- United States

- /

- Water Utilities

- /

- NasdaqGS:ARTN.A

Artesian Resources (NASDAQ:ARTN.A) Has Announced That It Will Be Increasing Its Dividend To US$0.27

Artesian Resources Corporation's (NASDAQ:ARTN.A) dividend will be increasing to US$0.27 on 23rd of May. This takes the dividend yield to 2.3%, which shareholders will be pleased with.

View our latest analysis for Artesian Resources

Artesian Resources' Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, Artesian Resources' earnings easily covered the dividend, but free cash flows were negative. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

The next year is set to see EPS grow by 5.5%. If the dividend continues along recent trends, we estimate the payout ratio will be 58%, which is in the range that makes us comfortable with the sustainability of the dividend.

Artesian Resources Has A Solid Track Record

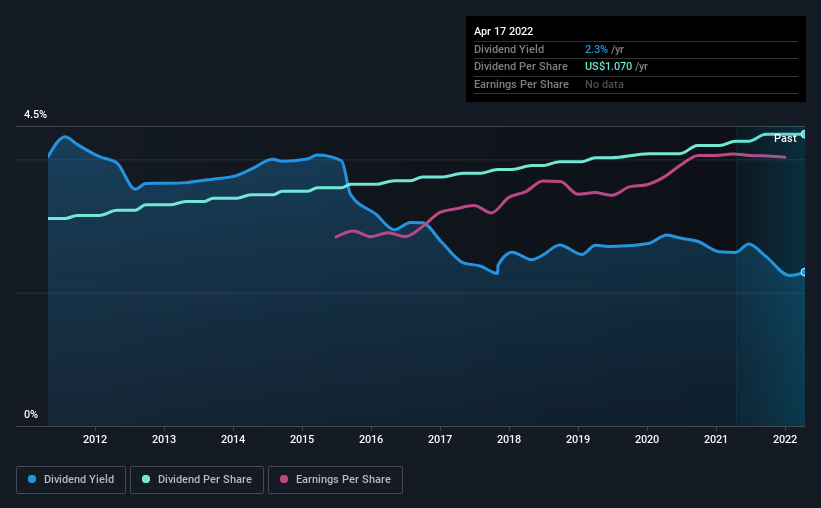

The company has a sustained record of paying dividends with very little fluctuation. The first annual payment during the last 10 years was US$0.76 in 2012, and the most recent fiscal year payment was US$1.07. This implies that the company grew its distributions at a yearly rate of about 3.5% over that duration. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

The Dividend's Growth Prospects Are Limited

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Earnings per share has been crawling upwards at 4.6% per year. Growth of 4.6% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

Our Thoughts On Artesian Resources' Dividend

In summary, while it's always good to see the dividend being raised, we don't think Artesian Resources' payments are rock solid. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come across 2 warning signs for Artesian Resources you should be aware of, and 1 of them can't be ignored. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ARTN.A

Artesian Resources

Provides water, wastewater, and other services in Delaware, Maryland, and Pennsylvania.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Investment Thesis: Olvi Oyj (OLVAS)

UnitedHealth Group's Future Revenue Grows by 3.59%: What Will It Mean?

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.