- United States

- /

- Electric Utilities

- /

- NasdaqGS:EVRG

Evergy (EVRG) Valuation in Focus After Advanced Nuclear and Data Center Growth Initiatives

Reviewed by Kshitija Bhandaru

Evergy (EVRG) is drawing interest after signing a memorandum of understanding with TerraPower to explore bringing advanced nuclear technology to its Kansas service territory. This move aligns with Evergy’s broader clean energy and infrastructure investment plans.

See our latest analysis for Evergy.

Evergy’s recent MOU with TerraPower follows a flurry of announcements about data center partnerships and expanding renewable infrastructure. This signals a forward-looking shift in its growth strategy. While the company’s 1-year total shareholder return is just 0.3%, steady progress on major projects suggests momentum is gradually building for investors with a longer horizon.

If nuclear and clean energy trends have you intrigued, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

After shares have advanced modestly and major projects are ramping up, investors may wonder whether Evergy remains attractively valued or if the recent growth outlook is already factored into the current share price.

Most Popular Narrative: Fairly Valued

With Evergy’s last close price nearly matching the most widely followed narrative fair value, there is no clear bargain or premium implied by consensus analysts. All eyes are on whether new catalysts will shift future expectations.

Accelerated investment in grid modernization, new natural gas, and solar generation, enabled by supportive state regulatory approvals and legislative mechanisms (such as PISA and CWIP), positions Evergy to efficiently deploy and recover capital, benefitting future net margins and regulated earnings.

Want to find out what’s fueling these growth expectations? See the surprising building blocks behind the projected profit transformation and uncover which assumptions underpin this price view. Don’t miss the full story behind the numbers.

Result: Fair Value of $75.60 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution delays or shifts in data center demand could quickly undermine these optimistic growth projections for Evergy's long-term earnings.

Find out about the key risks to this Evergy narrative.

Another View: Multiples-Based Perspective

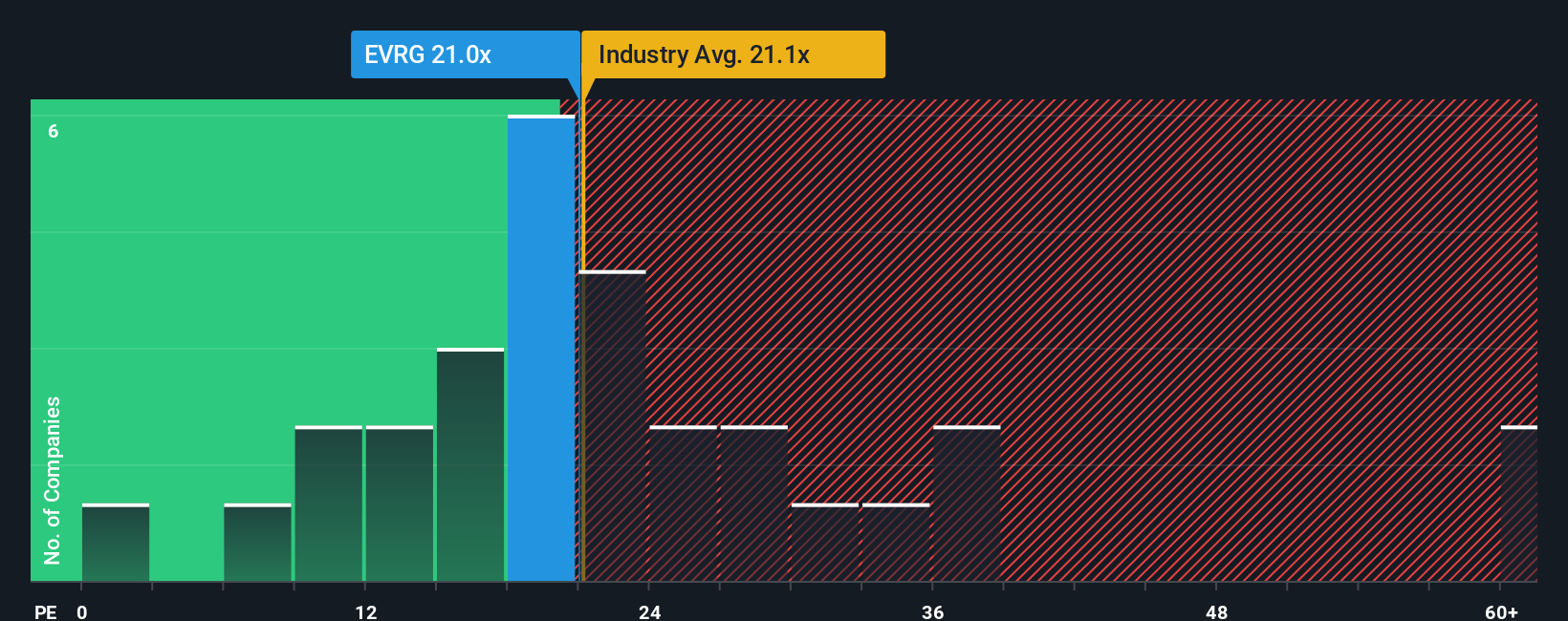

Looking at where Evergy trades compared to others, its price-to-earnings ratio sits at 20.8x, which is essentially on par with the US Electric Utilities industry average of 21x, but above the typical peer at 19.9x. The fair ratio for Evergy works out at 20.4x, so current pricing suggests little margin of safety. Is the market giving Evergy too much credit, or simply reflecting its growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Evergy Narrative

If you see the numbers differently or want to dig deeper on your own, you can craft your own perspective in just a few minutes with Do it your way.

A great starting point for your Evergy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop searching for the next opportunity. Supercharge your portfolio by researching hand-picked stocks with unique growth drivers, smart balance sheets, or resilient cash flows.

- Uncover rising stars with strong backstories by checking out these 916 undervalued stocks based on cash flows to spot stocks trading below their real worth before the broader market catches on.

- Position yourself for future breakthroughs as you scan these 26 quantum computing stocks, featuring innovators at the forefront of quantum computing and transformative tech advancements.

- Boost your income potential by reviewing these 19 dividend stocks with yields > 3% and see which companies are offering yields above 3% while maintaining financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evergy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EVRG

Evergy

Engages in the generation, transmission, distribution, and sale of electricity in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives