- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

American Electric Power Company (NasdaqGS:AEP) To Jointly Develop Major Transmission Projects With Dominion And FirstEnergy

Reviewed by Simply Wall St

American Electric Power Company (NasdaqGS:AEP) experienced a 5.31% increase in share price over the last quarter, reflecting steady investor confidence amidst significant company and market developments. The firm's collaboration with Dominion Energy and FirstEnergy in developing transmission projects across the PJM region highlights its commitment to addressing power reliability, impacting investor sentiment positively. Additionally, AEP's solid financial performance, with notable increases in net income and EPS, underscores its resilience and capability in the evolving energy landscape. Moreover, the ongoing market context, including a benign inflation report and a mixed performance in major indices such as the Nasdaq's 5.5% decline, provides a backdrop that accentuates AEP's solid quarterly result. With consistent dividend declarations and strategic executive appointments, AEP continues to secure its position, attracting investor attention despite broader market volatility. These developments, alongside macroeconomic trends, justify AEP's recent price movement amidst a fluctuating market.

Dig deeper into the specifics of American Electric Power Company here with our thorough analysis report.

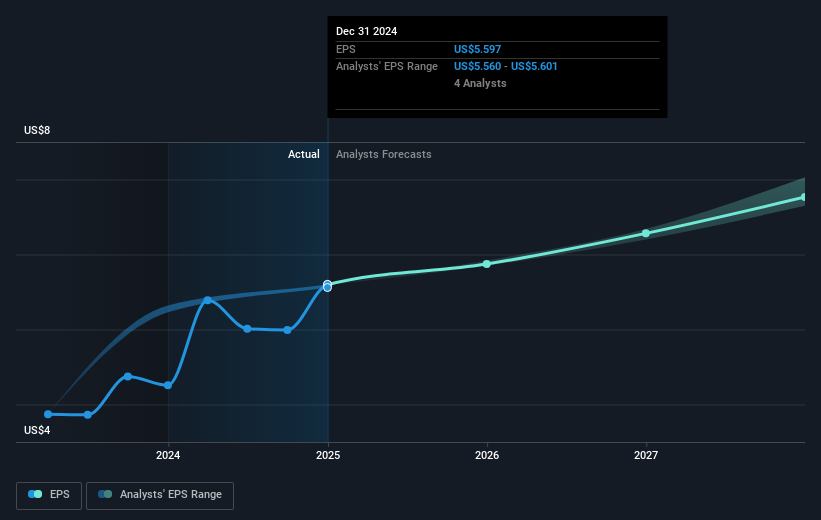

American Electric Power Company (AEP) delivered a total return, including share price appreciation and dividends, of 28.20% over the last year, outperforming the US Market's return of 14.7%. A key factor in this strong performance was the significant earnings growth, with a 34.4% increase in earnings over the past year. This growth rate surpassed both its historical 5-year average and the Electric Utilities industry's 8.2% growth, highlighting AEP's robust financial health in a competitive landscape. Additionally, AEP's commitment to consistent dividend payments, including an increase to $0.93 per share, further bolstered investor confidence.

Furthermore, AEP's proactive strategic initiatives, such as its selection for multiple transmission projects with Dominion Energy and FirstEnergy, underscore its focus on expanding infrastructure to meet regional power demands. However, the company faced a regulatory challenge in January 2025, agreeing to a settlement with the SEC for US$19 million, which did not deter its positive momentum. Such developments have contributed to its superior performance relative to the market over the last year.

- Learn how American Electric Power Company's intrinsic value compares to its market price with our detailed valuation report.

- Discover the key vulnerabilities in American Electric Power Company's business with our detailed risk assessment.

- Have a stake in American Electric Power Company? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives