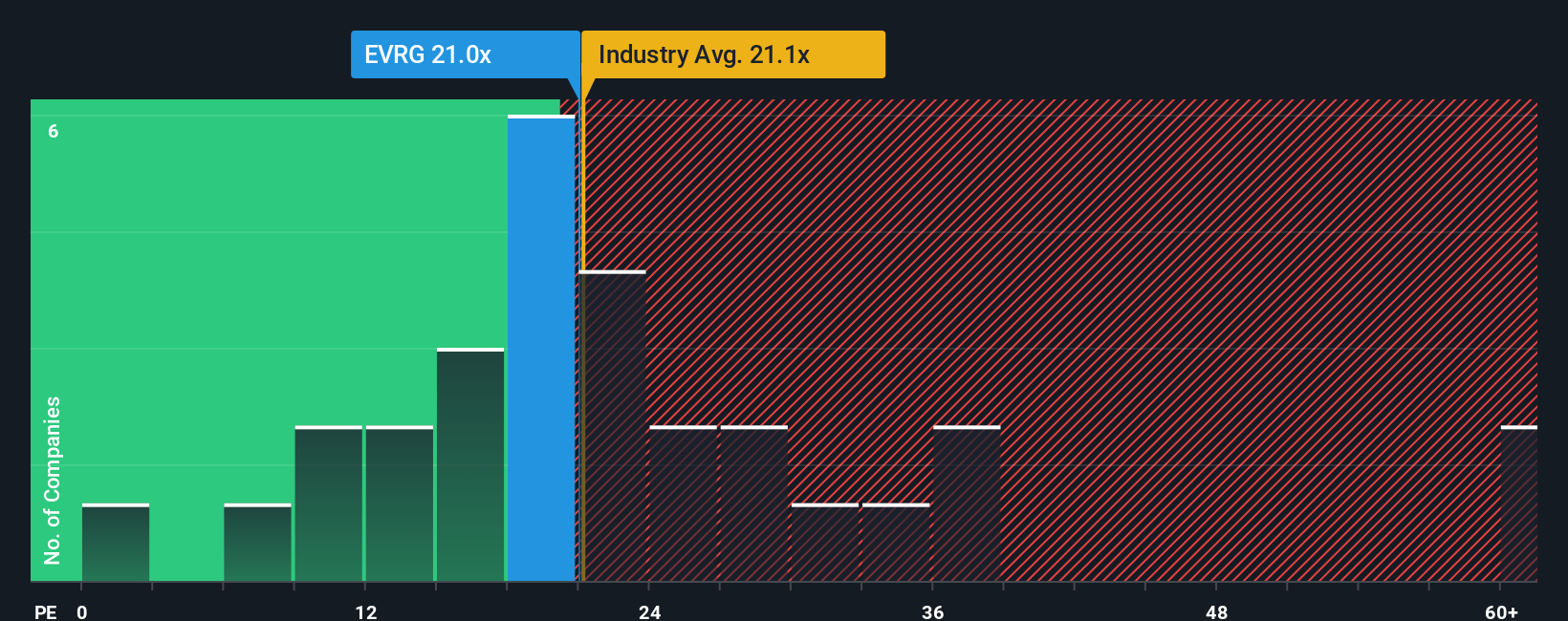

Currently, Evergy trades at a 21x PE ratio. This compares closely with its peer average of 20.1x and the broader electric utilities industry average of 21.1x. However, Simply Wall St’s proprietary "Fair Ratio" for Evergy is 20.4x. Unlike plain peer or industry averages, the Fair Ratio incorporates nuanced factors such as the company’s earnings growth, risk exposure, profit margins, its industry, and even market capitalization. This tailored approach gives a more accurate sense of what a reasonable valuation should be for Evergy’s unique profile.

With Evergy’s actual PE ratio just slightly above the Fair Ratio threshold, this suggests the stock is valued about right according to its fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Evergy Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own story about a company, combining your perspective and expectations, such as what you think Evergy’s future revenue, earnings, and margins will be, into a custom financial forecast that leads to an estimated fair value.

Narratives help you connect the dots between what is happening in the business and what that might realistically mean for the share price. They are accessible for everyone on Simply Wall St’s Community page, where millions of investors discuss their views and build dynamic, data-backed forecasts. Instead of relying solely on historical ratios, you can create, adjust, and compare Narratives to see how your expectations differ from consensus or analyst targets.

The power of Narratives comes from their flexibility and real-time updates. When news breaks or new earnings are released, your Narrative can update instantly, helping you stay ahead with the most relevant information. This lets you make smarter buy and sell decisions based on your personal fair value compared to the current market price.

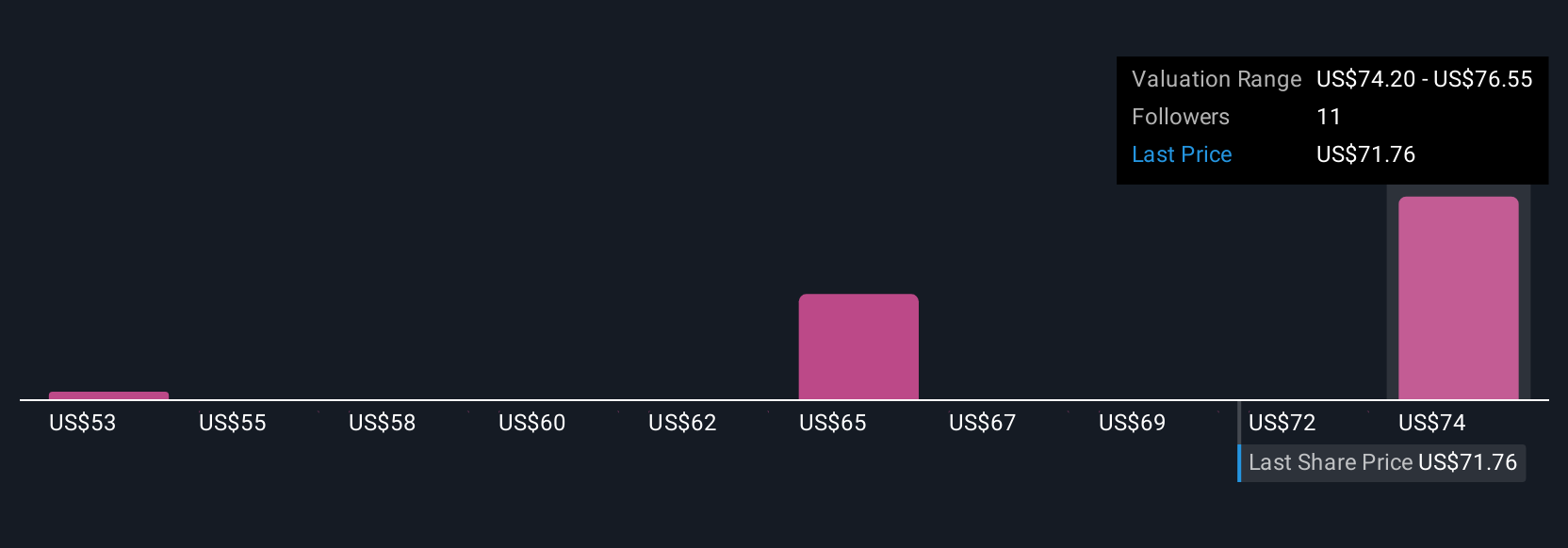

For example, one Evergy Narrative sees strong grid investments and robust demand growth leading to a fair value of $75.60, just above the current share price. Another, more cautious Narrative stresses execution and funding risks that could limit upside, resulting in a lower fair value. This demonstrates how different viewpoints can shape decisions.

Do you think there's more to the story for Evergy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVRG

Evergy

Engages in the generation, transmission, distribution, and sale of electricity in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives