- United States

- /

- Transportation

- /

- OTCPK:DIDI.Y

DiDi (OTCPK:DIDI.Y): Valuation Check After Robotaxi Trials, Self‑Driving Fundraise, Buyback and IPO Settlement Progress

Reviewed by Simply Wall St

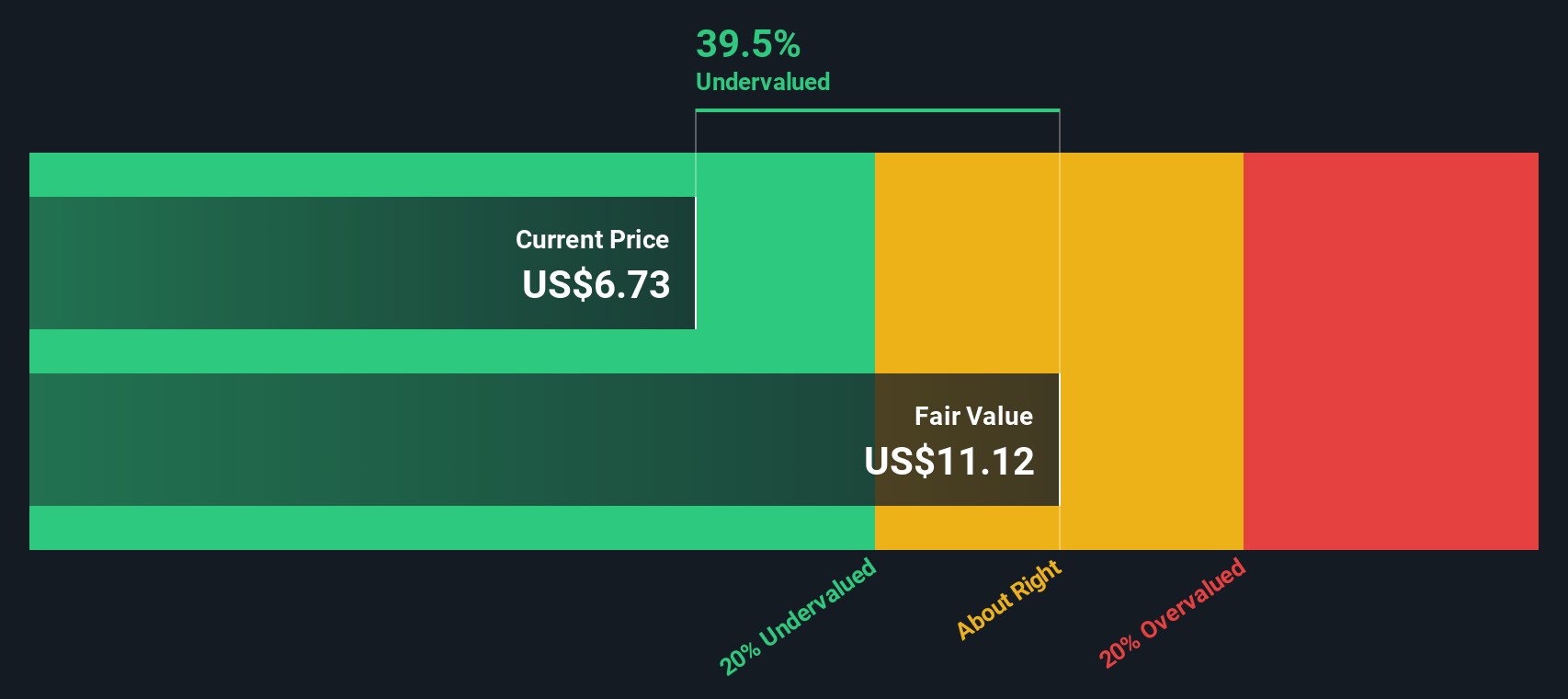

DiDi Global (OTCPK:DIDI.Y) is back in focus after launching 24/7 fully unmanned robotaxi trials in Guangzhou, raising fresh capital for its self-driving arm, completing a major buyback, and nearing closure on a sizeable U.S. IPO lawsuit settlement.

See our latest analysis for DiDi Global.

Despite the legal overhang easing and the robotaxi push signalling long term growth ambitions, DiDi Global’s 30 day share price return of 3.18 percent contrasts with a still weak 90 day share price return of minus 23.26 percent. This suggests momentum is only tentatively recovering, even as the three year total shareholder return of 41.53 percent shows longer term investors remain ahead overall.

If DiDi’s robotaxi and self driving story has caught your attention, this could be a good moment to hunt for other innovative mobility and EV names among auto manufacturers.

With DiDi still lossmaking but growing fast, trading below analyst targets yet boasting a strong three year return, investors face a key question: is this a discounted entry into China’s mobility champion, or has the market already priced in future growth?

Price-to-Sales of 0.8x: Is it justified?

DiDi Global trades on a 0.8x price-to-sales multiple at 5.18 dollars per share, implying the market is pricing its revenue well below peers.

The price-to-sales ratio compares the company’s market value with its annual revenue, a useful yardstick for fast growing but still unprofitable mobility platforms like DiDi.

Based on Simply Wall St’s checks, DiDi screens as good value on this metric, trading not only below peers on a 2.8x average but also below the broader US transportation sector on 1.2x.

What makes this discount more striking is that the estimated fair price-to-sales ratio for DiDi sits at 1.2x, a level the share could gravitate toward if sentiment and fundamentals continue improving.

Explore the SWS fair ratio for DiDi Global

Result: Price-to-Sales of 0.8x (UNDERVALUED)

However, DiDi’s ongoing losses and reliance on favorable regulatory conditions in China still risk derailing sentiment and limiting any valuation re-rating.

Find out about the key risks to this DiDi Global narrative.

Another View: What Our DCF Model Suggests

While the low price to sales hints at value, our DCF model paints an even starker picture, putting fair value at 19.46 dollars versus the current 5.18 dollars. That implies DiDi might be deeply undervalued, but are the growth and risk assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DiDi Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DiDi Global Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized thesis in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding DiDi Global.

Ready for more high conviction ideas?

Before you move on, lock in your next opportunities by using the Simply Wall St screener to pinpoint standout stocks that fit your strategy perfectly.

- Capture potential multibaggers early by zeroing in on these 3642 penny stocks with strong financials with the financial strength to back rapid growth stories.

- Ride the next technology wave by focusing on these 26 AI penny stocks that are applying artificial intelligence to real world problems with scalable business models.

- Strengthen your portfolio’s foundation by targeting these 13 dividend stocks with yields > 3% that can help support reliable long term income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIDI.Y

DiDi Global

Operates a mobility technology platform that provides various mobility and other services in the People's Republic of China, Brazil, Mexico, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)