- United States

- /

- Water Utilities

- /

- NasdaqGS:CWCO

Our Take On Consolidated Water Co. Ltd.'s (NASDAQ:CWCO) CEO Salary

In 2004 Rick McTaggart was appointed CEO of Consolidated Water Co. Ltd. (NASDAQ:CWCO). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Consolidated Water

How Does Rick McTaggart's Compensation Compare With Similar Sized Companies?

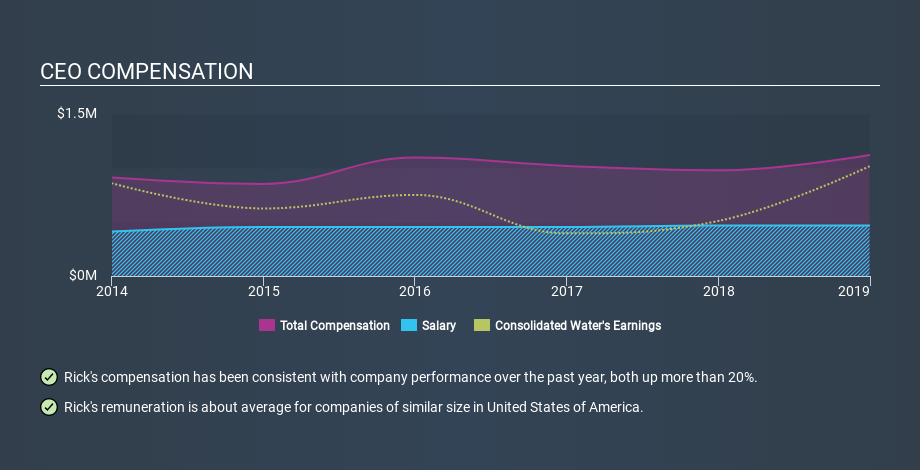

According to our data, Consolidated Water Co. Ltd. has a market capitalization of US$247m, and paid its CEO total annual compensation worth US$1.1m over the year to December 2018. We think total compensation is more important but we note that the CEO salary is lower, at US$468k. We looked at a group of companies with market capitalizations from US$100m to US$400m, and the median CEO total compensation was US$1.1m.

So Rick McTaggart receives a similar amount to the median CEO pay, amongst the companies we looked at. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance.

You can see, below, how CEO compensation at Consolidated Water has changed over time.

Is Consolidated Water Co. Ltd. Growing?

Over the last three years Consolidated Water Co. Ltd. has grown its earnings per share (EPS) by an average of 40% per year (using a line of best fit). It achieved revenue growth of 16% over the last year.

This shows that the company has improved itself over the last few years. Good news for shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. It could be important to check this free visual depiction of what analysts expect for the future.

Has Consolidated Water Co. Ltd. Been A Good Investment?

I think that the total shareholder return of 72%, over three years, would leave most Consolidated Water Co. Ltd. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Rick McTaggart is paid around the same as most CEOs of similar size companies.

Few would be critical of the leadership, since returns have been juicy and earnings per share are moving in the right direction. Indeed, many might consider the pay rather modest, given the solid company performance! Shareholders may want to check for free if Consolidated Water insiders are buying or selling shares.

If you want to buy a stock that is better than Consolidated Water, this free list of high return, low debt companies is a great place to look.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:CWCO

Consolidated Water

Supplies potable water, treats wastewater and water for reuse, and provides water-related products and services in the Cayman Islands, the Bahamas, the United States, and the British Virgin Islands.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026