- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Constellation Energy (NasdaqGS:CEG) Q2 Earnings Beat, Buyback Progress, and Dividend Affirmation Signal Strength

Reviewed by Simply Wall St

Navigate through the intricacies of Constellation Energy with our comprehensive report here.

Strengths: Core Advantages Driving Sustained Success for Constellation Energy

Constellation Energy has demonstrated robust financial performance, with second quarter GAAP earnings of $2.58 per share and adjusted operating earnings of $1.68 per share, as highlighted by Joe Dominguez, President and CEO. The company has also raised its guidance, showcasing confidence in its future performance. Operational efficiency is another strong point, with the nuclear division producing over 41 million-megawatt hours of reliable, carbon-free energy at a capacity factor of 95.4%. Additionally, Constellation Energy's commitment to a positive workplace culture is evident from its certification as a Great Place To Work. The company's stock is trading at $254.98, significantly below the estimated fair value of $412.57, indicating it may be undervalued despite its high Price-To-Earnings Ratio compared to peers and the industry.

Weaknesses: Critical Issues Affecting Constellation Energy's Performance and Areas For Growth

Despite its strengths, Constellation Energy faces notable weaknesses. The company's Price-To-Earnings Ratio of 33.3x is considerably higher than the peer average of 19.8x and the US Electric Utilities industry average of 19.9x, suggesting it is expensive relative to its peers. Stock compensation costs have also posed a challenge, as highlighted by Joe Dominguez, which could impact profitability. Regulatory scrutiny remains a concern, with ongoing challenges that could affect operational efficiency. Additionally, the target price being lower than the current share price indicates potential market skepticism about future growth prospects.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Constellation Energy has several opportunities for growth. The increasing demand for data centers represents a significant market opportunity, as emphasized by Joe Dominguez. The recent reforms in the PJM capacity market, approved by FERC, are designed to incentivize necessary supply, potentially benefiting the company. Sustainability initiatives, such as the release of the third sustainability report, highlight Constellation Energy's efforts to help customers achieve their goals, which could enhance its market position. The company also expects enhanced commercial margins, improving by $0.15 to $1.90 per megawatt hour, according to CFO Daniel Eggers, which could positively impact profitability.

Threats: Key Risks and Challenges That Could Impact Constellation Energy's Success

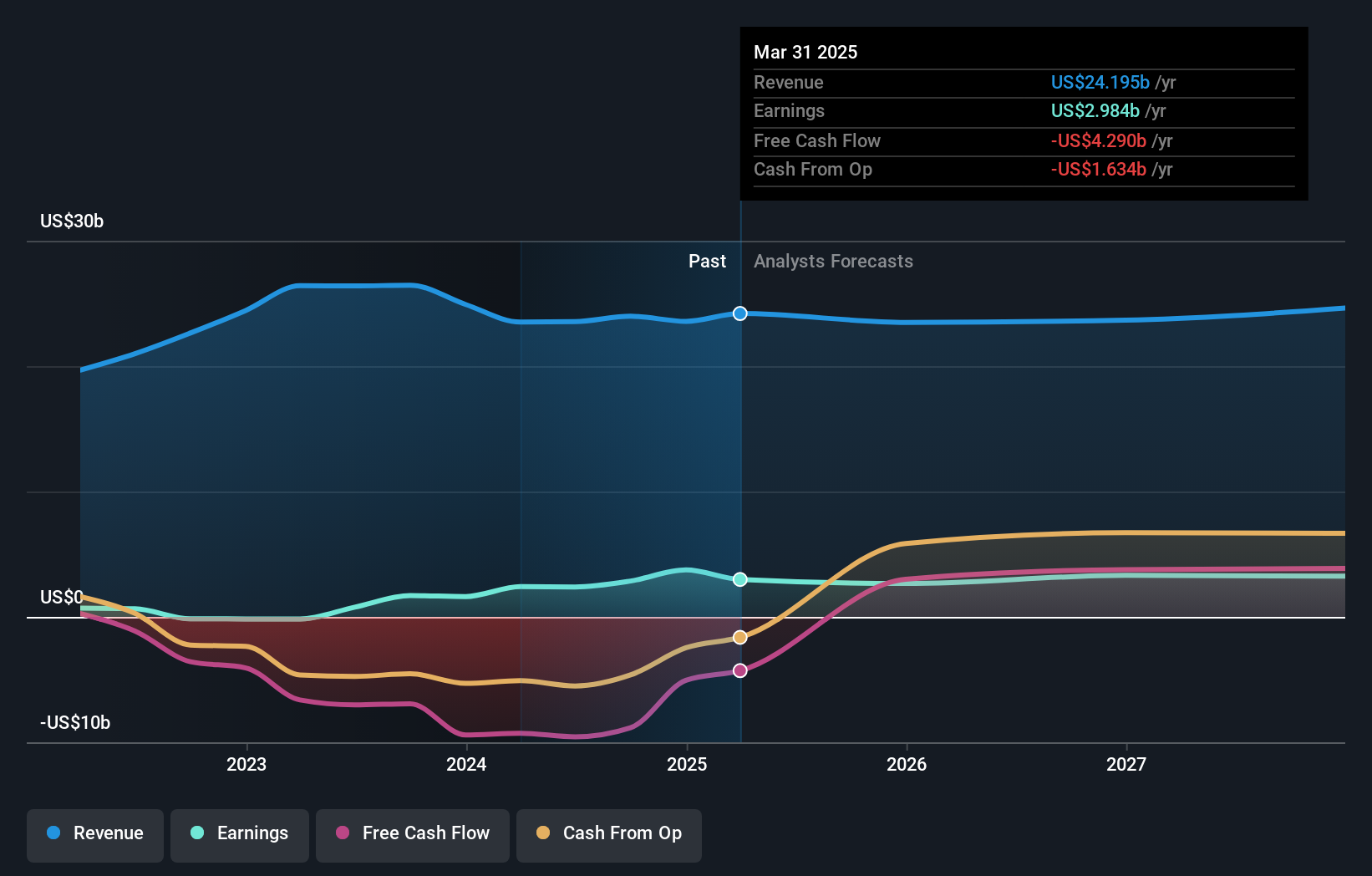

Constellation Energy faces several threats that could impact its success. The volatile power markets, driven by increased demand and a shift to more intermittent, non-dispatchable resources, pose a significant risk, as noted by Joe Dominguez. Economic uncertainty is another concern, with potential investor apprehension about the broader economic outlook. Regulatory risks remain a critical challenge, with uncertainties surrounding FERC's decisions, such as the Talen ISA, which could impact the company's operations. Additionally, the high level of non-cash earnings and the company's debt not being well covered by operating cash flow are financial risks that need to be addressed.

Conclusion

Constellation Energy's strong financial performance and operational efficiency, particularly in its nuclear division, position it well for sustained success. However, its high Price-To-Earnings Ratio and regulatory challenges suggest caution. The company's significant opportunities in the growing data center market and recent PJM capacity market reforms could drive future growth. Despite these strengths and opportunities, the stock trading at $254.98, well below the estimated fair value of $412.57, indicates potential market skepticism, which could impact investor sentiment and future performance.

Key Takeaways

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives