- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

Is American Electric Power Stock Fairly Priced After Renewable Energy Expansion and 27.6% 2024 Rally?

Reviewed by Bailey Pemberton

If you are standing at the crossroads with American Electric Power Company stock, you are definitely not alone. This household name in the utility industry has been catching investors' eyes, not just for its steady dividends, but also for the curious way its share price has been moving lately. Over the last month, AEP climbed an impressive 9.5%, and so far in 2024, it is boasting a 27.6% gain. Those holding on for the long term are sitting on strong results too, with the stock up 20.6% over the past year and a hefty 56.0% over five years. That said, last week saw a dip of 1.1%, offering a brief pause after the recent surge.

What could be behind these moves? Part of the excitement comes from American Electric Power’s recent announcement of its ambitious renewable energy projects and expanded grid modernization. This is a clear signal that the company is adapting to the industry’s rapid transformation. Long-term investors see these moves as growth opportunities, while others are closely watching for potential regulatory shifts and evolving demand expectations.

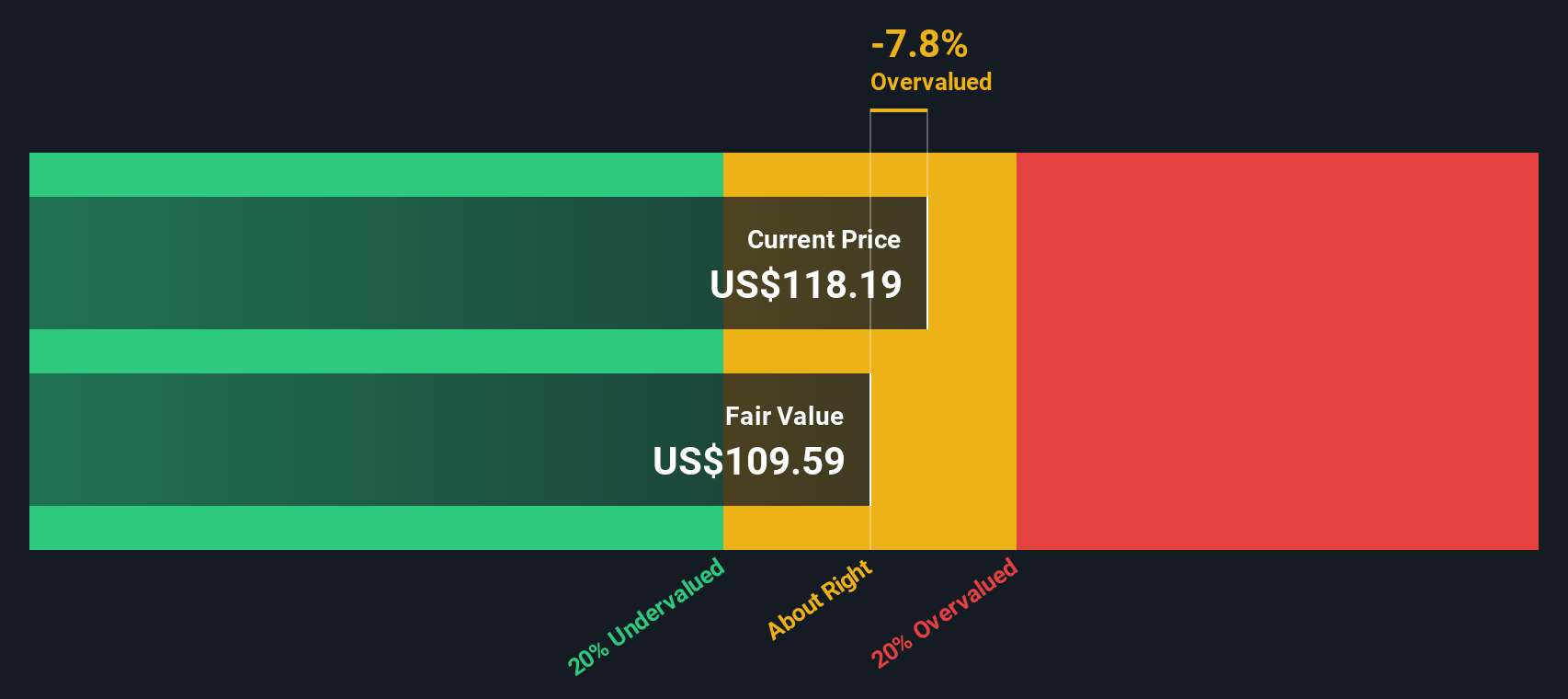

Of course, the big question on everyone’s mind is whether AEP is undervalued, fully priced, or maybe even trading above its true worth. Using six classic valuation checks, the stock earns a value score of 3, meaning it’s undervalued in half of the major categories. But as you will see, there is a nuanced picture behind that score. Let’s dig in to the valuation approaches, and later in the article, I will introduce a smarter way to think about what AEP is really worth.

Approach 1: American Electric Power Company Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a classic way to estimate a stock’s fair value by projecting future dividend payments and discounting them back to today. This approach essentially evaluates how much a company’s stream of future dividends is worth in present terms. For American Electric Power Company, the model starts with an annual dividend per share of $4.13, a payout ratio near 70%, and an underlying growth expectation in dividends of about 3.08% per year, capped slightly to reflect conservative modeling. Return on equity stands solidly at 10.4%, supporting the sustainability of these payouts.

Using these inputs, the DDM produces an estimated intrinsic value of $111.82 for AEP shares. With the current market price coming in about 4.9% above this estimate, the model suggests the stock may be just slightly overvalued based on dividend fundamentals alone. However, this margin is small and within the usual fluctuations of utility sector valuations.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out American Electric Power Company's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: American Electric Power Company Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies like American Electric Power Company because it connects the business’s share price directly to its earnings, showing what investors are willing to pay for each dollar of profit. A PE ratio is especially meaningful for steady, mature sectors such as utilities, where companies consistently generate earnings year after year.

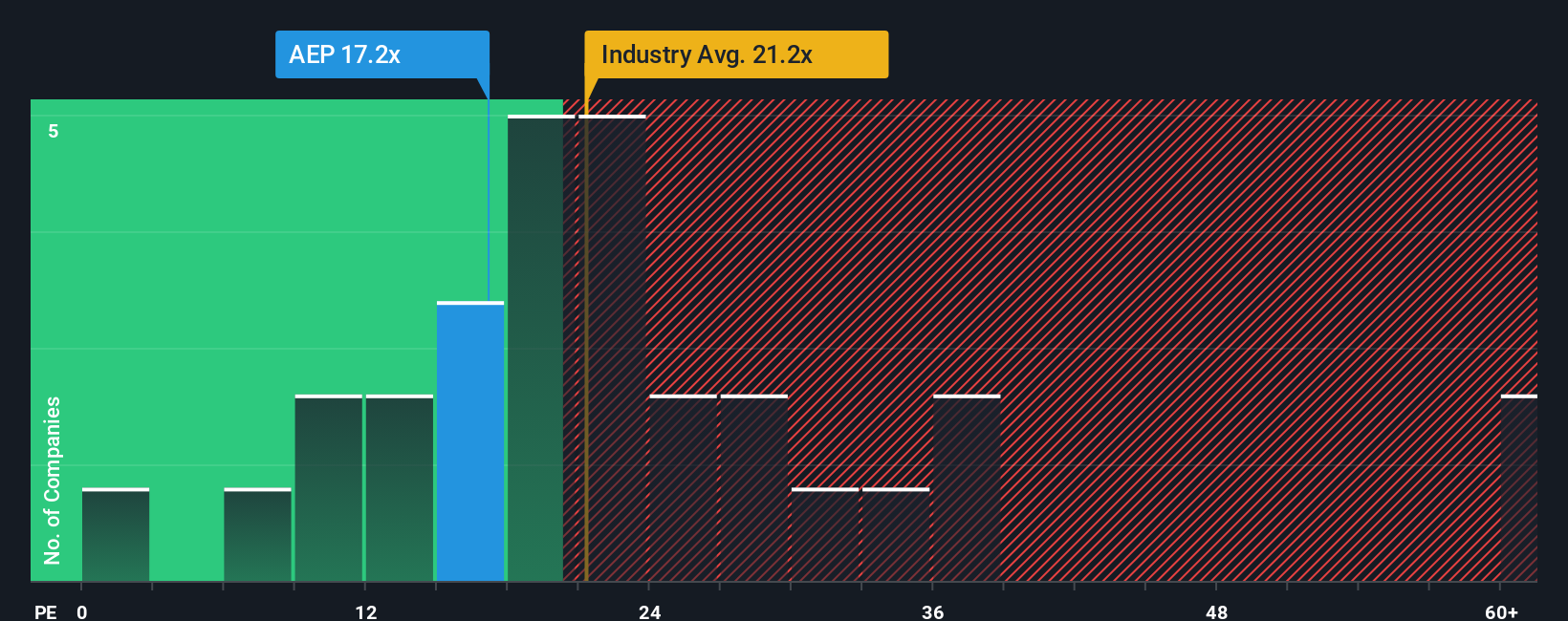

The “right” or “fair” PE ratio depends on growth expectations and perceived risk. Faster-growing or lower-risk companies tend to command higher PE multiples, while slower growth or more uncertainty might push it lower. For AEP, the current PE ratio stands at 17.18x. That is lower than the industry average of 21.35x and below the peer group’s average of 21.72x. This suggests a modest discount relative to the sector.

Simply Wall St’s proprietary “Fair Ratio” is 20.83x and provides a more refined benchmark. Unlike a simple industry or peer comparison, the Fair Ratio incorporates the company’s unique mix of earnings growth, market risks, profit margins, and market capitalization for a tailored valuation bar. Comparing AEP’s actual PE of 17.18x to its Fair Ratio of 20.83x, the stock currently appears to be undervalued on this basis, with its valuation sitting below what would be typical given its business profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Electric Power Company Narrative

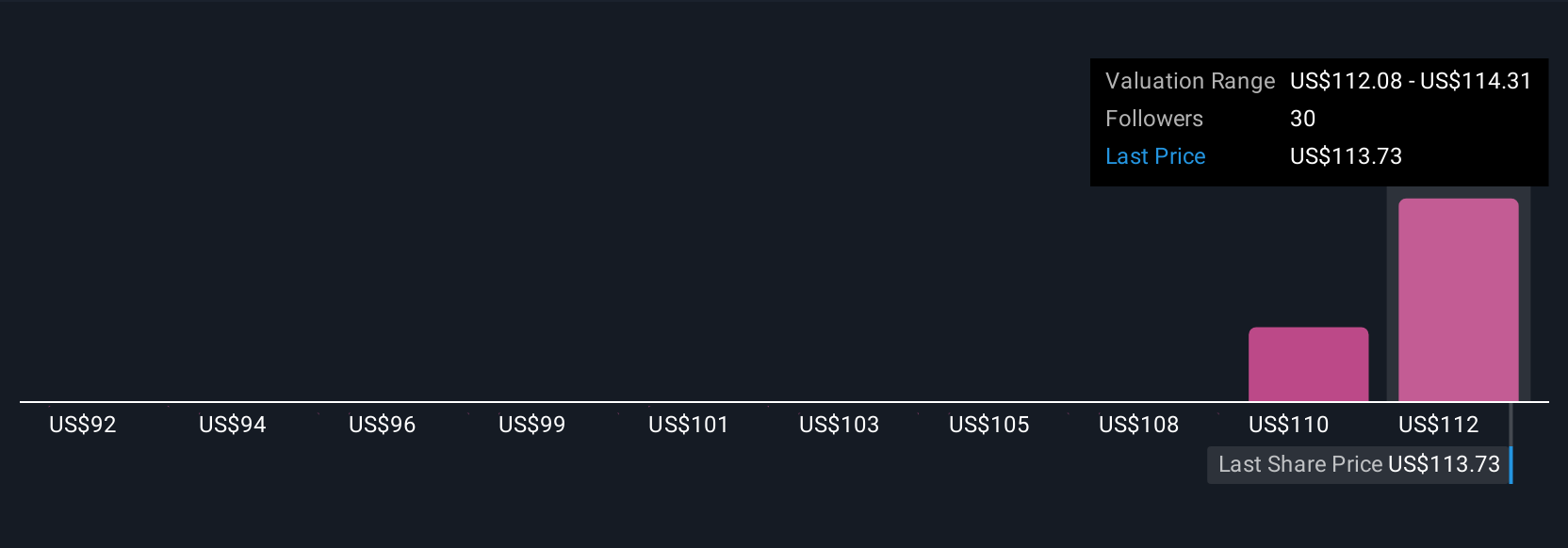

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story you tell about a company, your view of where it’s headed, made explicit through your own assumptions about revenue growth, earnings, margins, and what you believe is a fair value.

Narratives empower you to link the company’s story to its financial forecast and, ultimately, to what you think the shares should be worth. On Simply Wall St’s Community page, millions of investors use Narratives to map their beliefs onto real numbers, helping them make informed buy or sell decisions by comparing their Fair Value to the current Price. Narratives are automatically refreshed as new news or earnings data comes in.

For example, some investors may be confident in AEP’s aggressive capital spending and project robust industrial demand, arriving at a high Narrative fair value of $120.41 per share. Others may focus on risks like regulatory shifts or lower margin commercial growth, leading to a more cautious estimate of $108.36 per share. By creating, following, and debating Narratives, you gain a clearer and more dynamic picture of American Electric Power Company’s true potential, tailored to your unique view of the future.

Do you think there's more to the story for American Electric Power Company? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives