- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Will Constellation Energy's (CEG) Updated Guidance and Board Change Reveal Its Long-Term Strategic Priorities?

Reviewed by Sasha Jovanovic

- Constellation Energy Corporation reported its third quarter 2025 results, showing revenues of US$6.57 billion and net income of US$930 million, both slightly changed compared to the same period last year, along with updated guidance reflecting ongoing market challenges.

- Peter Oppenheimer has notified the Board of his decision to retire effective December 31, 2025, coinciding with significant investment plans in battery storage and nuclear power as the company seeks to capitalize on long-term energy sector trends.

- We’ll explore how the latest earnings revision and board changes could influence Constellation Energy’s long-term growth narrative and industry positioning.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Constellation Energy Investment Narrative Recap

To believe in Constellation Energy as a shareholder, you have to buy into the long-term need for reliable, carbon-free power and trust the company can manage both the complexity of nuclear operations and the evolving grid. The recent board retirement and earnings revisions don't materially change the near-term catalyst of new, high-margin contracts with large customers, but the biggest risk remains the rising costs and regulatory hurdles tied to its aging nuclear assets.

Against this backdrop, Constellation's announcement of sustained high nuclear plant reliability, operating at 98.8% capacity over the summer, stands out for investors. This reliability helps address major risk factors by supporting contract wins and steady cash flows, reinforcing the short-term positive catalysts tied to growing demand for clean, always-on energy.

Yet, in sharp contrast, evolving costs and compliance requirements tied to nuclear generation are risks that investors should be aware of as ...

Read the full narrative on Constellation Energy (it's free!)

Constellation Energy's narrative projects $26.7 billion in revenue and $3.6 billion in earnings by 2028. This requires a 2.5% yearly revenue growth rate and a $0.6 billion increase in earnings from the current $3.0 billion level.

Uncover how Constellation Energy's forecasts yield a $404.07 fair value, a 19% upside to its current price.

Exploring Other Perspectives

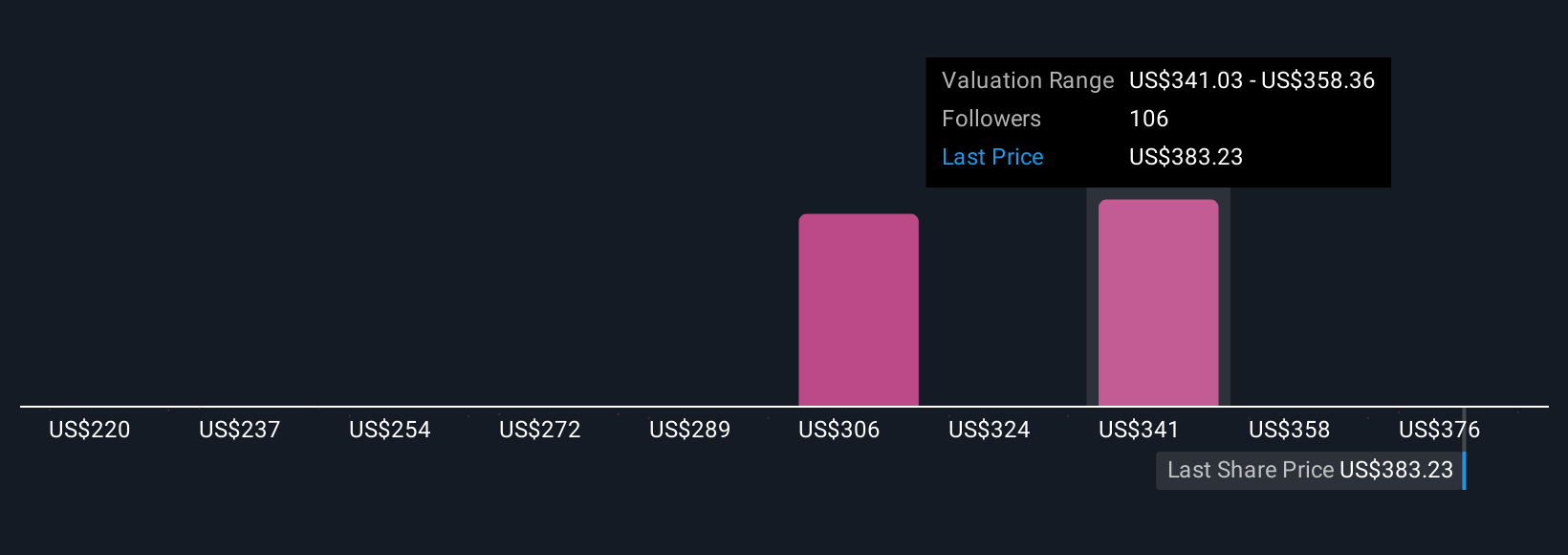

Thirteen members of the Simply Wall St Community provided fair value estimates for Constellation Energy, ranging widely from US$230 to US$492.26 per share. With regulatory and operational costs in focus, these diverse perspectives invite you to explore how opinion can shift with changing market risks.

Explore 13 other fair value estimates on Constellation Energy - why the stock might be worth as much as 45% more than the current price!

Build Your Own Constellation Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Constellation Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Energy's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives