- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Constellation Energy (CEG) Is Up 7.8% After US$1 Billion DOE Loan and Leadership Shift Announced

Reviewed by Sasha Jovanovic

- In November 2025, Constellation Energy announced a series of senior leadership changes and highlighted the restart of its Crane Clean Energy Center, supported by a US$1 billion Department of Energy loan, as part of preparations to complete its acquisition of Calpine later this year.

- This influx of federal support and policy momentum for nuclear expansion underscores the company’s central role in meeting rising demand for clean, reliable power nationwide.

- We’ll explore how this substantial US$1 billion federal loan and executive reshuffle could influence Constellation Energy’s investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Constellation Energy Investment Narrative Recap

To be a shareholder in Constellation Energy, investors need confidence in the ongoing demand for carbon-free, reliable power and sustained bipartisan support for nuclear energy policy. The recent executive changes and the US$1 billion DOE loan for the Crane Clean Energy Center reflect meaningful progress toward expanding capacity and operational scale, but they do not materially change the immediate catalysts or principal risks, the largest of which remains regulatory and operational uncertainty tied to nuclear assets and aging infrastructure costs.

Among recent announcements, the reinstatement of the Crane Clean Energy Center with federal backing stands out. This project directly supports the company’s efforts to meet growing clean energy needs and could boost capacity in line with the increasing pull for long-duration power contracts from corporate and data center customers, reinforcing a key catalyst for revenue growth.

However, while these milestones demonstrate momentum, investors should also consider the heightened exposure to rising regulatory and decommissioning costs that come with reliance on aging nuclear assets...

Read the full narrative on Constellation Energy (it's free!)

Constellation Energy's outlook projects $26.7 billion in revenue and $3.6 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 2.5% and a $0.6 billion increase in earnings from the current $3.0 billion level.

Uncover how Constellation Energy's forecasts yield a $403.77 fair value, a 11% upside to its current price.

Exploring Other Perspectives

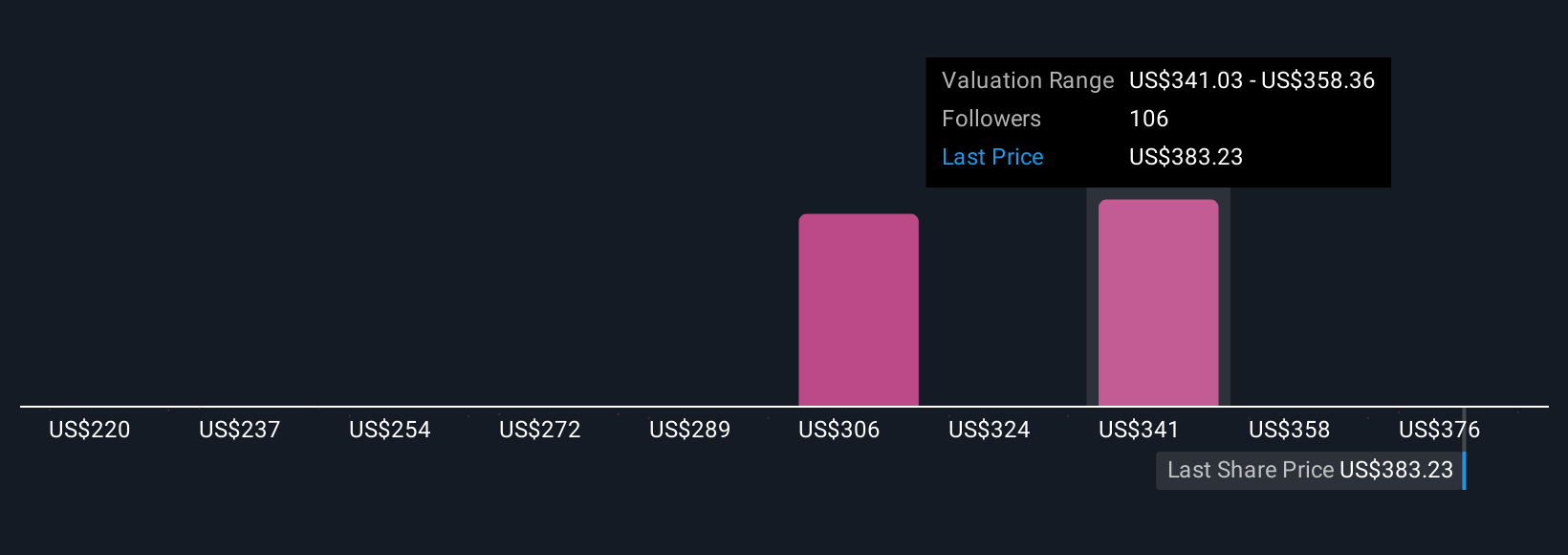

Fourteen distinct fair value estimates from the Simply Wall St Community span US$230 to US$492,256, with several clustered below and above the analyst consensus. Despite this range, regulatory and decommissioning risks play an important role in shaping future profitability and could impact shareholder outcomes in unexpected ways.

Explore 14 other fair value estimates on Constellation Energy - why the stock might be worth as much as 35% more than the current price!

Build Your Own Constellation Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Constellation Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Constellation Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Constellation Energy's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026