- United States

- /

- Life Sciences

- /

- NasdaqGS:MRVI

Promising Penny Stocks To Consider In September 2025

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq Composite reach new closing highs, investors are closely monitoring upcoming inflation data that could influence Federal Reserve decisions. In this context, penny stocks—often associated with smaller or newer companies—remain a relevant investment area despite their somewhat outdated term. These stocks can offer growth opportunities at lower price points, especially when backed by strong fundamentals and financial stability.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.13 | $473.61M | ✅ 4 ⚠️ 0 View Analysis > |

| ATRenew (RERE) | $4.18 | $971.4M | ✅ 3 ⚠️ 1 View Analysis > |

| Waterdrop (WDH) | $1.87 | $672.69M | ✅ 4 ⚠️ 0 View Analysis > |

| VTEX (VTEX) | $4.03 | $740.59M | ✅ 3 ⚠️ 1 View Analysis > |

| WM Technology (MAPS) | $1.21 | $210.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.54 | $237.25M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.92 | $23.87M | ✅ 4 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.969988 | $7.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.00 | $91.76M | ✅ 3 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $4.80 | $627.75M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 378 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Hyperfine (HYPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hyperfine, Inc. is a health technology company focused on producing, supplying, servicing, and commercializing MRI products with a market cap of $99.80 million.

Operations: The company generates revenue primarily from its Medical Imaging Systems segment, amounting to $10.80 million.

Market Cap: $99.8M

Hyperfine, Inc. is navigating the penny stock landscape with a focus on expanding its portable MRI technology, evidenced by recent UKCA approval for its Optive AI software and FDA clearance in the US. Despite being unprofitable and having less than a year of cash runway, Hyperfine's short-term assets exceed both short and long-term liabilities. The company reported second-quarter revenue of US$2.7 million, with net losses narrowing slightly compared to last year. Hyperfine's strategic initiatives include international expansion and partnerships to enhance market presence in neurology offices, potentially driving future revenue growth despite current financial challenges.

- Take a closer look at Hyperfine's potential here in our financial health report.

- Learn about Hyperfine's future growth trajectory here.

Maravai LifeSciences Holdings (MRVI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Maravai LifeSciences Holdings, Inc. is a life sciences company that offers products supporting the development of drug therapies, vaccines, cell and gene therapies, and diagnostics across multiple regions globally, with a market cap of approximately $679.26 million.

Operations: The company generates revenue through two primary segments: Nucleic Acid Production, which accounts for $155.58 million, and Biologics Safety Testing, contributing $64.25 million.

Market Cap: $679.26M

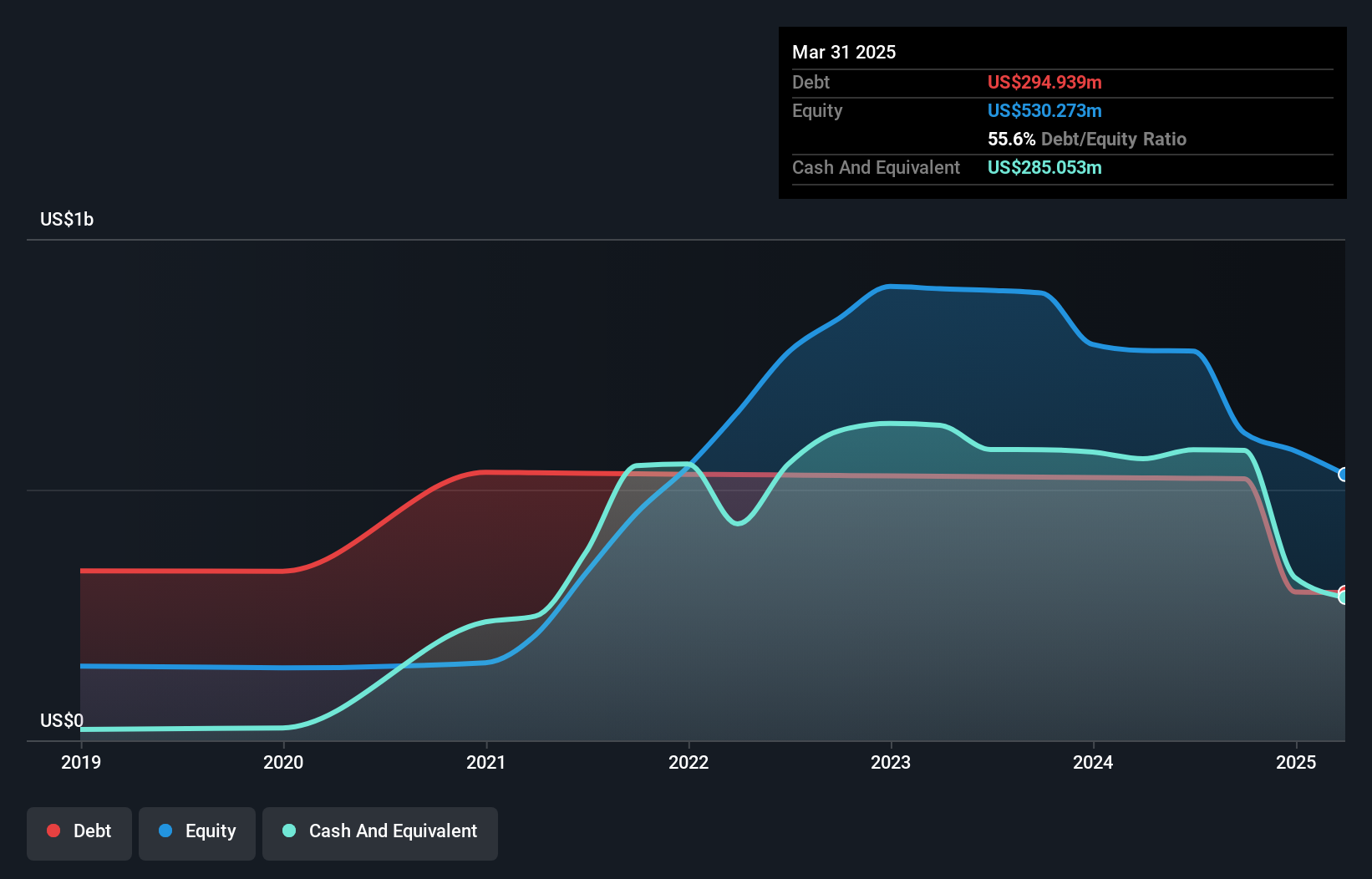

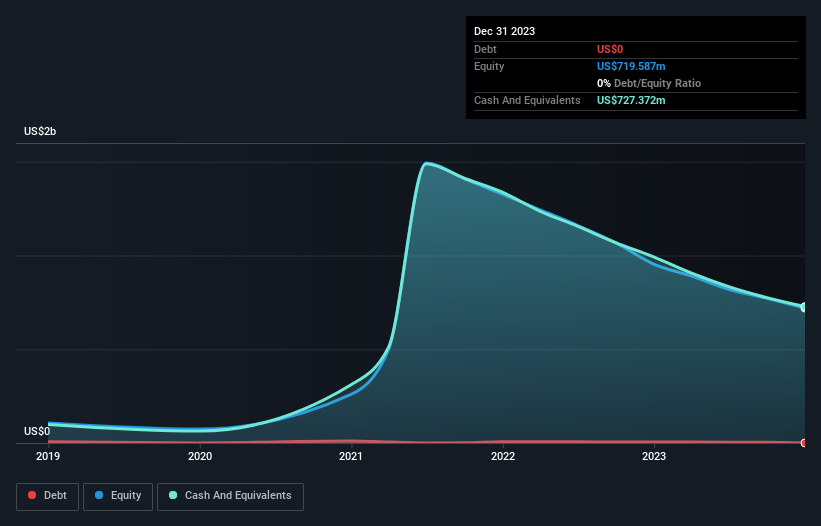

Maravai LifeSciences Holdings is experiencing significant challenges in the penny stock arena, marked by a strategic restructuring that includes workforce reductions and executive changes. The company reported a second-quarter net loss of US$39.59 million, with sales declining to US$47.4 million from the previous year. Despite having short-term assets of US$359.8 million exceeding liabilities, Maravai's operations remain unprofitable with negative operating cash flow and a high debt-to-equity ratio previously reduced to 62.8%. Recent management transitions aim to stabilize operations as revenue guidance for 2025 has been suspended amid ongoing business reviews and forecasting processes.

- Click to explore a detailed breakdown of our findings in Maravai LifeSciences Holdings' financial health report.

- Review our growth performance report to gain insights into Maravai LifeSciences Holdings' future.

CreateAI Holdings (TSPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CreateAI Holdings Inc. is an artificial intelligence technology company that specializes in the production and publishing of video games and anime, with a market cap of $113.49 million.

Operations: CreateAI Holdings Inc. has not reported any specific revenue segments.

Market Cap: $113.49M

CreateAI Holdings Inc., with a market cap of US$113.49 million, is a pre-revenue company in the artificial intelligence sector, focusing on video games and anime production. Recent announcements highlight its technological advancements, including the launch of an advanced motion capture center in Beijing and enhancements to its AI video generation platform Animon.ai. Despite these developments, CreateAI reported minimal sales of US$13K for Q2 2025 alongside a net loss of US$17.78 million. The company's short-term assets significantly exceed liabilities, but it faces challenges with high volatility and limited cash runway if current cash flow trends persist.

- Click here to discover the nuances of CreateAI Holdings with our detailed analytical financial health report.

- Learn about CreateAI Holdings' historical performance here.

Where To Now?

- Unlock more gems! Our US Penny Stocks screener has unearthed 375 more companies for you to explore.Click here to unveil our expertly curated list of 378 US Penny Stocks.

- Ready For A Different Approach? Uncover 9 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVI

Maravai LifeSciences Holdings

A life sciences company, provides products that enable the development of drug therapies, vaccines, drug therapies, cell and gene therapies, and diagnostics North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin and Central America.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives