- United States

- /

- Electric Utilities

- /

- NasdaqGS:AEP

AEP (AEP): Assessing Valuation After $54 Billion Infrastructure and Renewables Investment Plan Announcement

Reviewed by Kshitija Bhandaru

American Electric Power Company (AEP) has drawn attention with its latest commitment to invest $54 billion between 2025 and 2029 in major infrastructure upgrades and renewable projects. Investors are watching how this focus may shape AEP’s growth trajectory.

See our latest analysis for American Electric Power Company.

The share price of American Electric Power Company has gradually gained ground, reflecting investor confidence following its bold $54 billion infrastructure and renewables plan. Recent successful fixed-income offerings further highlight this momentum, while AEP’s 0.18% one-year total shareholder return signals a modest but steady long-term performance as strategic upgrades continue to unfold.

If AEP’s steady climb has you rethinking your strategy, it might be time to broaden your perspective and discover fast growing stocks with high insider ownership

Yet with AEP’s shares closing in on analyst price targets and recent gains reflecting optimism, the real question for investors remains: Is this the right moment to buy, or has the market already priced in the company’s future growth?

Most Popular Narrative: Fairly Valued

While American Electric Power Company’s last close of $114.06 is nearly identical to its widely-followed fair value of $115, sentiment points to a balanced outlook and heightened anticipation for upcoming catalysts.

The company has a substantial capital investment plan of $54 billion over the next 5 years, with an additional potential of $10 billion, primarily aimed at expanding transmission and distribution, indicating future growth in earnings.

What is fueling such a bold valuation? There is a critical quantitative leap baked into projections for AEP’s future margins and profit, combined with expectations of shifting demand. The mechanics of how these big numbers transform into a premium assessment can be observed by exploring the narrative to see the actual math and the crucial assumptions behind this fair value.

Result: Fair Value of $115 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory shifts and the company’s heavy reliance on commercial growth could challenge AEP’s optimistic outlook if there are changes in market conditions.

Find out about the key risks to this American Electric Power Company narrative.

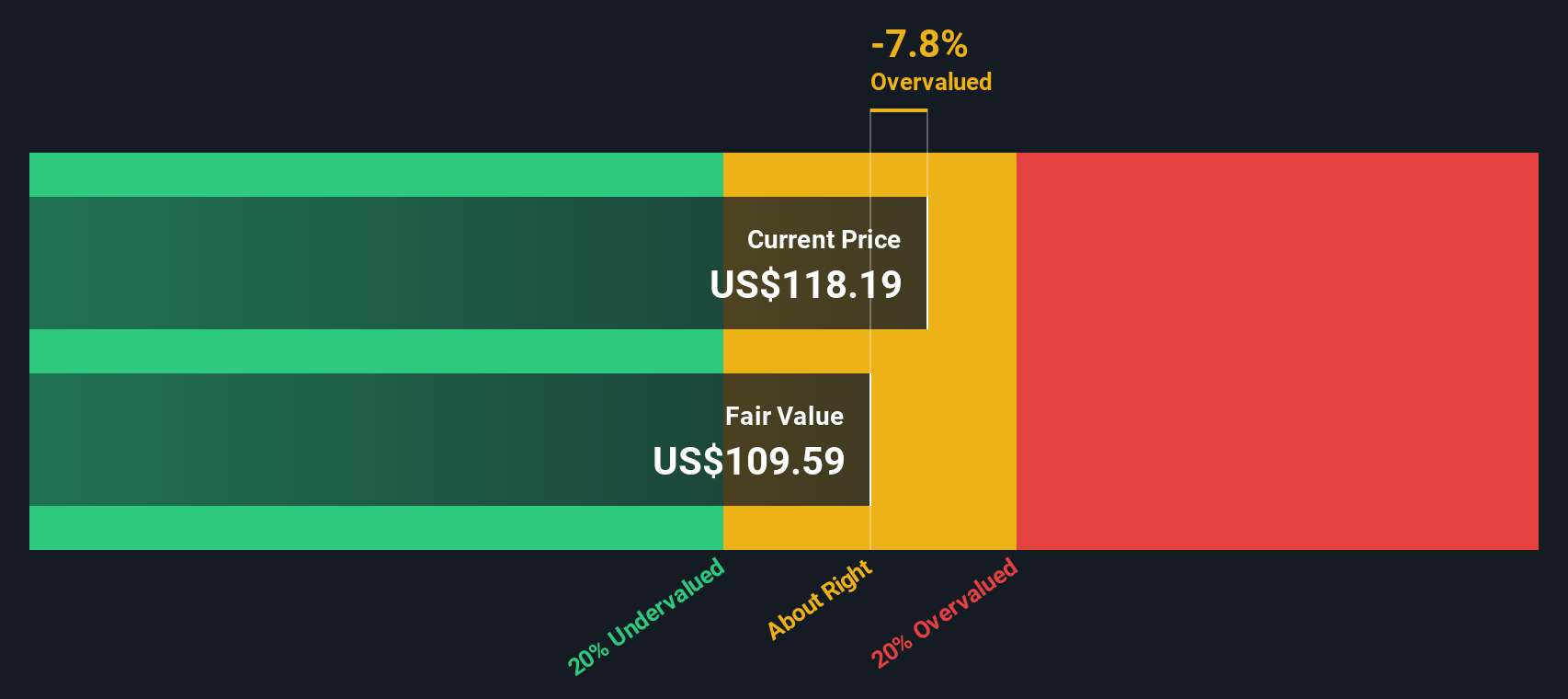

Another View: What Our DCF Model Shows

While analysts see American Electric Power Company as fairly valued, our SWS DCF model presents a more cautious perspective. The DCF suggests the current share price may be running slightly ahead of estimated future cash flows, which raises the risk that the market’s optimism could be excessive.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out American Electric Power Company for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own American Electric Power Company Narrative

If you want to go beyond the consensus and craft your own perspective using the numbers, our tools make it easy to build a narrative in under three minutes. So why not Do it your way

A great starting point for your American Electric Power Company research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity pass you by. Take charge of your portfolio growth by checking out exclusive screens tailored for breakthrough performance.

- Target stable returns by reviewing these 19 dividend stocks with yields > 3% with yields above 3% for consistent income from industry leaders.

- Unleash your potential for high returns by tapping into these 3567 penny stocks with strong financials showing strong financials and the resilience to outperform peers.

- Capitalize on future technology by joining early movers in these 26 quantum computing stocks poised to benefit from advances in quantum computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AEP

American Electric Power Company

An electric public utility holding company, engages in the generation, transmission, and distribution of electricity for sale to retail and wholesale customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives