- United States

- /

- Transportation

- /

- OTCPK:DIDI.Y

DiDi Global (OTCPK:DIDI.Y) Swings to Q3 Net Income, Challenging Ongoing Loss Narratives

Reviewed by Simply Wall St

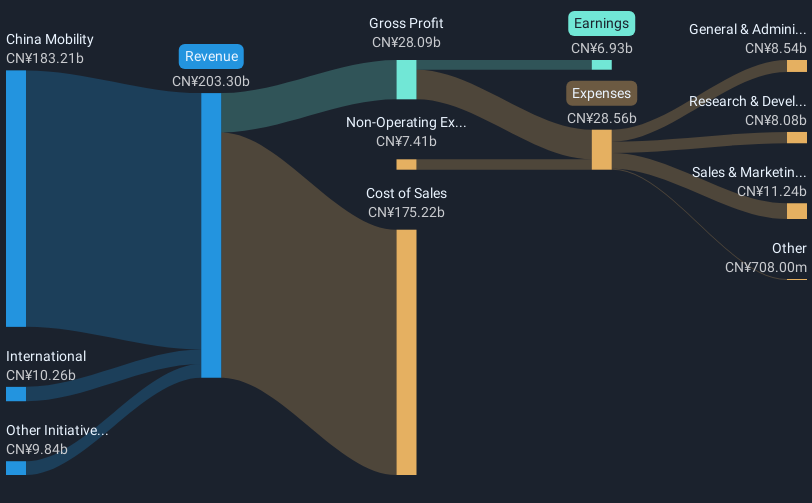

DiDi Global (OTCPK:DIDI.Y) just posted its Q3 2025 results, reporting revenue of ¥58.6 billion and basic EPS of ¥0.31. Looking at recent trends, revenue has moved from ¥53.0 billion in Q4 2024, to ¥53.3 billion in Q1 2025, to ¥56.4 billion in Q2 2025, and now to the latest ¥58.6 billion reported. Net income also saw a swing, landing at ¥1.5 billion this quarter after being in the red last period. Despite not turning a full-year profit yet, these numbers suggest margins are showing signs of stabilization.

See our full analysis for DiDi Global.Next up, we’ll put these latest earnings side by side with the prevailing narratives followed by the market and community. Some stories might hold, while others could be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Cut by Over Half in Five Years

- Trailing twelve month net losses have been trimmed to just $10.7 million, a dramatic improvement from prior periods. DiDi has reduced annual losses at a 54.2% rate over the past five years.

- Momentum behind cost controls and narrowing net losses is cited as supporting the outlook for eventual profitability, according to prevailing market analysis.

- Net income in Q3 2025 rebounded to $1.5 billion after last quarter’s loss of $2.5 billion, underlining the swing potential even as DiDi has not yet posted an annual profit.

- With forecasts calling for annual earnings growth of 57.03% over the next three years, investors focusing on turnaround stories may note this pace is above the US market’s average for the sector.

Discounted Valuation Signals Potential Upside

- At a current share price of $5.50, DiDi trades at a 0.8x price-to-sales ratio, which is lower than the US transportation industry’s 1x and US peer group’s 3x average.

- Valuation metrics highlight how DiDi’s large discount to its DCF fair value of $19.46 could draw value-oriented investors, even as the company works to shift into sustainable profits.

- Despite persistently negative trailing twelve month earnings, the gap between market price and fair value remains wide, indicating optimism about future growth prospects.

- Analysts note that no notable risks have been flagged over the past year, which stands out among similar high-growth, high-uncertainty peers.

Revenue Growth Still Trails US Market

- DiDi’s revenue is projected to climb by 8.9% annually, just below the 10.5% rate expected for the wider US market.

- This slower revenue growth pace tempers the most bullish narratives, as even market supporters acknowledge DiDi must beat sector trends to justify a higher valuation multiple.

- Consensus analysis points out that, while quarterly revenue is steadily increasing, up nearly $3 billion from Q1 to Q3 2025, the company still has work to do to close the gap with broader market growth rates.

- Bulls highlight diversification and tech ambitions as positive tailwinds, but sustained outperformance will require improving both the growth rate and earnings quality.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on DiDi Global's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rebounding earnings and margin improvements, DiDi’s revenue growth still lags the broader US market and raises questions about long-term consistency.

If you want steadier performers with proven track records, check out stable growth stocks screener (2075 results) for companies that consistently deliver reliable revenue and earnings growth. This can help your portfolio remain resilient through changing cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:DIDI.Y

DiDi Global

Operates a mobility technology platform that provides various mobility and other services in the People's Republic of China, Brazil, Mexico, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.