- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Constellation Energy (NasdaqGS:CEG) Reports Q4 Earnings Growth Despite 2% Price Dip

Reviewed by Simply Wall St

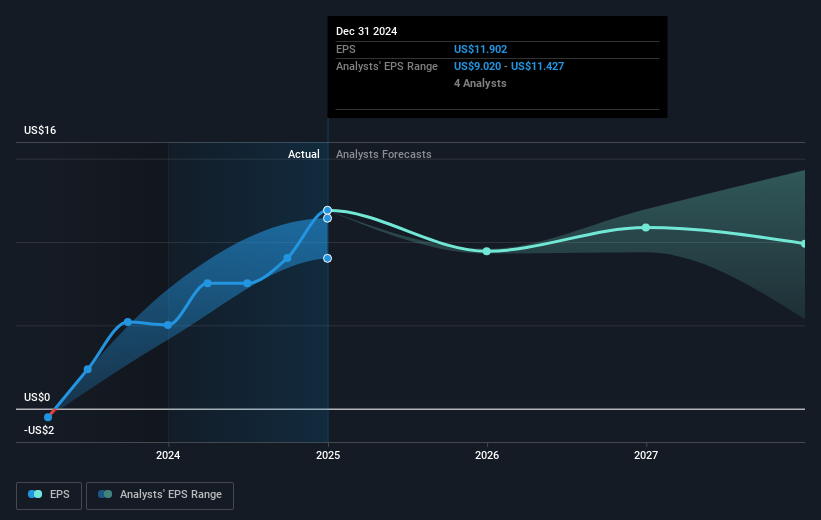

Constellation Energy (NasdaqGS:CEG) recently reported significant improvements in net income and earnings per share for both the fourth quarter and the full year 2024, despite a decline in sales. However, the company’s lack of share buybacks during the last quarter might have had less supportive consequences for its stock price. Simultaneously, Constellation’s quarterly dividend declaration highlights its commitment to returning value to shareholders. Despite these positive financial indicators, the company's stock witnessed a price decrease of 2.34% over the past quarter. This may have been influenced by broader market conditions, where the tech-heavy Nasdaq Composite posted a 5.5% decline in February due to investor concerns over economic conditions and policy impacts. While inflation data offered some reprieve, overall market volatility was evident. This challenging market backdrop may have contributed to the subdued quarterly performance of Constellation Energy’s stock.

Navigate through the intricacies of Constellation Energy with our comprehensive report here.

The last three years have witnessed significant growth for Constellation Energy's shares, with a remarkable total return of 403.60%. This performance includes both share price appreciation and dividends, illustrating the company's strong capacity for generating shareholder value during this period. Comparatively, over the past year, Constellation outpaced both the US market and the US Electric Utilities industry in total return.

A key driver of this performance can be attributed to Constellation's robust earnings growth, evidenced by a 131% increase over the past year, surpassing industry growth rates. Noteworthy developments include Constellation's advanced discussions to acquire Calpine Corporation for approximately US$30 billion, which could enhance its asset base significantly. Additionally, securing over US$1 billion in contracts with U.S. governmental agencies reflects its growing influence in energy efficiency and supply. Finally, Constellation's expansion in clean energy solutions, including the launch of 100% clean nuclear energy products, marks its commitment to sustainable growth.

- See how Constellation Energy measures up with our analysis of its intrinsic value versus market price.

- Gain insight into the risks facing Constellation Energy and how they might influence its performance—click here to read more.

- Shareholder in Constellation Energy? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives